Zambia VAT on fuel suspended African Energy

Rethinking VAT Making sense of Zambia s policy U turn on VAT

Rethinking VAT Making sense of Zambia s policy U turn on VAT

Rethinking VAT Making sense of Zambia s policy U turn on VAT

Rethinking VAT Making sense of Zambia s policy U turn on VAT

Rethinking VAT Making sense of Zambia s policy U turn on VAT

Harnessing the power of electronic fiscal devices to increase VAT

Transformation of Zambia s VAT Framework to Smart Invoice Mbulo

Transformation of Zambia s VAT Framework to Smart Invoice Mbulo

Transformation of Zambia s VAT Framework to Smart Invoice Mbulo

PwC Zambia Our 6th edition of the Africa VAT Guide Facebook

VAT in Zambia A Comprehensive Guide for Business Owners

VAT in Zambia A Comprehensive Guide for Business Owners

VAT GUIDE 2021 Zambia Revenue Authority

Mozambique VAT rate cut to 16 was approved by the Parliament

ZAMBIA TAX GUIDE An Overview Of The Fiscal Framework The Taxes And

VAT Rates in Japan Rates for all goods amp services

VAT GUIDE 2021 Zambia Revenue Authority

VAT in Zambia A Comprehensive Guide for Business Owners

Mozambique VAT rate cut to 16 was approved by the Parliament

ZAMBIA TAX GUIDE An Overview Of The Fiscal Framework The Taxes And

VAT Rates in Japan Rates for all goods amp services

Zambia VAT Submission Guide Vat Submission Guides Tolley s EU and

PUBLIC NOTICE VOLUNTARY VAT Zambia Revenue Authority

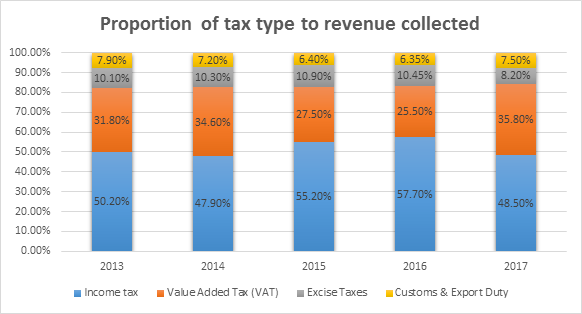

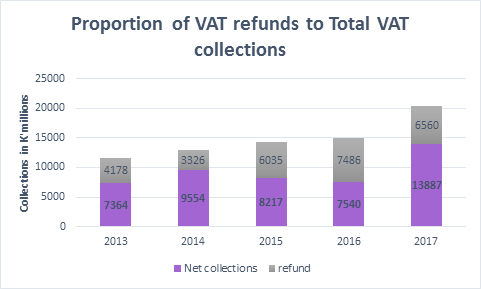

Taxation in Zambia Achievements and Challenges PMRC

Know Your Tax Quiz Grand Finale Zambia Revenue Authority

In Lusaka the Zambia Revenue Zambia Revenue Authority

Understand the Value Added Tax VAT in Zambia The Ultimate Guide

Here is your tax compliance Zambia Revenue Authority

Revenue authority prosecutes 175 VAT fraud related cases secures four

Zambia Import Duty The Only Guide You Need Zambia Trade

Zambia e invoicing soft launch until 1 Oct 2024 vatcalc com

South Africa VAT rise prospect vatcalc com

South Africa VAT rise prospect vatcalc com

Zambia Revenue Authority ZRA on LinkedIn zratax zambia

Know Your Tax Contributions Zambia Revenue Authority

Zambian Revenue Authority Launches E Payment System ZambiaInvest

Press Statement on VAT Rule 18 Zambia Chamber of Mines

Press Statement on VAT Rule 18 Zambia Chamber of Mines

What Businesses Are VAT Exempt Searche

What Are Zero Rated VAT Items Searche

Can You Claim VAT On Accommodation In South Africa

Can You Claim VAT On Accommodation In South Africa

Zimbabwean government announces VAT on Tourism after all APTA

How is VAT Calculated in South Africa Searche

Understanding Zimbabwean Value Added Tax VAT system Lucent Consultancy

How to Claim Back VAT in South Africa Searche

How to Register for VAT in Zimbabwe Complete 2025 Guide amp Required

Smart Invoice launched Always ask for your receipt By Zambia

SMART INVOICE ELECTRONIC INVOICING UPDATE FOR VAT REGISTERED

Increasing tax revenues from SMEs in Zambia

Zambian government reintroduces VAT and Levy on fuel Zimpricecheck

How Does VAT Work with Business in South Africa Searche

VAT in South Africa The Basics

What are the requirements to Register for Value Added VAT Tax in

Zambia ZRA increases the number of withholding VAT agents

Zambia Revenue Authority ZRA on LinkedIn KNOW YOUR TAX QUIZ

Everything You Need to Know About VAT Registration in South Africa

How To Apply For A VAT Number In South Africa Searche

How To Check The Validity Of A VAT Number Searche

VAT is going to be headache for all City Press

Tax System Taxation in Zambia Studocu

High VAT encouraging tax evasion Nkombo Zambia News Diggers

Advance Income Tax For Importers Into Zambia And How to Avoid It M

Are Salaries VAT Exempt or Zero rated in South Africa Accounting Boss

Ministry drafts amendments to increase VAT management

Zambias Tax system Law of taxation lecture notes The Zambia Tax

Dentons Global tax guide to doing business in Zambia

Zimbabwe Amends VAT Exemptions For Essential Goods And Services

VAT What is it and how does it work in South Africa CVW Accounting

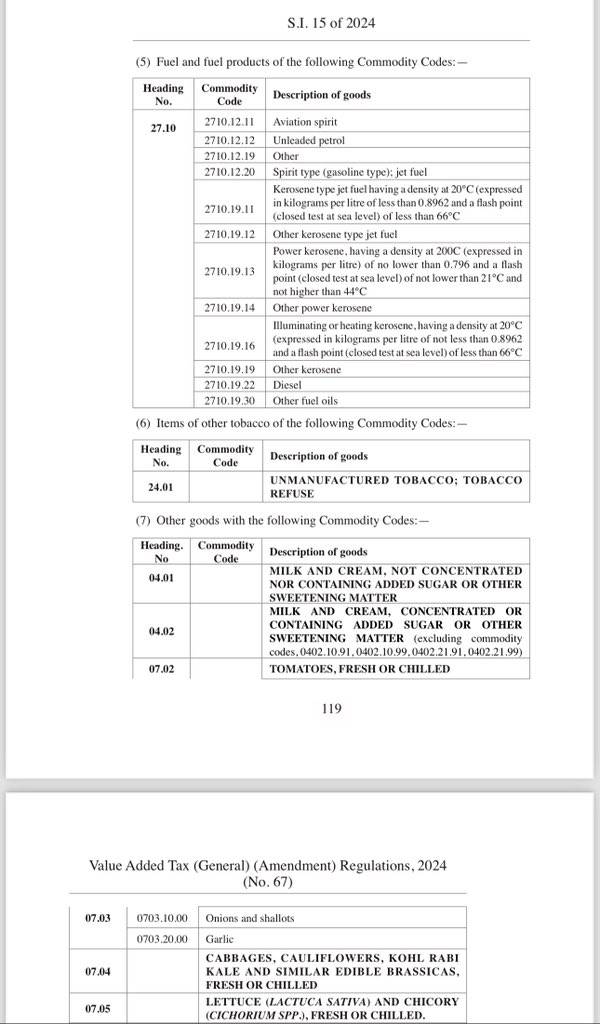

What Is Vat In Zambia - The pictures related to be able to What Is Vat In Zambia in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.