VAT Explained Ireland Right Solution Centre

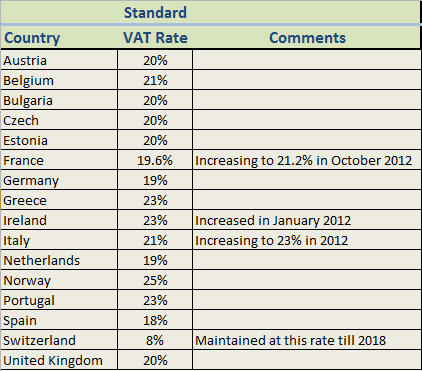

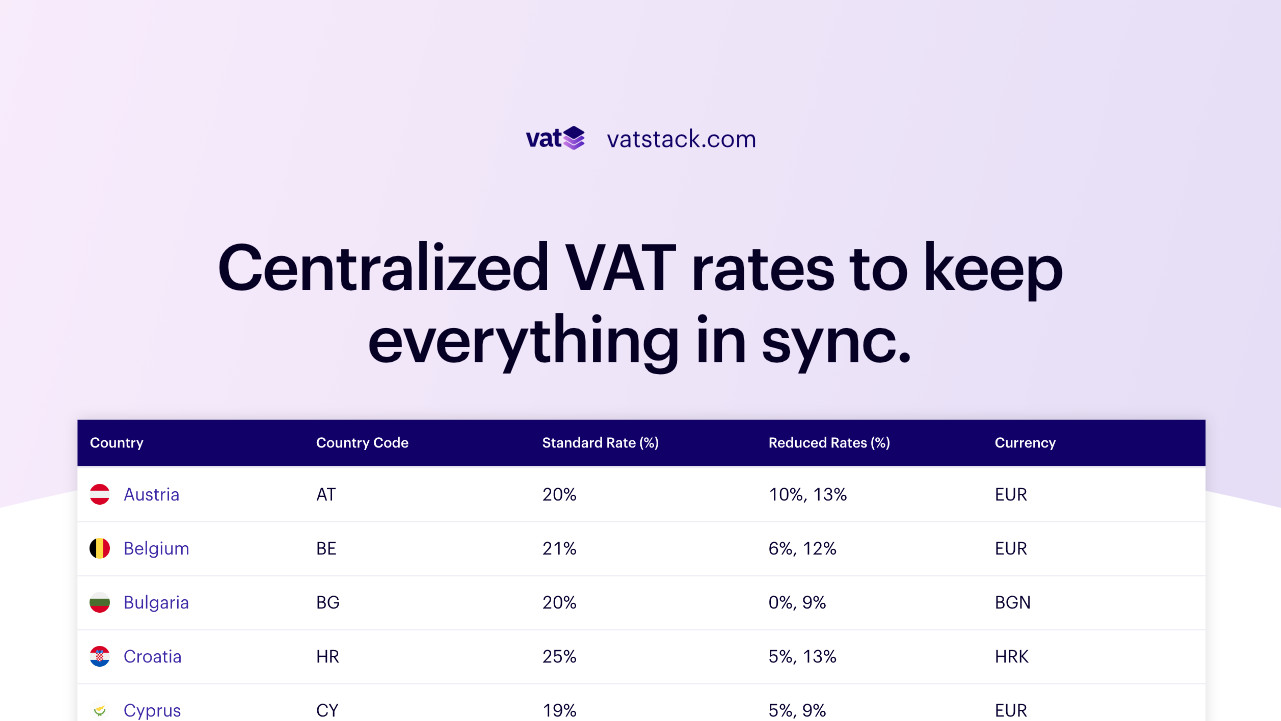

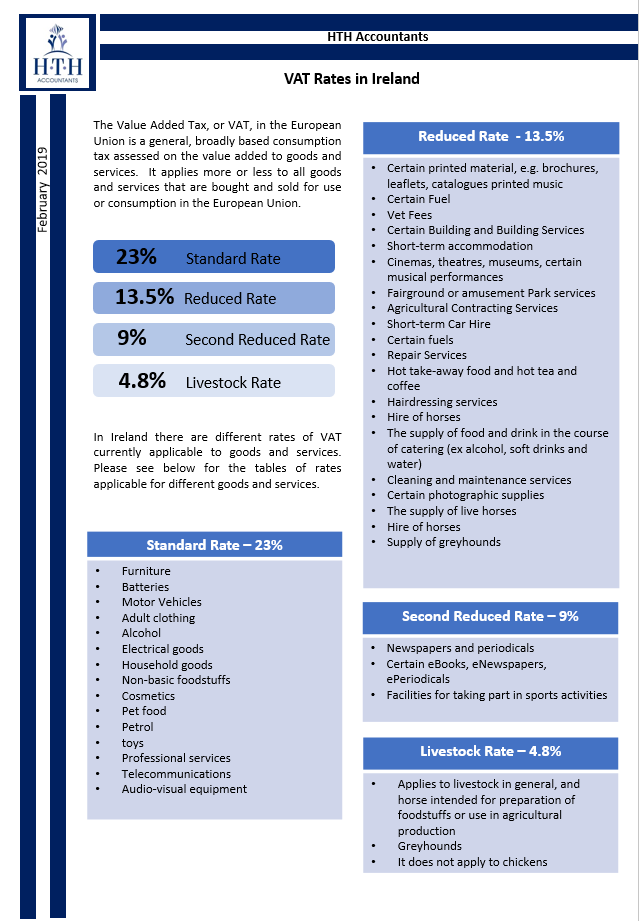

VAT Rates in Ireland HTH Accountants

VAT Rates in Ireland HTH Accountants

VAT Calculator Ireland October 2024 Standard Rate is 23

Irish Income Tax Calculator 2023 VAT Calculator

Ireland VAT Explained Rates Rules amp Compliance eClear

Ireland VAT Explained Rates Rules amp Compliance eClear

Ireland VAT Explained Rates Rules amp Compliance eClear

UK Ireland VAT Calculator

VAT registration in Ireland Taxology

Ireland VAT Registration formacompany ie

Vat rates Ireland Fitzgerald Power

Vat rates Ireland Fitzgerald Power

Vat rates Ireland Fitzgerald Power

Vat rates Ireland Fitzgerald Power

Ireland raises VAT registration threshold 2025 vatcalc com

Ireland raises VAT registration threshold 2025 vatcalc com

VAT Registration Ireland Guide for 2025

Ireland VAT Guide Taxback International

Vat rates Ireland Fitzgerald Power

Vat rates Ireland Fitzgerald Power

Ireland raises VAT registration threshold 2025 vatcalc com

Ireland raises VAT registration threshold 2025 vatcalc com

VAT Registration Ireland Guide for 2025

Ireland VAT Guide Taxback International

VAT in Ireland 5 Common Questions Answered Ag Associates

VAT in Ireland a complete guide Firmbee

VAT Rate Change for Ireland The British Beauty Council

VAT Returns File Your Returns in Ireland VAT Digital

How to do VAT Returns in Ireland My Vat Calculator

How do I get a VAT number in Ireland First Accounts Ireland

Ireland Changes VAT Rates for Newspapers Hospitality amp Tourism

Add VAT In Ireland Calculate VAT My Vat Calculator Ireland

VAT On Services In Ireland Understanding the Regulations and Requirements

Understanding VAT Demystifying Irelands Taxation System Biz World

Smart Ireland VAT Calculator 2023 Quick amp Accurate Results

VAT RETURNS VAT Registrations Pay Less Tax at taxes365 ie

Guide to Irish VAT Square Ireland

VAT Calculator Ireland Add Or Remove VAT Calculate Irish VAT 2024

Barry Caldwell Author at My Vat Calculator

VAT Calculator Ireland Calculate Irish VAT

The Essential Guide to Value Added Tax VAT in Ireland TAS

VAT in Ireland What you should know Lalor and Company

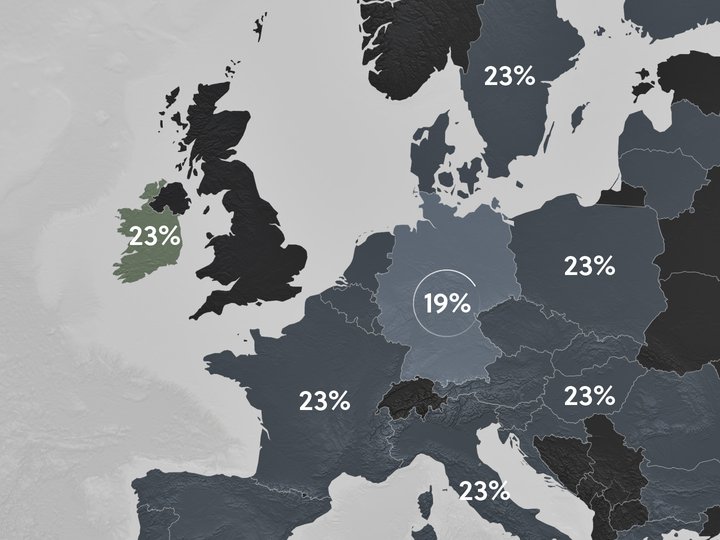

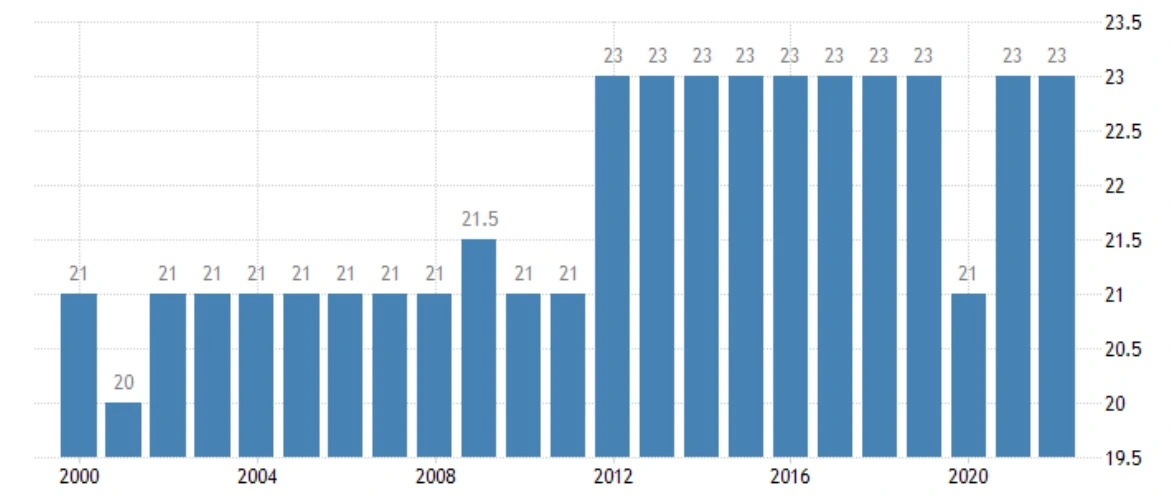

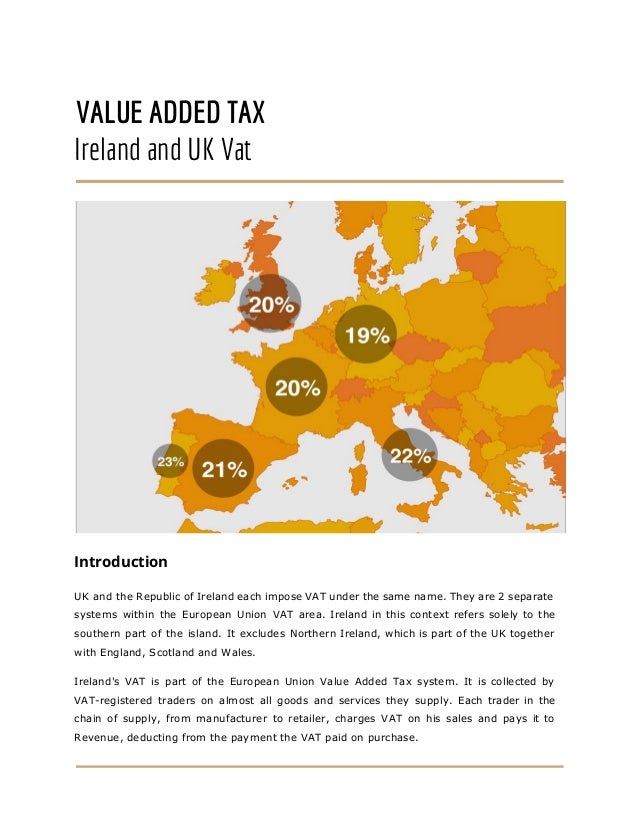

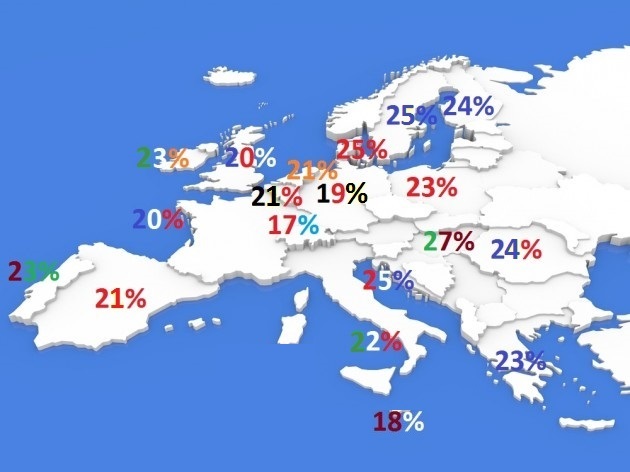

How does Ireland s VAT compare to the rest of Europe 183 TheJournal ie

VAT Registration Revenue Commissioners Ireland First Accounts Ireland

Guide to Charging VAT in Ireland the EU and Internationally TAS

Does my Irish company need to apply for VAT Registration

The Essential Guide to Value Added Tax VAT in Ireland TAS

VAT in Ireland What you should know Lalor and Company

How does Ireland s VAT compare to the rest of Europe 183 TheJournal ie

Check VAT Numbers Ireland Verify VAT Number Now

VAT Registration Revenue Commissioners Ireland First Accounts Ireland

Guide to Charging VAT in Ireland the EU and Internationally TAS

Does my Irish company need to apply for VAT Registration

Dynamics of the VAT proceeds in Ireland as a percentage of GDP

VAT rates Taxworld Ireland

When do I need to Register for VAT and Tax in Ireland

What is VAT A guide to VAT for small businesses in Ireland Sage

Irish VAT registration two tier system Right Solution Centre

VAT Invoice in Ireland Definition Sample and Creation

What is VAT Understanding VAT Principles Implementation theGSTco

Irish VAT Before Starting a Business Qeedle UK

How to Apply Ireland s Recent VAT Changes VAIT

Ireland s 23 VAT Rate is Back My Duty Collect

Using EU Reverse Charges on VAT Returns Ireland AccountsIQ

How To Do An Irish VAT RTD Return

Taxes in Ireland Examining Taxation Income Inequality and Poverty

Irish VAT due to Increase to 23 Gallagher Keane

VAT for Beginners Irish VAT Explained with 7 Key Points Brad 225 n

Set up Irish taxes in your Shopify store Sufio for Shopify

VAT for Beginners Irish VAT Explained with 7 Key Points Bradan

VAT in Ireland When Should I Register and How Does it Work

Everything Irish Businesses Need to Know about VAT

How To Charge VAT In Ireland the EU and Internationally A Complete

New VAT rules for goods bought from non EU countries

What Is Vat In Ireland - The pictures related to be able to What Is Vat In Ireland in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

.png)