VIES VAT API Integration Automate VAT Number Validation Processes

WooCommerce EU VAT Number Easy Guide VIES Checker AovUp formerly

VAT Validation Understanding how VIES help your Company

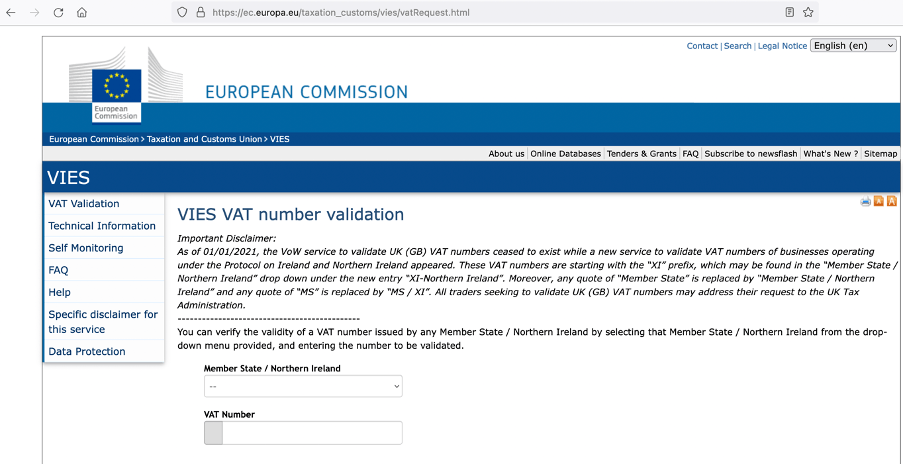

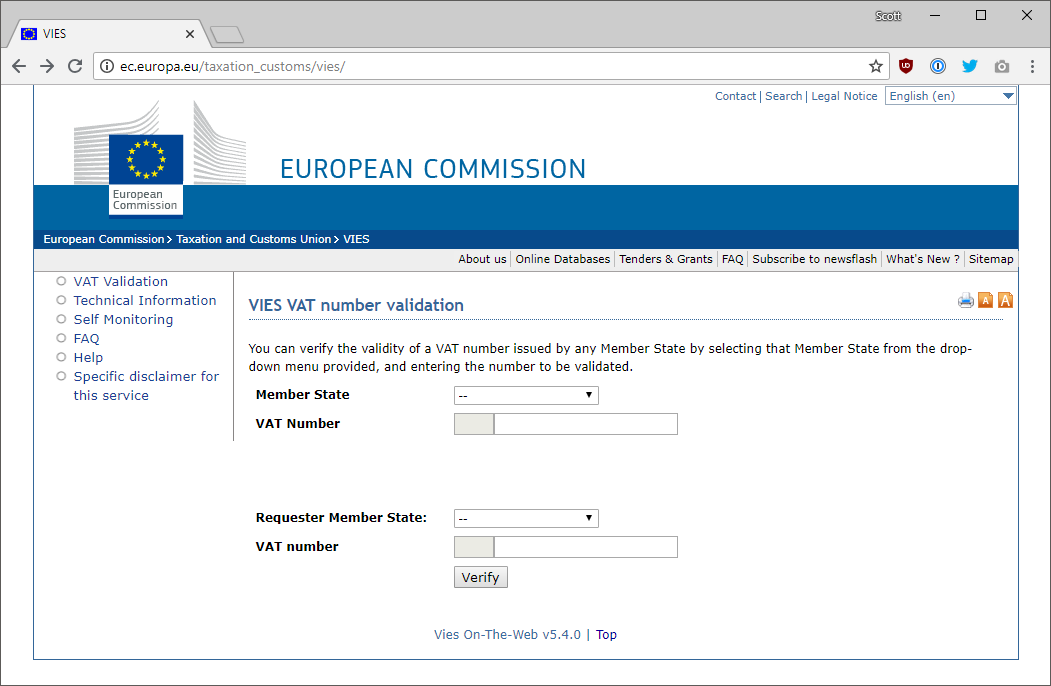

What is VIES the VAT Information Exchange System

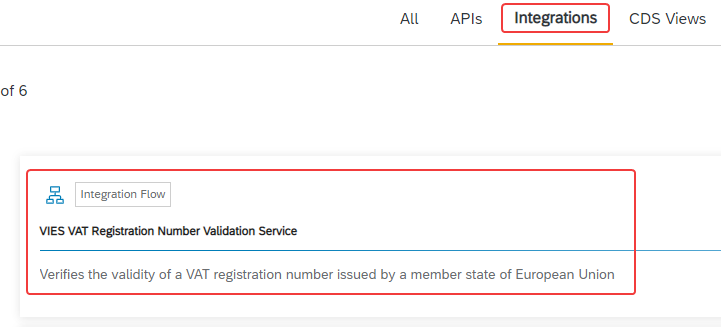

Integrating VIES VAT Validation with SAP S4 HANA SAP Integration Hub

Integrating VIES VAT Validation with SAP S4 HANA SAP Integration Hub

Integrating VIES VAT Validation with SAP S4 HANA SAP Integration Hub

Integrating VIES VAT Validation with SAP S4 HANA SAP Integration Hub

Downloadable VIES VAT data from the EU Network Programming in NET

VIES VAT API Microsoft Dynamics NAV Integration Point amp Click Solution

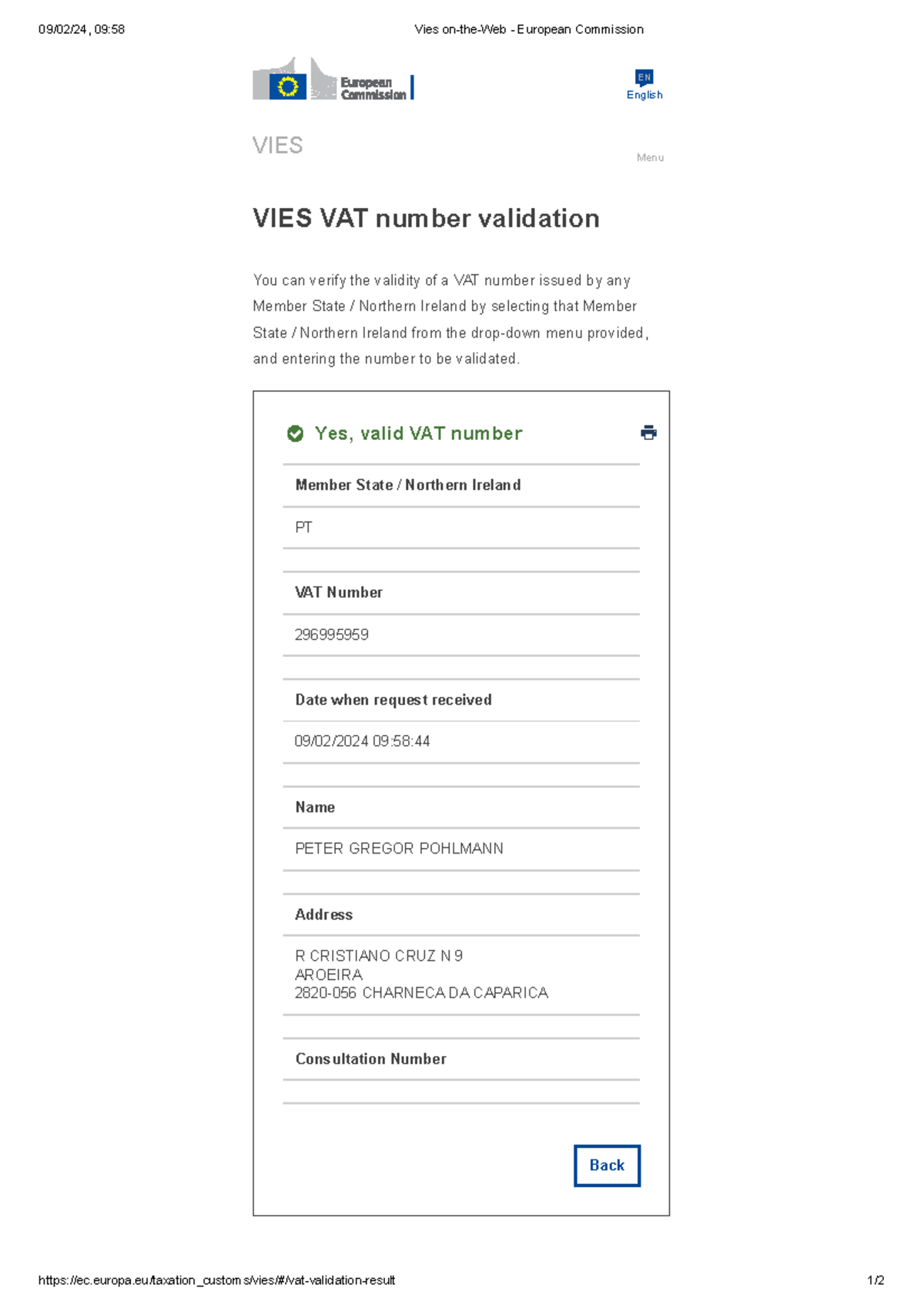

Fillable Online VIES VAT number validation European Commission Fax

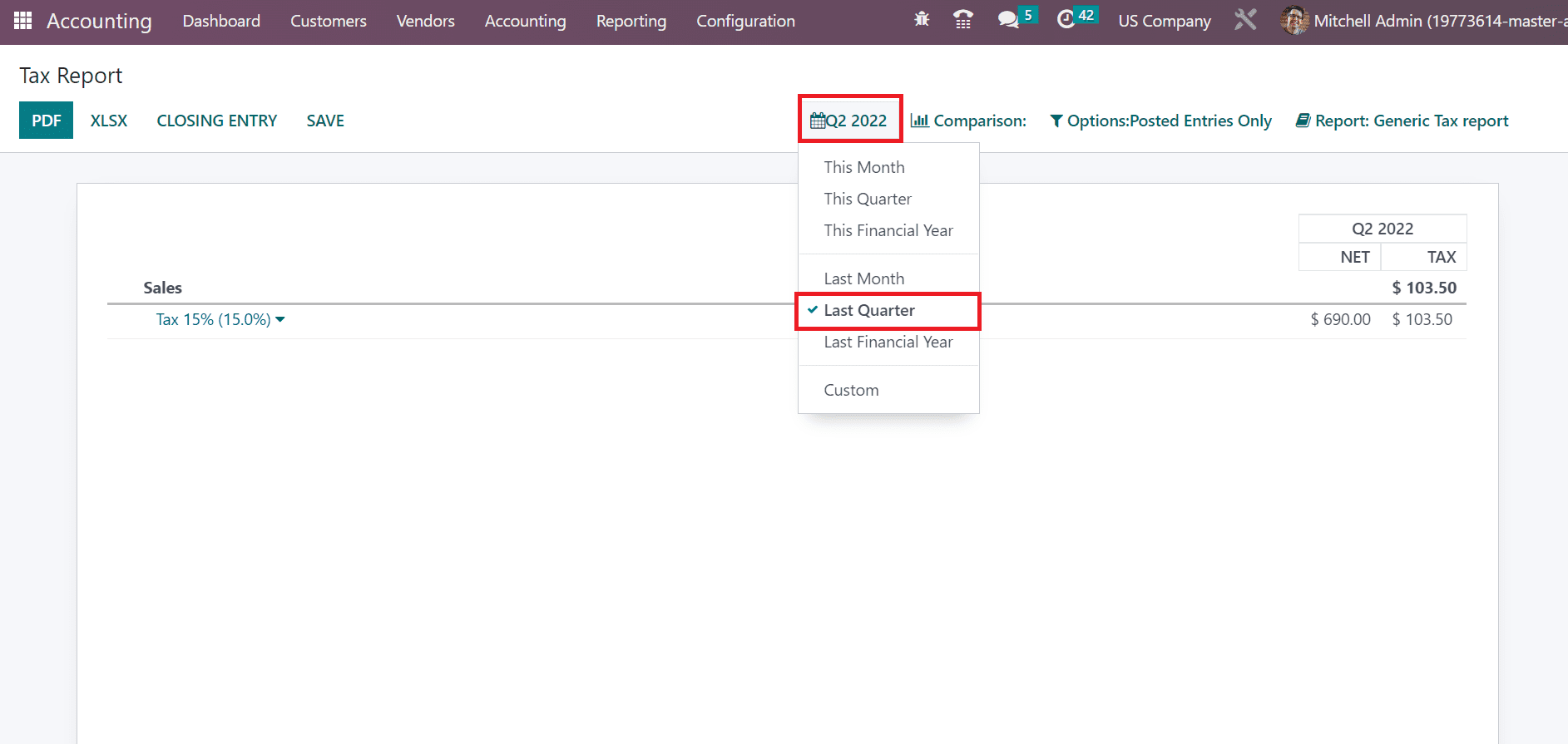

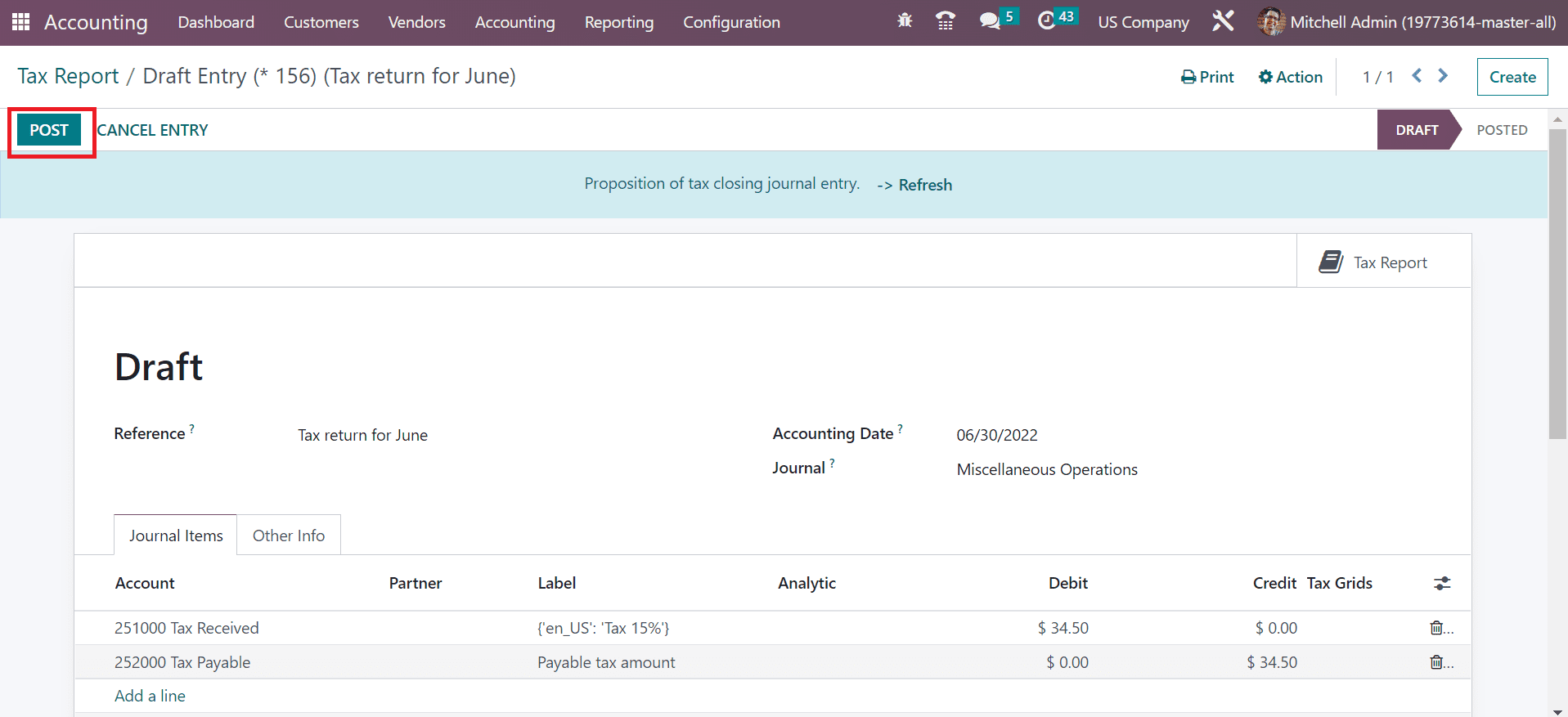

How to Verify VAT Numbers Using European Vies in Odoo 17 Accounting

How to Verify VAT Numbers Using European Vies Service in Odoo 16

How to Verify VAT Numbers Using European Vies Service in Odoo 16

What is a VIES Return AccountsPLUS

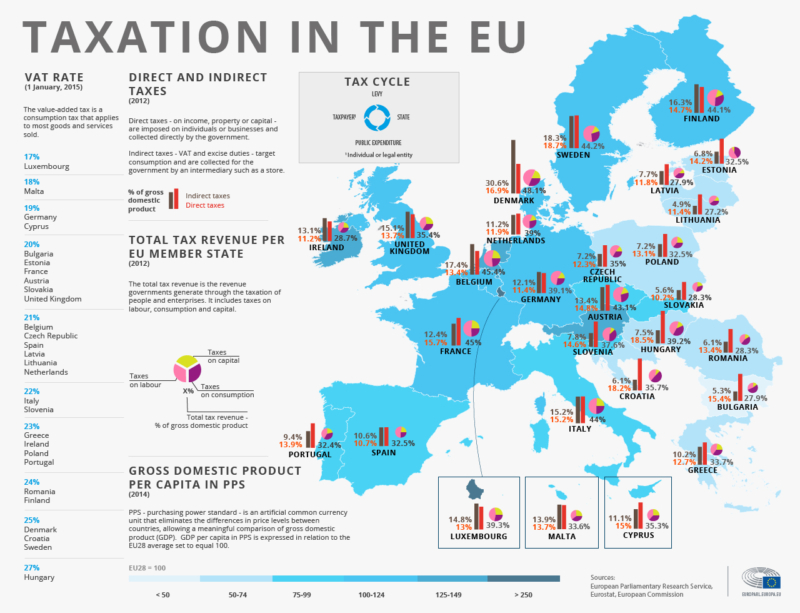

Paying VAT in Europe What is VIES and How Does it Apply To Business

VAT Information Exchange system VIES

What is VIES VAT Information Exchange System Lawants

Paying VAT in Europe What is VIES and How Does it Apply To Business

VAT Information Exchange system VIES

What is VIES VAT Information Exchange System Lawants

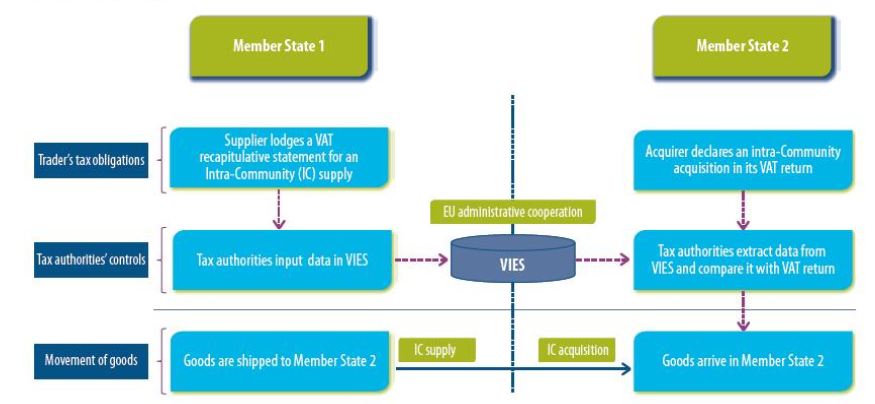

How do EU Member States exchange VAT information VIES Intrastat

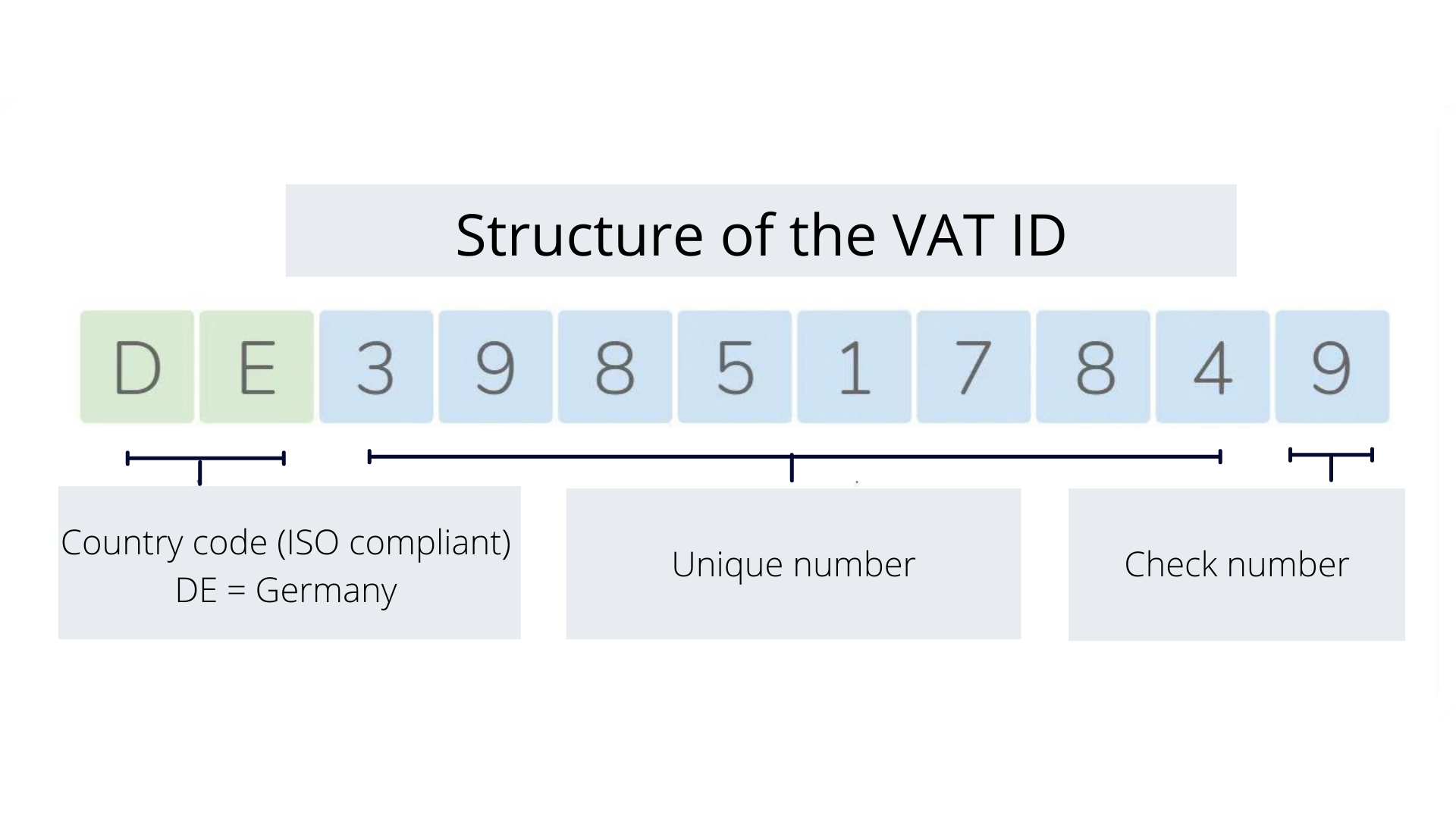

What Is VAT Number Online VAT Calculate

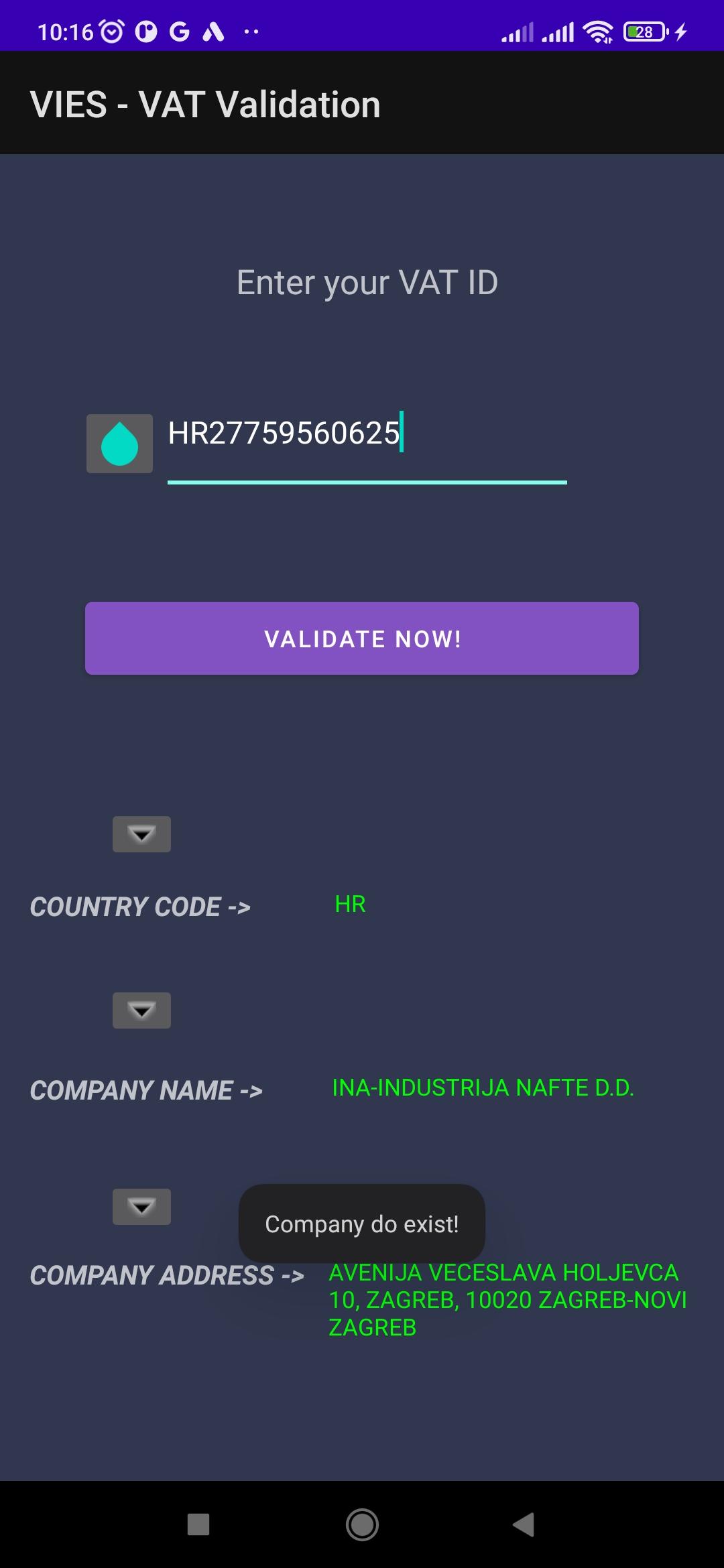

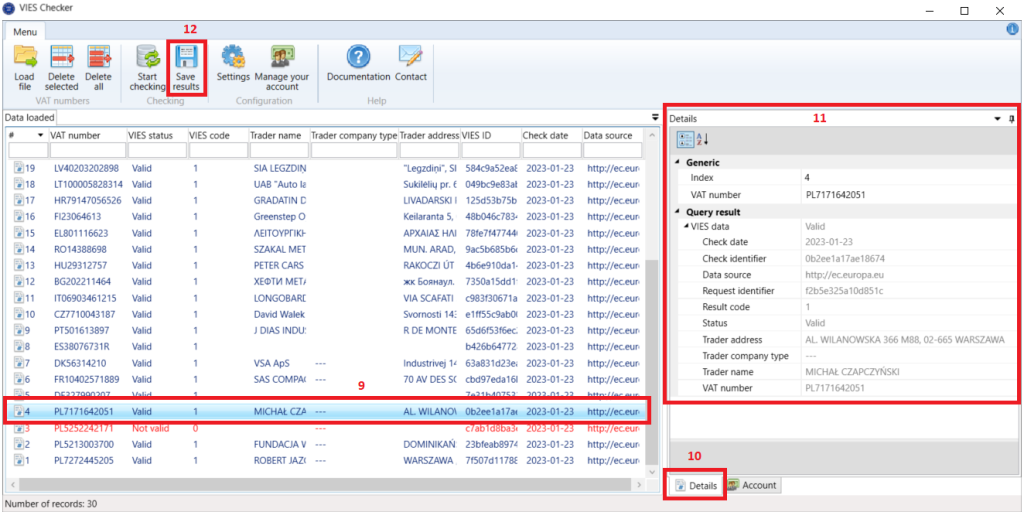

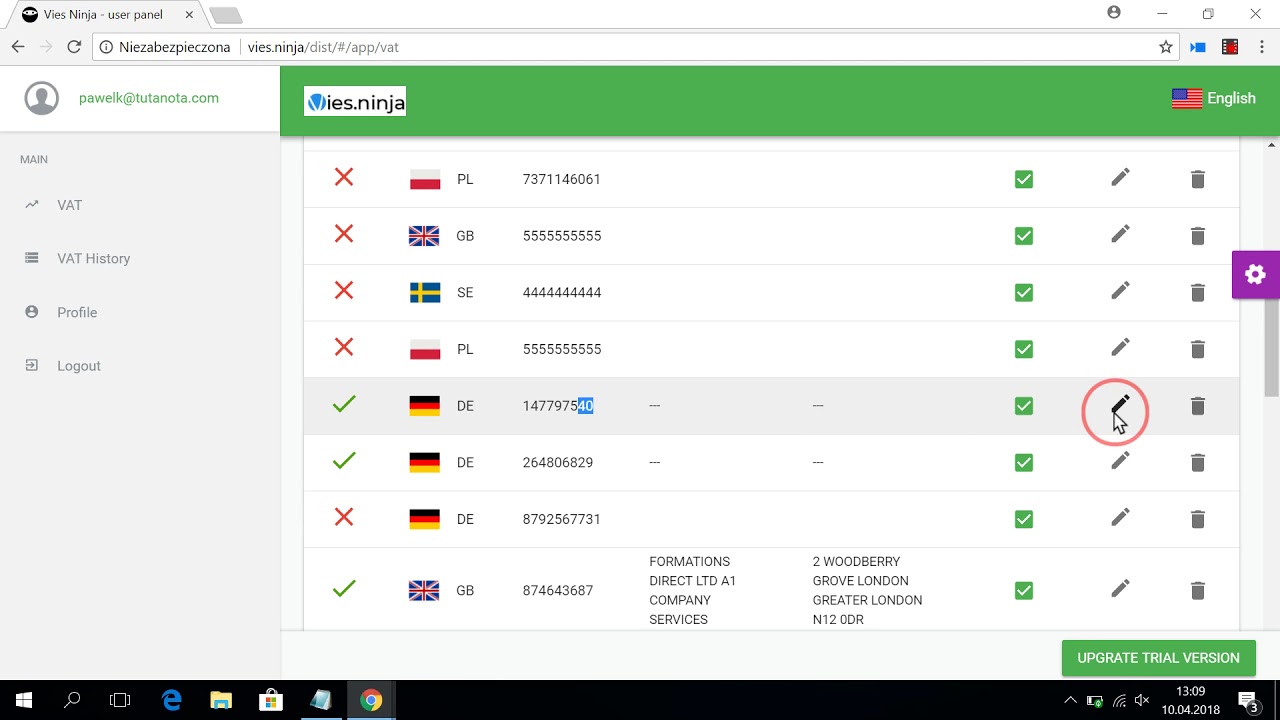

Automatic checking of EU VAT numbers in the VIES system in simply 3

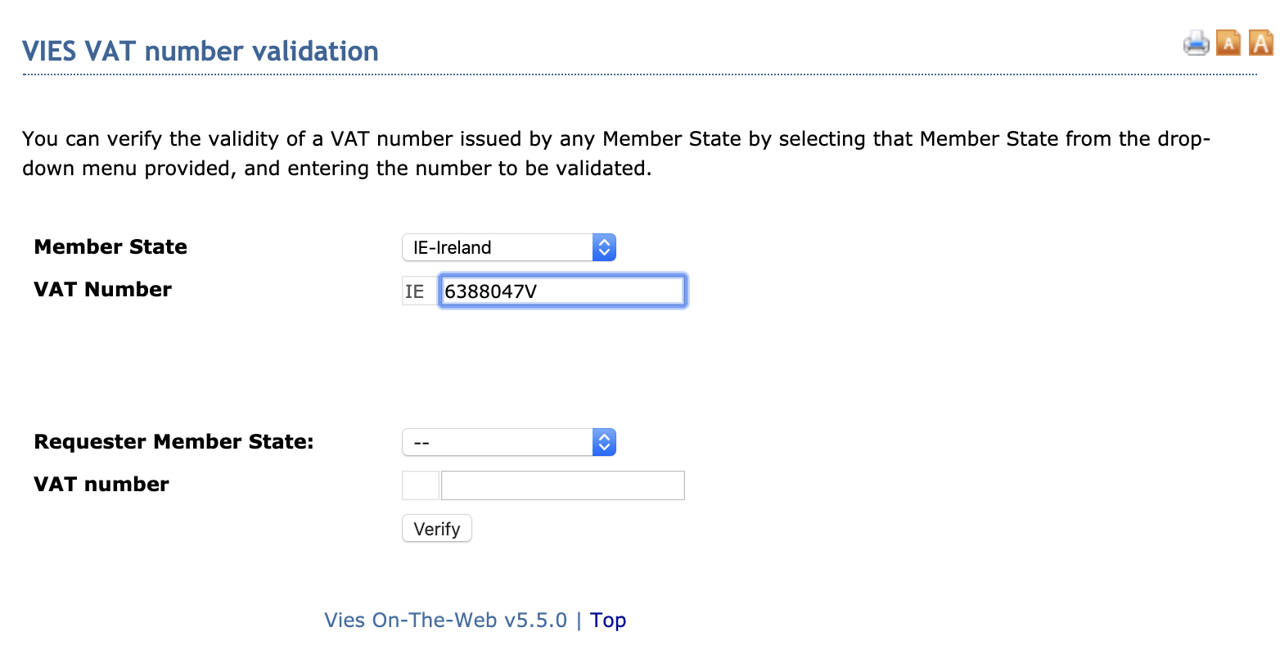

How to check if your VAT number is VIES compliant Search Autodesk

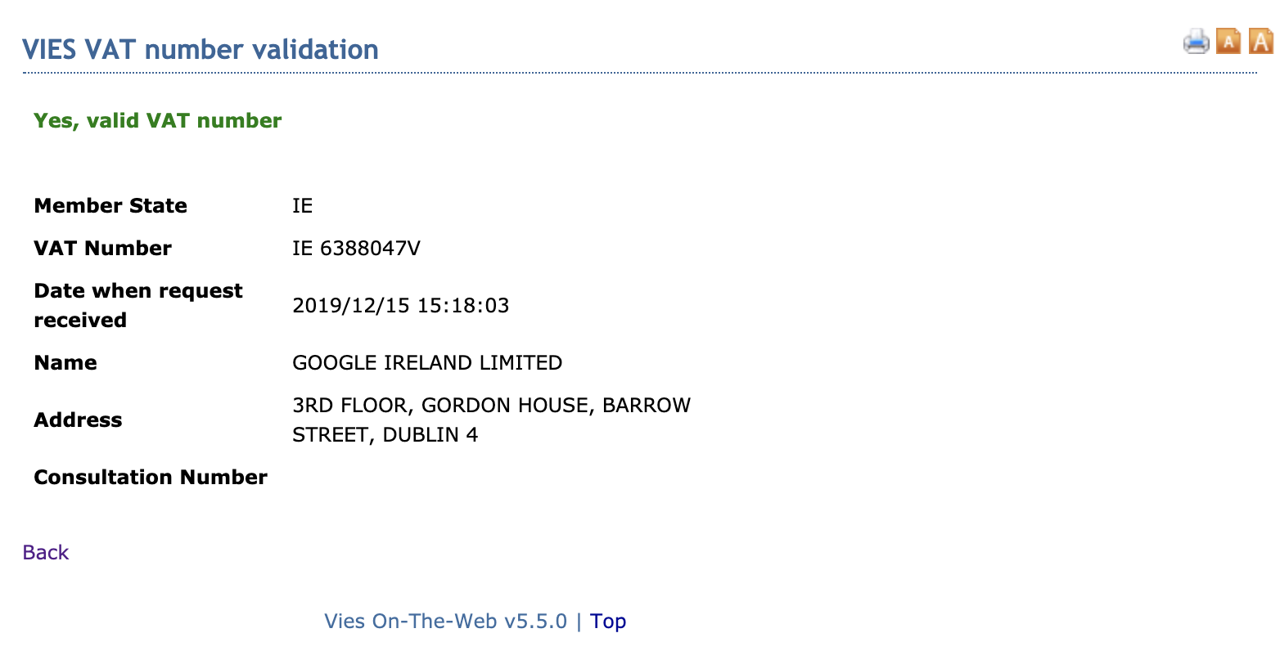

Check the validity of an Euopean VAT Number via VIES

VAT Number and VAT Registration Euro VAT Refund

VIES VAT check New Residency

VAT ID Verification Essential Guide for EU Traders

Vat validation check uk cadtaia

What is VAT Definition and Examples

A Brief History of VAT Sufio

What exactly is VAT Chartered Accountants

What is a VAT Number How to Use Them in the UK

What is VAT mean VAT Rate Advantages Demerits in the UAE

Is the Input VAT paid prior to Enrollment claimable VAT

What is VAT Understanding VAT Principles Implementation theGSTco

How To File VAT Return In UAE VAT Return Filing Procedures

Check the intra community VAT number the VIES tool

How to Check and Validate EU VAT Numbers Vatstack

VIES Is Having Issues Again So Here s What You Can Do About It

What is a VAT number eCommerce Sellers

What is VAT Number Learn how VAT Number can help you

What is a VAT Number Quaderno Medium

Use This VAT Validation API To Check Ireland VAT Number by

How to File a VAT Return Searche

How to Check and Validate EU VAT Numbers Vatstack

VIES Is Having Issues Again So Here s What You Can Do About It

What is a VAT number eCommerce Sellers

What is VAT Number Learn how VAT Number can help you

What is a VAT Number Quaderno Medium

Use This VAT Validation API To Check Ireland VAT Number by

How to File a VAT Return Searche

VAT Number Check API Most Common Uses Cases

Best VAT Number Check API For Worldwide Companies

VIES VAT Co musisz wiedzie o systemie VAT w UE Magazyn Firmowy

What are the key VAT implications for the education sector in the UAE

Calls for government to improve VAT system for SMEs Nationwide

VAT number search Simple steps to find the VAT number of a business

VAT number What is that and how to get it CloudOffice

What Is A VAT Number Validation And Why Should You Use One

Unlock Success Harnessing A VAT Number Validation API by

How to check the validity of an intracommunity VAT number ASD Group

Vies cosa 232 e a cosa serve

VAT VIES validation and automatic 0 VAT rate in PrestaShop

Vies on the Web European Commission europa taxation customs vies

Check VAT numbers in bulk on VIES YouTube

VIES VAT Number Validation in Europe why it needs an urgent update

VIES VAT API Integration Learn how TaskCentre can automate your VAT

VIES VAT number validation YouTube

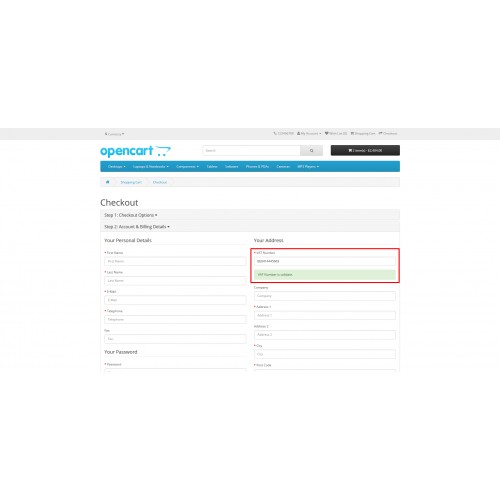

OpenCart VIES EU VAT number validation

VIES VAT EU HostBill Billing amp Automation Software for WebHosts

How the EU made our website slow

What Is Vat Vies - The pictures related to be able to What Is Vat Vies in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.