Vietnam brings financial intermediaries into VAT compliance vatcalc com

Value Added Tax in Vietnam 2023 VAT Guide for Your Business

Vietnam VAT on digital services update vatcalc com

Vietnam VAT B2B e invoice implementations starts Nov 2021 VATupdate

Vietnam VAT What You Need to Know

VAT rate in Vietnam Learn the Details of the Changes

Vietnam VAT What You Need to Know 2022 Update

VAT in Vietnam Your 2022 Guide Cekindo Vietnam

Vietnam VAT What You Need To Know 2025 Update

Vietnam consider new 2 VAT rate cut on basics vatcalc com

Vietnam extends 2 VAT till 31 Dec 2024 vatcalc com

Vietnam Change to VAT treatment of e commerce Blog 2019

The Vietnam VAT Law 2008 Lawfirm SBLaw

VAT Filing service in Vietnam Declare Finalize Tax for Foreigners

Vietnam lowers VAT to 8 again amid economic headwinds Nikkei Asia

Vietnam VAT B2B e invoices vatcalc com

Value Added Tax VAT in Vietnam An overview for foreigners

Value Added Tax VAT in Vietnam An overview for foreigners

VAT Tax Vietnam Objects and Calculation 187 LOOKOFFICE VN

VAT Tax Vietnam Objects and Calculation 187 LOOKOFFICE VN

VAT Tax Vietnam Objects and Calculation 187 LOOKOFFICE VN

VAT Tax Vietnam Objects and Calculation 187 LOOKOFFICE VN

Vietnam VAT rate reduction and CIT deduction

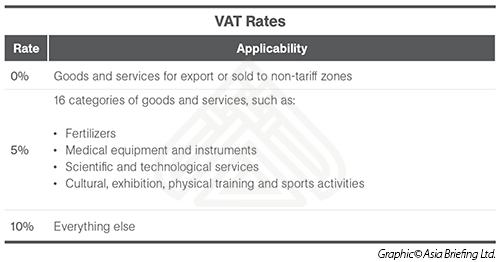

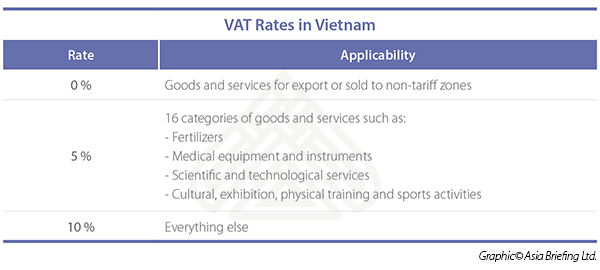

VAT Rates in Vietnam Dezan Shira amp Associates

Vietnam VAT rate reductions

Vietnam COVID 19 VAT returns to 10 on key supplies 2023 vatcalc com

Understanding VAT and Sales Tax Requirements in Vietnam

If You re Going to Vietnam You Need to Know About Dau Vat Visitmagazines

Asiapedia VAT Rates in Vietnam Dezan Shira amp Associates

VAT Refunds for Companies in Vietnam Your Questions Answered

Vietnam to extend VAT cut until mid 2024 to support economy CNA

How to Declare VAT for Foreign Contractors in Vietnam ANT Lawyers

25 Vat Vietnamese Images Stock Photos amp Vectors Shutterstock

What is VAT Definition and Examples

What is VAT Definition and Examples

Vietnamese VAT legislation

A Brief History of VAT Sufio

Summary measures of VAT rates and bases in Vietnam 2005 Download Table

Common types of taxes in Vietnam that an expat should know 2023

Vietnam What are the differences between VAT calculation of import

What is VAT mean VAT Rate Advantages Demerits in the UAE

Vietnam cuts VAT to 8 till year end VnExpress International

Value added tax VAT in Vietnam Explained Acclime

Plans to increase VAT from 10 per cent to 12 while reducing the number

REGULATIONS ON VAT OF CONSTRUCTION Pham Consult Vi t Nam

What are VAT rates in Vietnam in 2024 What goods and services are

What is VAT Understanding VAT Principles Implementation theGSTco

Understanding Vietnam Tax System

Understanding Vietnam Tax System

Vietnam to extend VAT cut until year end to prop up slowing economy

In Vietnam VAT proposed for goods imported via e commerce platforms

Improved VAT Procedures To Enhance Laos Business Climate

What is VAT Why is the company recommended to register for VAT

Vietnam Gov t agrees to cut VAT tax to 8 until year end Vietstock

Vietnam s Tax Codes An Explainer

Understanding Vietnam s Import and Export Regulations

How effective will VAT reduction be The Saigon Times

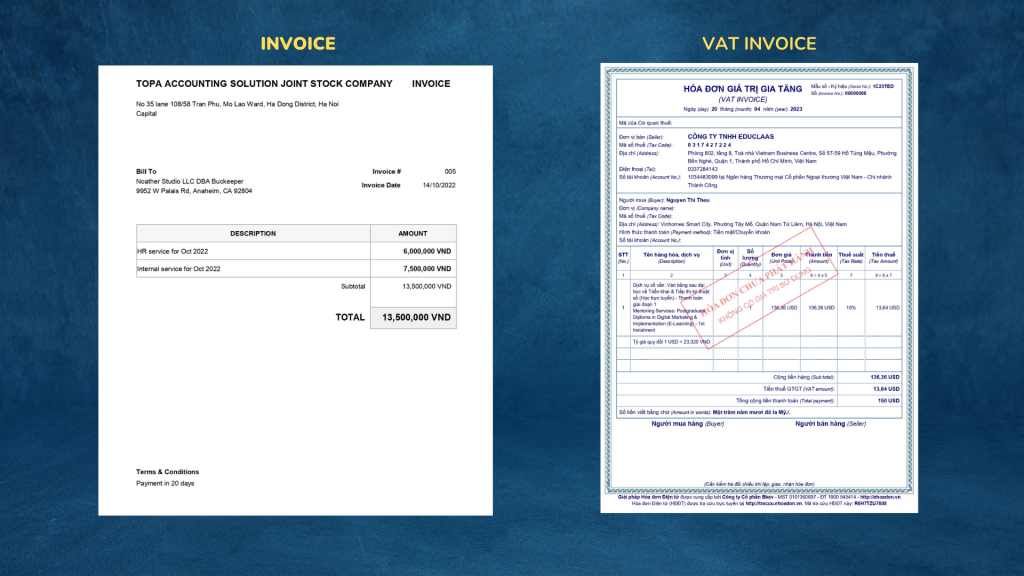

Demystifying Retail Invoices vs VAT Invoices A Guide for New Invoice

Vietnam Double Tax Avoidance Agreements Vietnam Guide Doing

Research and analyze the impact of VAT on small businesses in Vietnam

A Guide to Understanding Vietnam s VAT Asia Briefing

Key points to consider when applying the 0 VAT rate for exported

Vietnam issues Draft Pronouncement on Tax Administration Transfer

Vietnam Personal Income Tax Vietnam Guide Doing Business in Vietnam

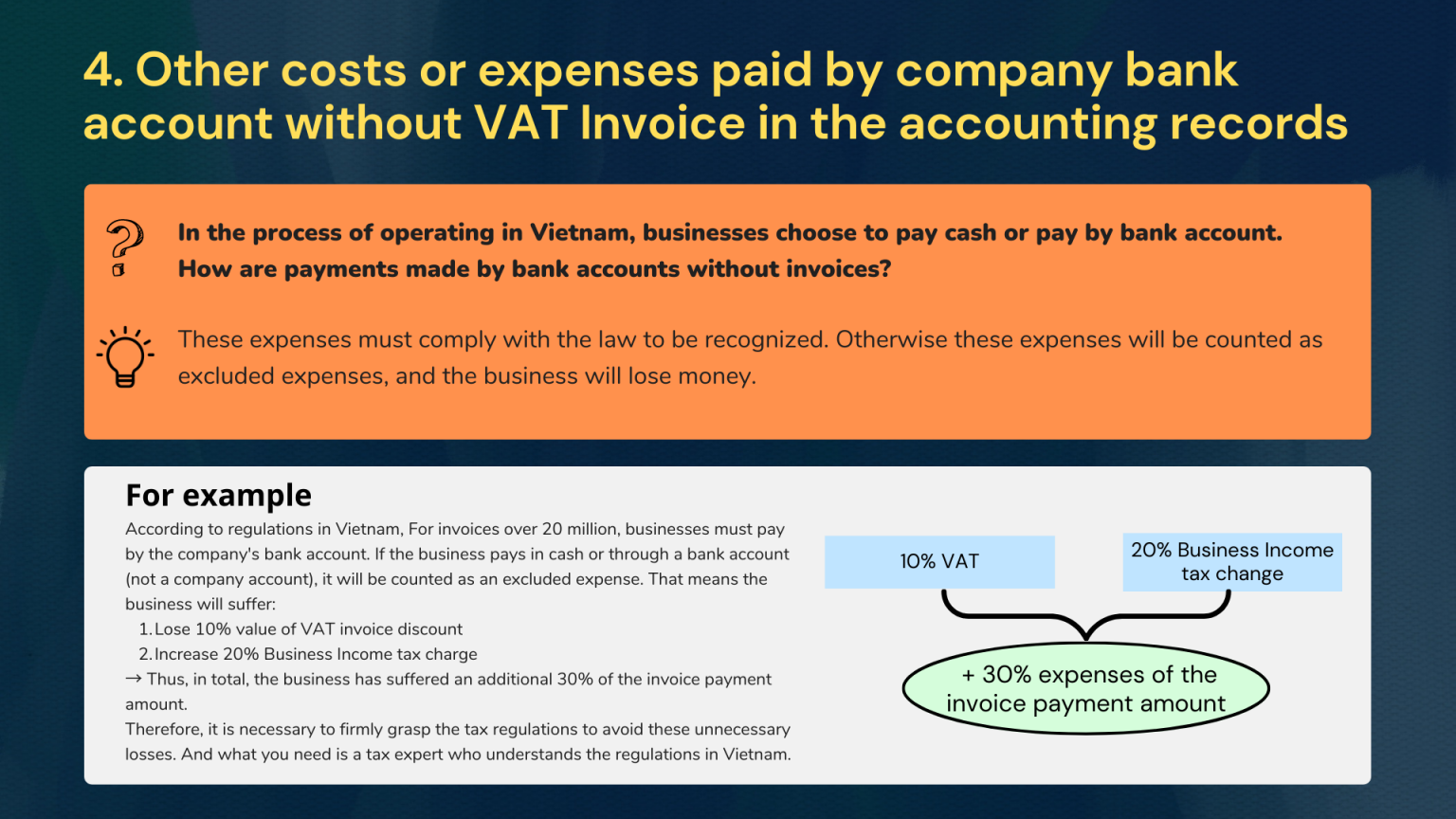

VAT Invoice in Vietnam What you need to know Topa vn

VAT Invoice in Vietnam What you need to know Topa vn

The Vietnamese government has decided not to reduce VAT by 2 for the

Vietnam should maintain fiscal support into 2023 Nh p s ng kinh t

Finance ministry proposes 2 VAT reduction for first half of 2025

Vietnamese Government considers extending VAT reduction to mid 2024

Vietnam s 2024 VAT Law and Extension of 2 VAT Reduction till June 25

Vietnam Guidance necessary for the new VAT plan ASEAN Economic

Vietnam set to raise effective tax rate on multinationals as part of

VAT ngh a l 224 g 236 vi t t t c a t n 224 o trong ti ng Anh 221 ngh a c a VAT

Vat L 224 G 236 L i 205 ch C a Vat i V i N n Kinh T Ra Sao Thu Vat L 224 G 236

What Is Vat Vietnam - The pictures related to be able to What Is Vat Vietnam in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.