VAT for Hospitality Creative Word Training

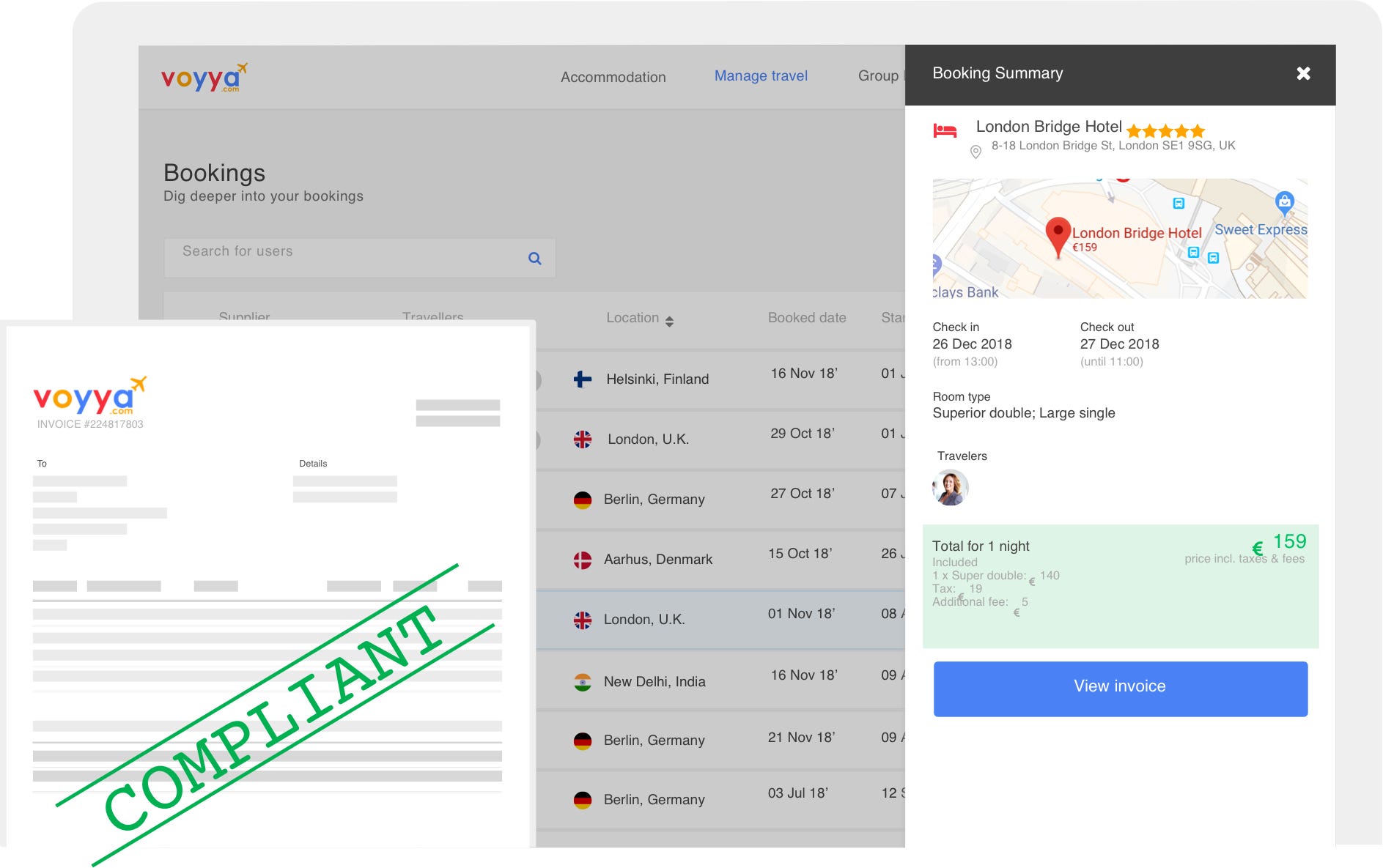

Hotel Booking Software amp Best Room Reservation VAT Billing Management

VAT on Hotel Rooms AirBNB and Holiday Lets

Value Added Tax VAT for hotels in the Philippines FAQs included

VAT Refund for Hotels amp Travel Expenses in the EU VAT4U

Here s a brief guide on booking VAT Ai s services Infovatai Medium

VAT q amp a Can companies claim VAT on hotel bookings

Hoteliers won t gain from Booking com s VAT registration Southern

Travelbook ph offers VAT free hotel bookings Gadgets Magazine Philippines

Do I need to pay VAT for my booking Schools Plus Ltd

VAT on Tourist Accommodation in Spain All you need to know WELEX

How to get VAT invoices on booking com bookings by Chris Malherbe

VAT on Tourist Accommodation in Spain All you need to know WELEX

How to get VAT invoices on booking com bookings by Chris Malherbe

Is there VAT on train tickets and other VAT questions FreeAgent

New Hospitality VAT rate for hospitality Legislation Change Sage

Hospitality VAT at 5 do you know what is covered Crowe UK

The quick guide to recovering VAT on hotels TravelPerk

More details on hospitality VAT reduction Saint

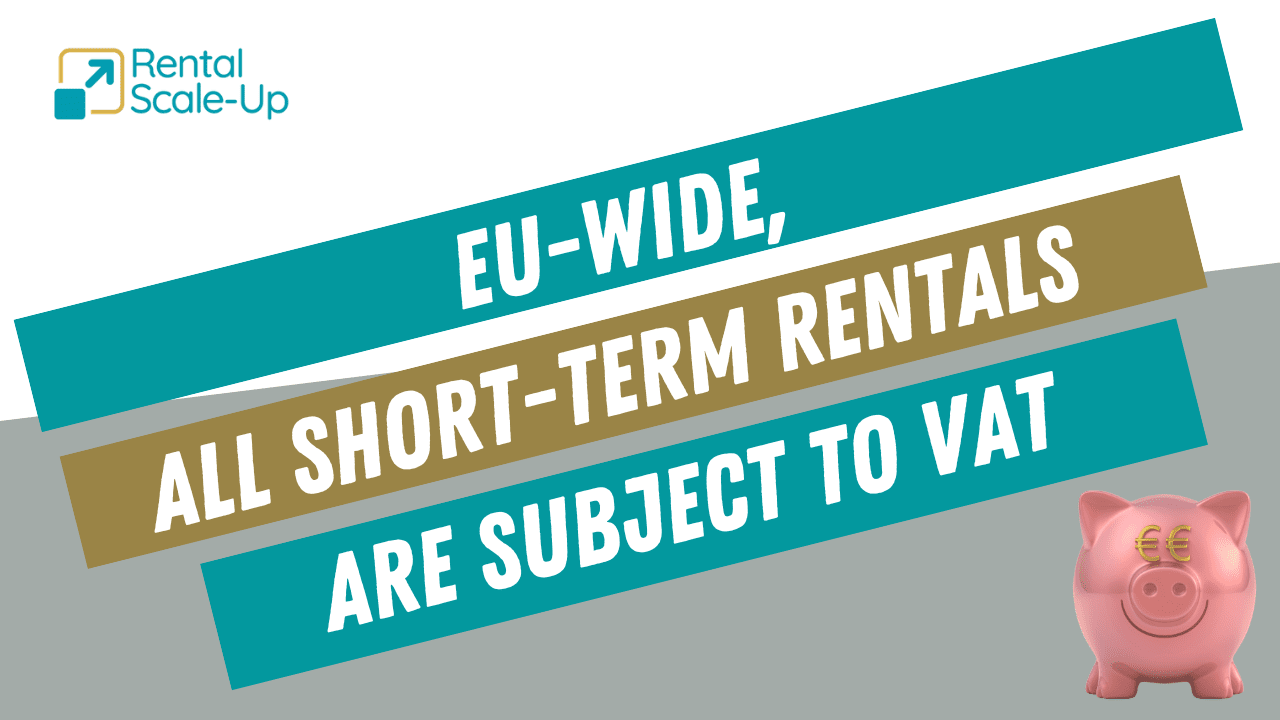

E U VAT added to all STR stays collected by Airbnb and other

New Hospitality VAT rate for hospitality Legislation Change Sage

Hospitality VAT at 5 do you know what is covered Crowe UK

The quick guide to recovering VAT on hotels TravelPerk

More details on hospitality VAT reduction Saint

E U VAT added to all STR stays collected by Airbnb and other

E U VAT added to all STR stays collected by Airbnb and other

E U VAT added to all STR stays collected by Airbnb and other

E U VAT added to all STR stays collected by Airbnb and other

How To Manage The New Hospitality 5 VAT Rate AccountsPortal

Temporary reduced rate of VAT for hospitality and tourism sector HUSA

VAT reduced rate for hospitality holiday accommodation and attractions

Reduced VAT rate for hospitality sector Blog Torgersens Chartered

Can You Claim VAT On Accommodation In South Africa

Reduced VAT for tourism hospitality sectors

Hospitality Industry Increased VAT Rate

VAT Rate Change for the Hospitality Sector from October 2021

Is Vat Applicable On Commercial Rent

Reduced rate of VAT for hospitality a reminder Gerald Edelman

The New Hospitality Industry VAT Rate DH Business Support

VAT REDUCED RATE FOR HOSPITALITY HOLIDAY ACCOMMODATION AND

VAT on Hotels and holiday accommodation Cowgills

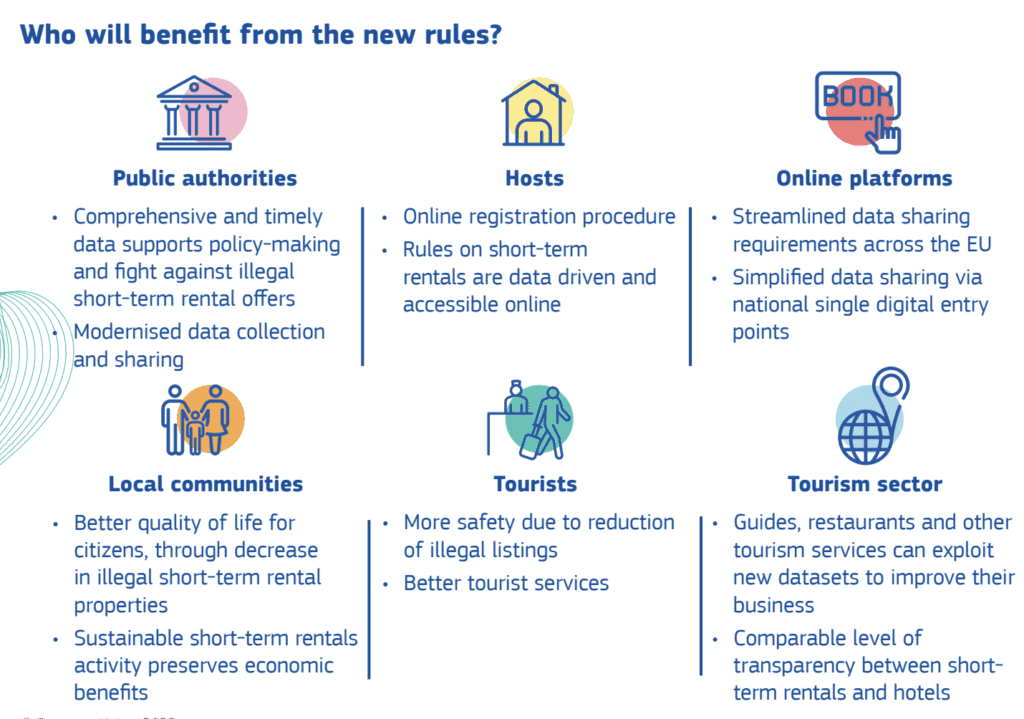

New EU VAT rules for the accommodation and transport sector

Hospitality VAT Rate Change

New Reduced Rate of VAT for Hospitality and Leisure Accounting Firms

Hospitality VAT rate to return to 13 5 next year

Hospitality VAT increase how to maintain profits and prices

Hospitality VAT increase how to maintain profits and prices

Hospitality VAT increase how to maintain profits and prices

Hospitality VAT increase how to maintain profits and prices

Hospitality VAT increase how to maintain profits and prices

Are you King of your VAT Recovery process Playbuzz

The quick guide to recovering VAT on Hotels Viap Travel

VAT on Serviced Accommodations Is your Income over the VAT threshold

VAT on holidays Do you pay VAT on flights and hotels Personal

Changes to Hospitality VAT Rates

Pay foreign hotels in the right way have VAT refunded automatically

Hospitality VAT increase how to maintain profits and prices

Hospitality VAT increase how to maintain profits and prices

Reduced rate of VAT for hospitality and leisure Holden Associates

VAT Reduced Rate For Hospitality Holiday Accommodation and

VAT rate for the hospitality sector reverts to 13 5 KPMG Ireland

Reduced VAT rate for hospitality holiday accom and attractions

Hospitality VAT Increase How will it affect your business

GST Input Tax Credit On Hotel Bills Pice

The Economic Case for the Retention of the 9 Hospitality Vat Rate for

New VAT rate for Hospitality Holiday Accommodation and Attractions

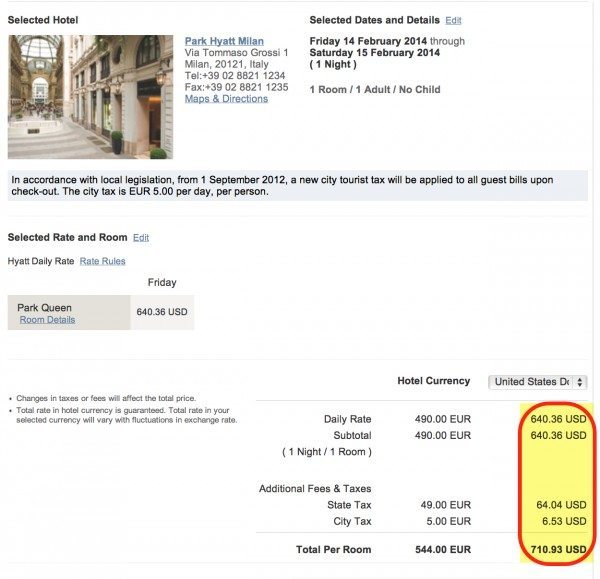

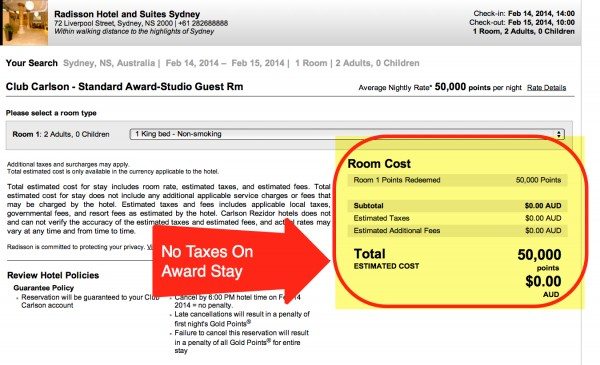

Hotel Award Tax Million Mile Secrets

Hotel Award Tax Million Mile Secrets

Temporary reduced rate of VAT for hospitality holiday accommodation

5 VAT on tourism and hospitality from 15th July 2020 PAYadvice UK

VAT Reduction Hospitality How does it actually work in practice HB amp O

New VAT Regulations to Impact British Landlords with Holiday Rentals in

What is hotel tax Room occupancy and lodging tax guide

Ibec calls for the retention of 9 VAT rate for tourism

How to Reduce VAT in Hospitality amp Tourism HB amp O

VAT 5 hospitality rate Get the details right AccountingWEB

What Is Vat When Booking A Hotel - The pictures related to be able to What Is Vat When Booking A Hotel in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/7TLTQOUXNK4CEWIVQJQ4XXUXII.jpg)