Impact of VAT on Hotel and Leisure Sector N R DOSHI amp PARTNERS

VAT for Hospitality Creative Word Training

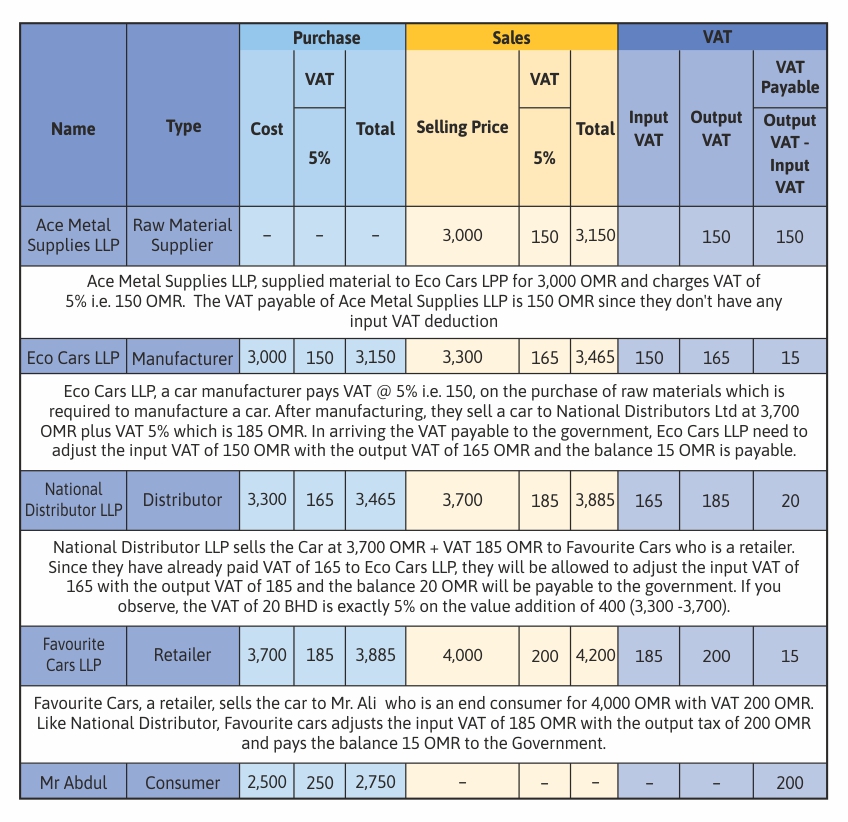

Basics of Value Added Tax VAT Zoho Books

Value Added Tax VAT for hotels in the Philippines FAQs included

VAT Refund for Hotels amp Travel Expenses in the EU VAT4U

VAT q amp a Can companies claim VAT on hotel bookings

VAT on Tourist Accommodation in Spain All you need to know WELEX

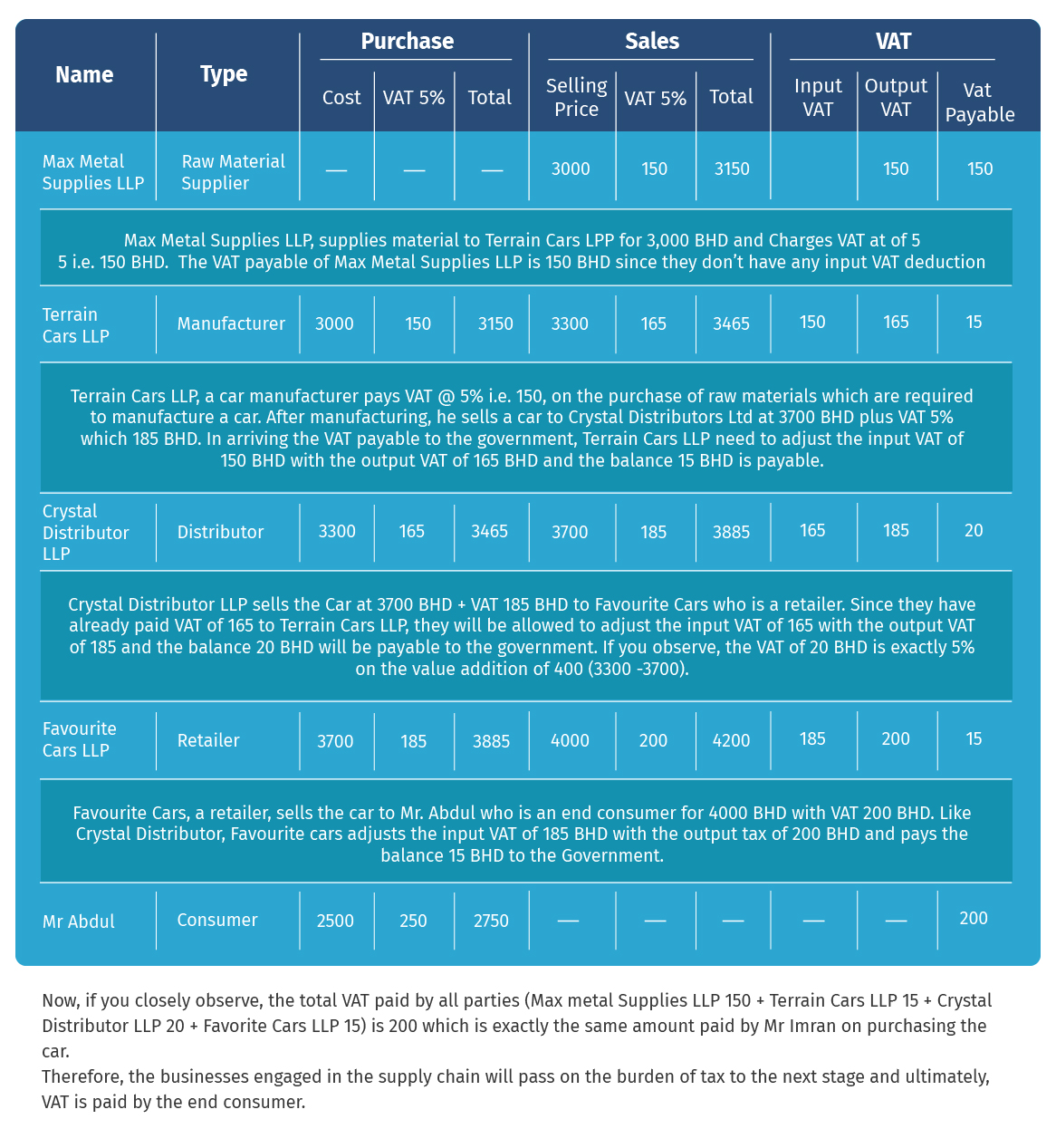

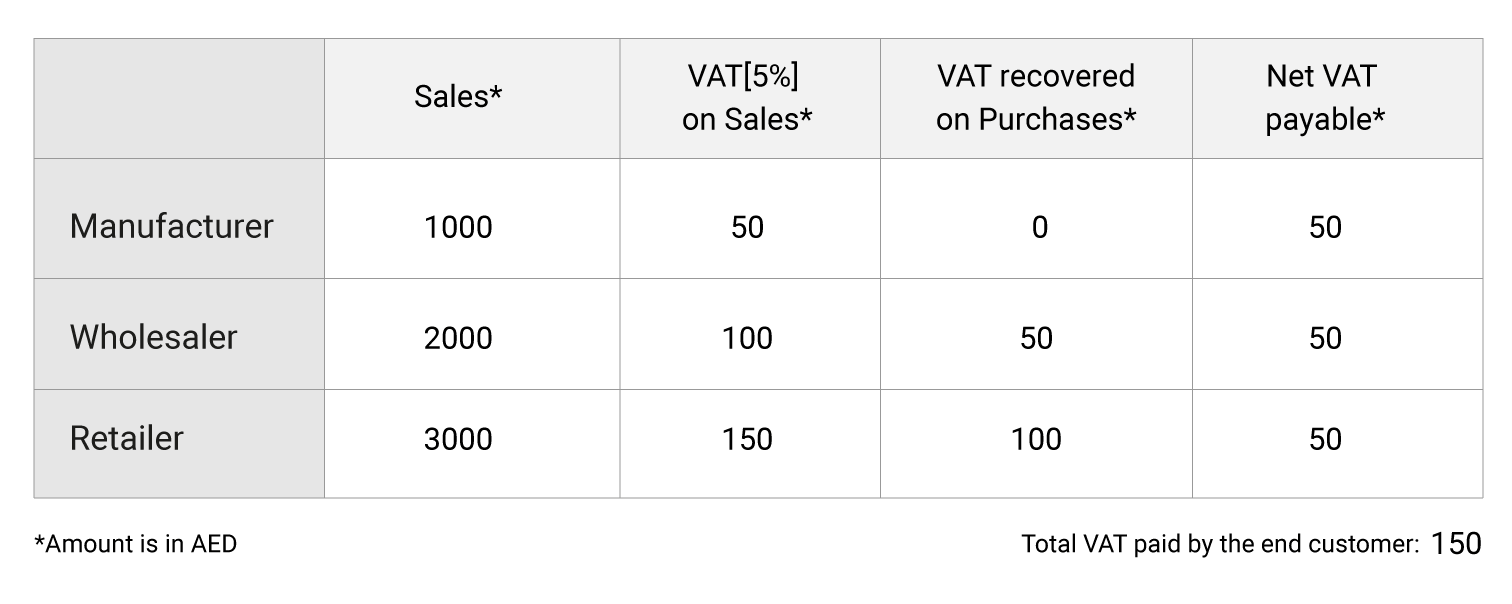

What is VAT amp How Does It Work Tally Solutions

VAT on Tourist Accommodation in Spain All you need to know WELEX

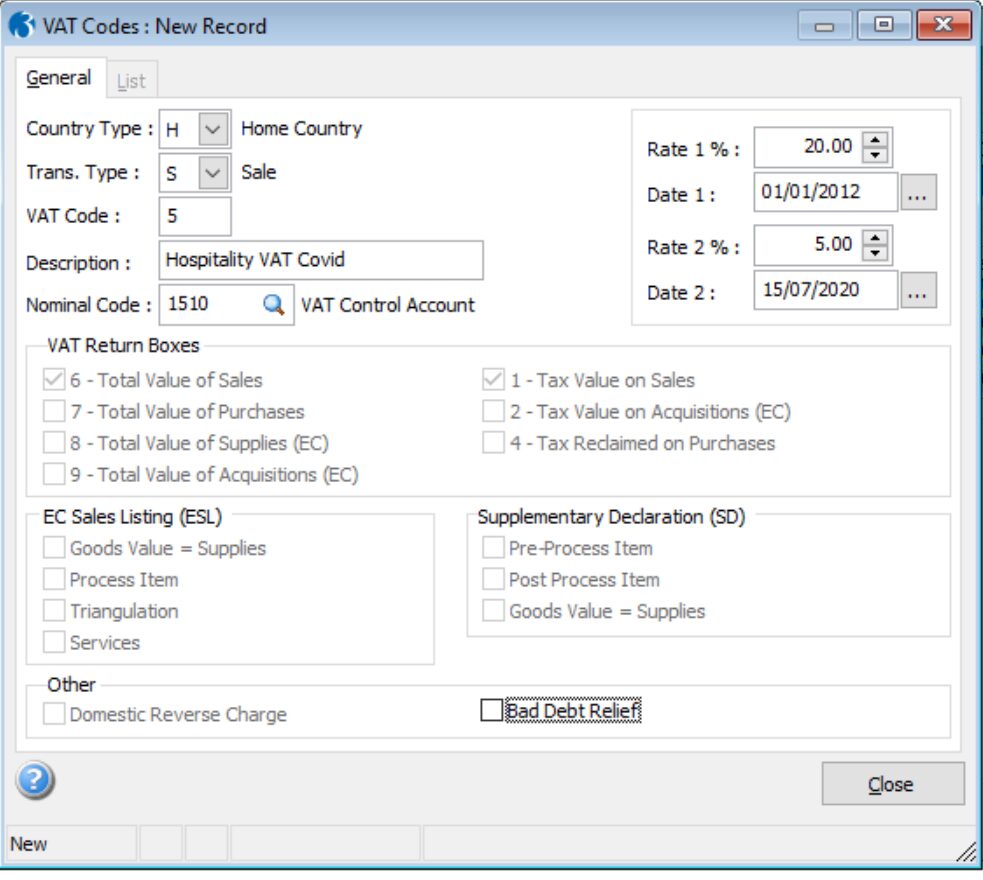

New Hospitality VAT rate for hospitality Legislation Change Sage

Hospitality VAT at 5 do you know what is covered Crowe UK

Ch 226 teau Mouton Rothschild The Vat Room

The quick guide to recovering VAT on hotels TravelPerk

More details on hospitality VAT reduction Saint

E U VAT added to all STR stays collected by Airbnb and other

E U VAT added to all STR stays collected by Airbnb and other

E U VAT added to all STR stays collected by Airbnb and other

E U VAT added to all STR stays collected by Airbnb and other

How To Manage The New Hospitality 5 VAT Rate AccountsPortal

UK Hospitality VAT Changes Complete IT

E U VAT added to all STR stays collected by Airbnb and other

E U VAT added to all STR stays collected by Airbnb and other

How To Manage The New Hospitality 5 VAT Rate AccountsPortal

UK Hospitality VAT Changes Complete IT

Temporary reduced rate of VAT for hospitality and tourism sector HUSA

Reduced VAT rate for hospitality sector Blog Torgersens Chartered

Can You Claim VAT On Accommodation In South Africa

Hospitality Industry Increased VAT Rate

VAT Rate Change for the Hospitality Sector from October 2021

Is Vat Applicable On Commercial Rent

Reduced rate of VAT for hospitality a reminder Gerald Edelman

The New Hospitality Industry VAT Rate DH Business Support

What is VAT and How Value Added Tax in Bahrain Works Tally Solutions

Hospitality Business VAT Reduction Ends KSB Recruitment

VAT on Hotels and holiday accommodation Cowgills

VAT rate change for the hospitality and tourism sector Saint

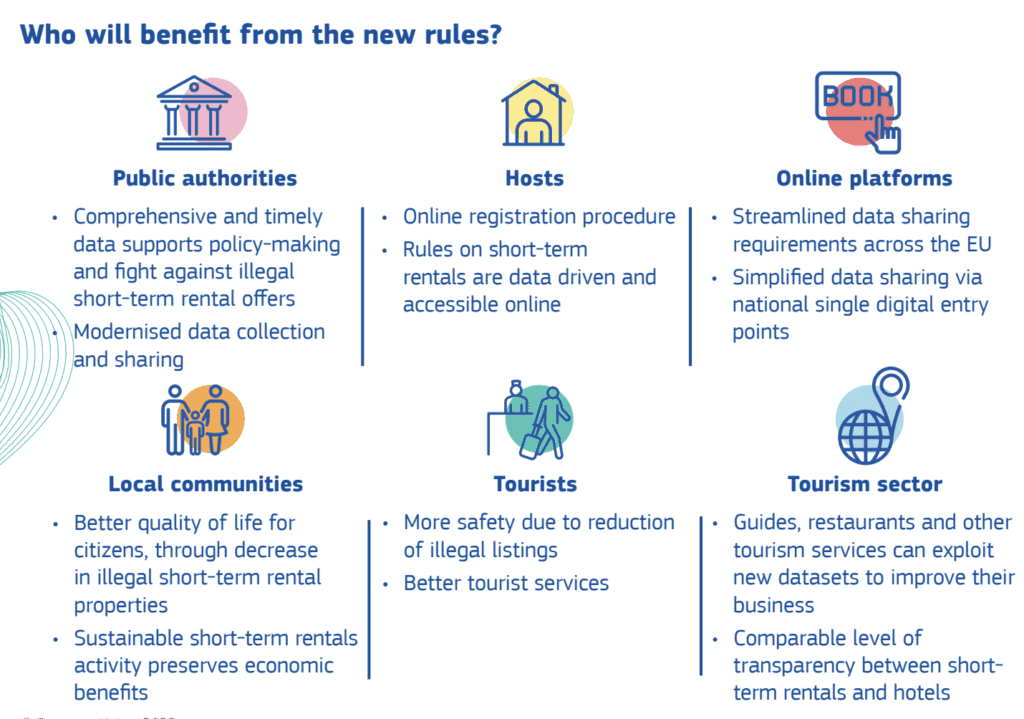

New EU VAT rules for the accommodation and transport sector

Hospitality VAT Rate Change

Airbnb rentals and the VAT threshold Duncan amp Toplis News

New Reduced Rate of VAT for Hospitality and Leisure Accounting Firms

The 5 VAT Rules And Reduced Rate VAT Eligibility Criteria Shapcotts

Hospitality VAT rate to return to 13 5 next year

Hospitality VAT increase how to maintain profits and prices

Hospitality VAT increase how to maintain profits and prices

Hospitality VAT increase how to maintain profits and prices

The quick guide to recovering VAT on Hotels Viap Travel

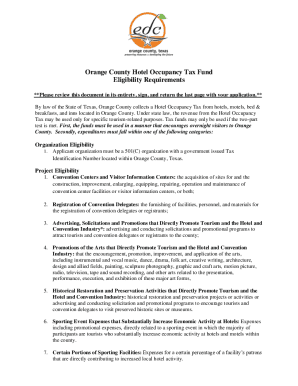

Hotel Occupancy Tax Uses PPT

VAT on Serviced Accommodations Is your Income over the VAT threshold

Hotel Occupancy Tax Uses PPT

VAT on Serviced Accommodations Is your Income over the VAT threshold

VAT on holidays Do you pay VAT on flights and hotels Personal

Smooth VAT implementation at hotels say UAE hoteliers Hotelier

VAT reduction on tourism What does it mean for your business White

Hospitality VAT increase how to maintain profits and prices

Hospitality VAT increase how to maintain profits and prices

Reduced rate of VAT for hospitality and leisure Holden Associates

12 5 VAT rate change for the hospitality holiday accommodation and

Reduced VAT rate for hospitality holiday accom and attractions

Hospitality VAT Increase How will it affect your business

The Economic Case for the Retention of the 9 Hospitality Vat Rate for

New VAT rate for Hospitality Holiday Accommodation and Attractions

Hoteliers won t gain from Booking com s VAT registration Southern

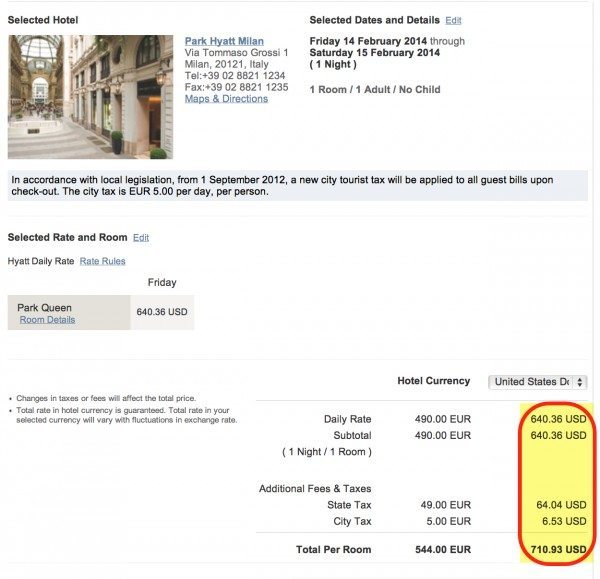

Hotel Award Tax Million Mile Secrets

Temporary reduced rate of VAT for hospitality holiday accommodation

Navigating VAT for Restaurant Owners Hints and Tips A2Z Accounting

This is how VAT works Its a tax that no one can escape even if you re

VAT Rates in the Hospitality and Catering Sectors in European

VAT Reduction Hospitality How does it actually work in practice HB amp O

Changing VAT rates causing confusion for hospitality businesses

What is hotel tax Room occupancy and lodging tax guide

How to Reduce VAT in Hospitality amp Tourism HB amp O

Fillable Online Hotel amp Motel Occupancy Tax Fax Email Print pdfFiller

VAT 5 hospitality rate Get the details right AccountingWEB

Are you ready for the VAT rate increase for the hospitality industry

Understanding Hotel Taxes Resort Fees amp Deposits For Incidentals

VAT Guide for Entertainment Accommodation and Catering Value Added

What Is Vat On Hotel Rooms - The pictures related to be able to What Is Vat On Hotel Rooms in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/7TLTQOUXNK4CEWIVQJQ4XXUXII.jpg)