VAT rates in Hungary VATupdate

Understanding the Hungary VAT Rate A Complete Overview

VAT deduction in Hungary Helpers Magazine

Invoicing in Hungary Invoice Requirements in Hungary

VAT Hungary 2025 Taxology

Hungary VAT country guide 2023 vatcalc com

Hungary VAT country guide vatcalc com

Hungary VAT country guide 2023 vatcalc com

Taxually Hungarian VAT Rates and Compliance Requirements

Hungarian VAT numbers Advocate Abroad

Hungary VAT Update Essentia Global VAT Tax Management

Hungary VAT guide for digital businesses The VAT index for digital

Business Definition Series VAT in Hungary Business Management Hungary

Hungary VAT Guide Taxback International

VAT in Hungary a complete guide Firmbee

VAT in Hungary a complete guide Firmbee

VAT Hungary New era in Hungarian VAT compliance

VAT Registration in Hungary wit international experience MGI BPO

Hungary VAT Guide Taxback International

VAT rates in Hungary HELPERS

VAT Hungary New era in Hungarian VAT compliance

VAT Registration in Hungary wit international experience MGI BPO

Hungary VAT Guide Taxback International

VAT rates in Hungary HELPERS

Hungary VAT Guide Taxback International

Complete Guide to VAT in Hungary Rates Registration and Reporting

What is a VAT report in Hungary and how does it work HELPERS

VAT gap in Hungary 2011 2015 Download Scientific Diagram

VAT gap in Hungary 2011 2015 Download Scientific Diagram

Value Added Tax VAT Guidelines Hungary R 246 dl amp Partner

Hungary VAT registration threshold rise to HUF 18m 2025 vatcalc com

Registering for VAT in Hungary

Registering for VAT in Hungary

Hungary Expands Real Time VAT Controls Essentia Global VAT Tax Management

MICHELIN V 225 t map ViaMichelin

How does VAT in Hungary change in 2018 Helpers

Hungary extends property VAT cut for COVID vatcalc com

VAT in Hungary obligations of foreign companies

Hungary Tax Rates and Rankings Tax Foundation

Hungary Tax Rates and Rankings in 2025 Taxation for Individual

Hungarian VAT essentials AccountingBudapest

What is VAT Everything You Need to Know About VAT in Bulgaria Motion

Revolutionizing Hungarian VAT Compliance The Era of eVAT and M2M

Common VAT Mistakes in Hungary in 2024 and how to Avoid Them

Hungary Withholding Tax Rate

Hungarian and EU VAT number Company Formation

VAT in Hungary the guide to Intra Community VAT Easytax

VAT in Hungary the guide to Intra Community VAT Easytax

GitHub rocketfellows hu vat format validator This component provides

Is Hungary the new European Corporate tax haven Flag Theory

VAT Registration of Hungarian Companies Leinonen Hungary

Hungarian VAT legislation Cambiamenti IVA 2017 in Ungheria in

How and when to register a Hungarian VAT number Helpers Finance

Business tax revenues in Hungary Download Scientific Diagram

The essentials of corporate tax in Hungary Helpers Finance

The tax system in Hungary SilverOffice

What is VAT Why is it necessary Vezuve E hracat

Hungary s Tax Office Collected 41 2 Billion Euros In Revenue Last Year

Closer VAT cooperation is needed at EU level Emerging Europe

U S Hungary tax treaty no longer in effect Accounting Today

Effective tax rates in Hungary between 2007 and 2017 Download

Effective tax rates in Hungary between 2007 and 2017 Download

Local government tax revenues in Hungary 2015 2020 in million HUF

Hungarian VAT registration what you need to know

Unlocking Hungary s Competitive Edge Lowest Corporate Tax Rate in Europe

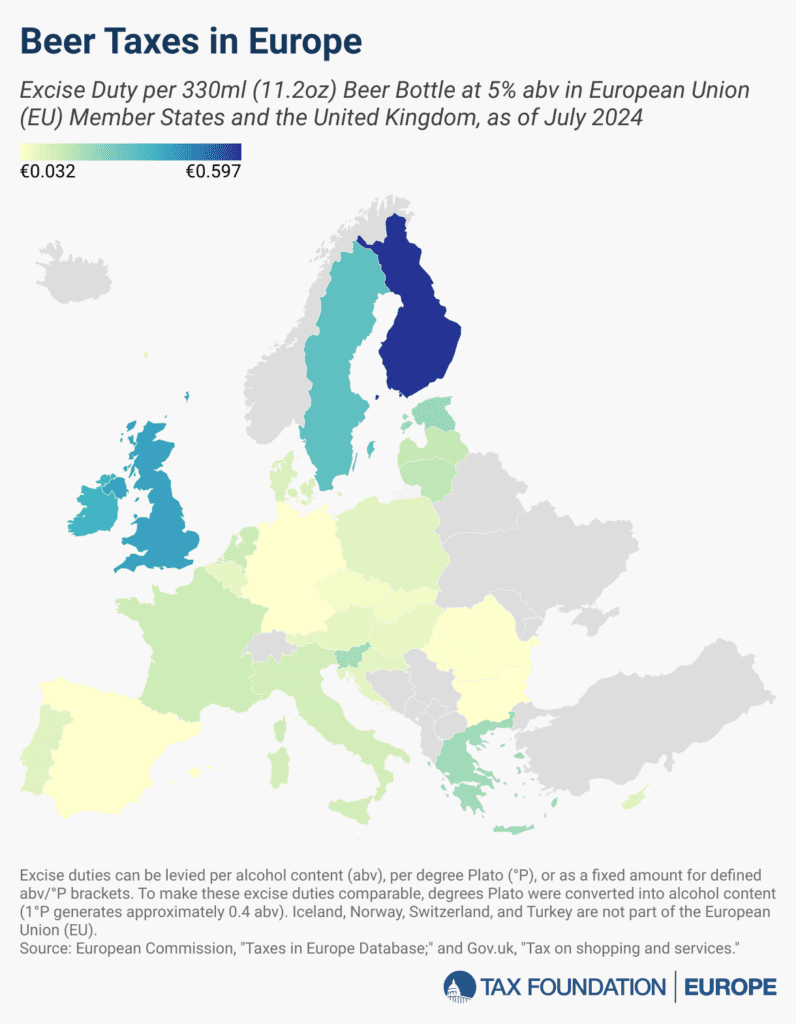

The EU countries with the highest standard VAT rates are Hungary 27

PDF Does VAT Cut Appear on the Menu The Consumer Price Impact of

How to Set Up a Company in Hungary Your Step by Step Guide

E Invoicing in Hungary 2025 Requirements

What does the current debate on VAT in Czechia mean for consumers

Hungary Approval of new tax package

Extended Producer Responsibility EPR in Hungary SME INFO 187 Process

Which is the best taxation system in Hungary Whispering Tree Blog

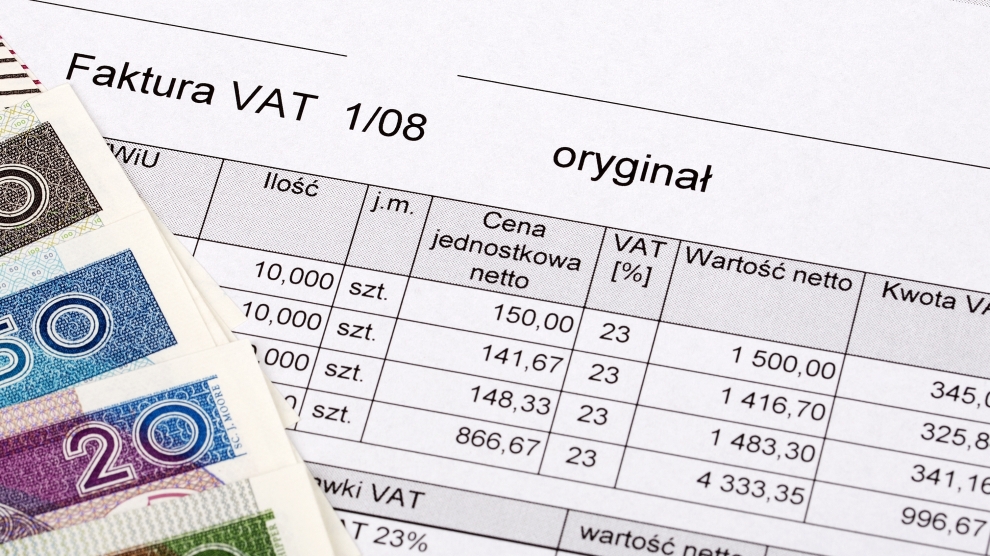

inscription Vat next to the polish zlotys Vat means value added tax

What Is Vat In Hungary - The pictures related to be able to What Is Vat In Hungary in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.