VAT Flat Rate Scheme Explained Vantage Accounting

Flat Rate VAT Scheme Percentages

VAT Flat Rate Scheme everything you need to know Xero

VAT Flat Rate Scheme Advantages Restricted Maze Accountants

Changes to the VAT Flat Rate Scheme Accountants and Tax Advisors

VAT Flat Rate Scheme 4 or 16 5 Updated 2024

VAT Flat Rate Scheme for small businesses Short Guide

VAT Flat Rate Scheme A Complete Overview Reed amp Co

Leaving the VAT Flat Rate Scheme Makesworth Accountants

The VAT Flat Rate Scheme explained FreeAgent

The VAT Flat Rate Scheme explained FreeAgent

Fillable Online VAT Flat Rate Scheme The flat rate scheme for small

VAT Flat Rate Scheme Accountants etc

Flat Rate Vat Scheme An Insight

Flat Rate Vat scheme FRS Alpha Business Services Accountants and

VAT Flat Rate Scheme Explained CALA Associates

VAT Flat Rate Scheme overview ECOVIS Wingrave Yeats

VAT flat rate scheme Pros and Cons Finerva

More on the VAT Flat Rate scheme changes

Using the VAT Flat Rate Scheme Codex Absolute Accountants amp Bookkeepers

VAT Flat Rate Scheme Explained CALA Associates

VAT Flat Rate Scheme overview ECOVIS Wingrave Yeats

VAT flat rate scheme Pros and Cons Finerva

More on the VAT Flat Rate scheme changes

Flat Rate VAT Scheme Eligibility Thresholds Flat Rates of VAT DNS

VAT Flat Rate Scheme Sage amp Company

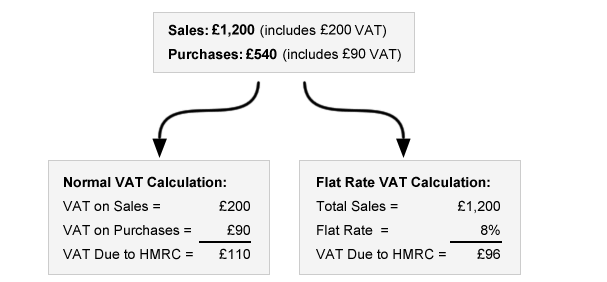

How does the flat rate VAT scheme work Company Bug

VAT Flat Rate Scheme Is It Worthwhile Accounting Firms

VAT Flat Rate Scheme a hidden gem FKGB Accounting

VAT Flat Rate Scheme RG Accountants amp Business Advisors

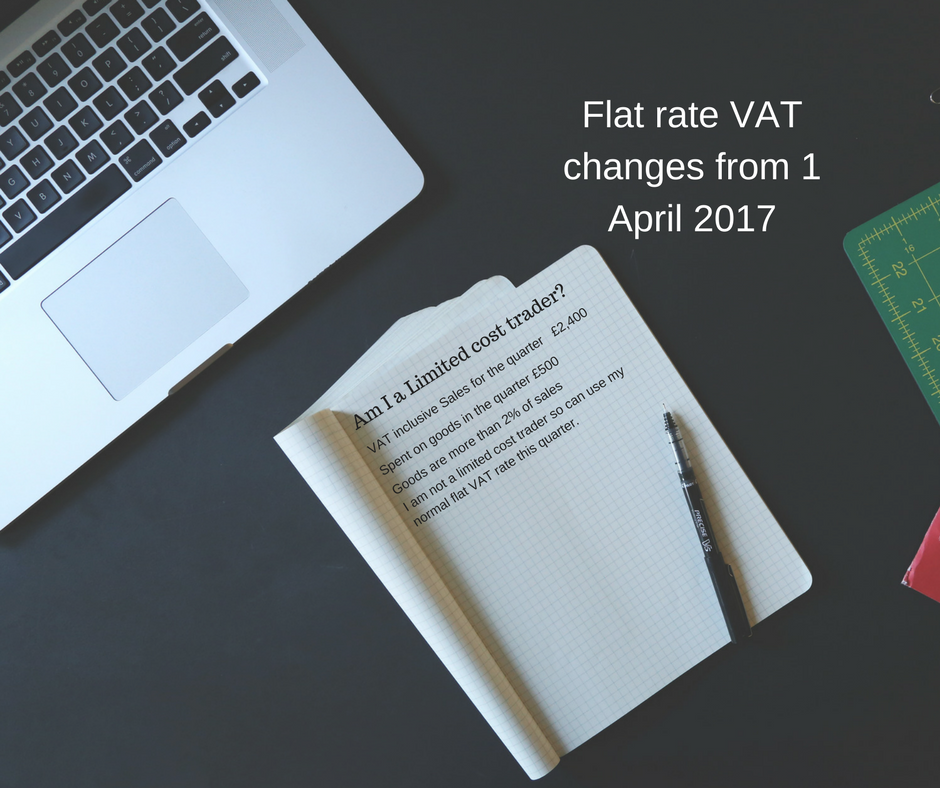

UK VAT Flat Rate Scheme FRS Changes from 1 April 2017 AccountsPortal

Pros and cons of the VAT flat rate scheme Makesworth Accountants

What s Flat Rate VAT Schemel VAT Flat Rate Schemel Accountingfirms

What you need to know about the VAT Flat Rate Scheme FRS

How Do You Know If The Flat Rate VAT Scheme Is Right For You VAT

A Guide to Changes of the Flat Rate VAT Scheme

How Does the Flat Rate VAT Scheme Work

PPT What you need to know about the VAT Flat Rate Scheme FRS

Fillable Online The VAT Flat Rate Scheme Finding your way around Fax

Is the Flat Rate VAT Scheme Right for Your Business

VAT flat rate scheme benefits over standard rate VAT scheme

What is VAT Flat Rate Scheme A Comprehensive Guide

What is VAT Flat Rate Scheme A Comprehensive Guide

Pros and cons of the VAT flat rate scheme Pro Taxman

Should you be using the VAT Flat Rate Scheme FreeAgent

FRS Flat rate vat scheme Is it still a benefit Alpha Business

The VAT flat rate scheme FreeAgent Support

Pros and cons of the VAT flat rate scheme Pro Taxman

Should you be using the VAT Flat Rate Scheme FreeAgent

The VAT flat rate scheme FreeAgent Support

How does the VAT flat rate scheme work Pros vs Cons

Will The Flat Rate VAT Scheme Save Your Small Business Money

Vat Flat Rate Scheme by MGT Accountancy Issuu

The VAT Flat Rate Scheme FRS FreeAgent

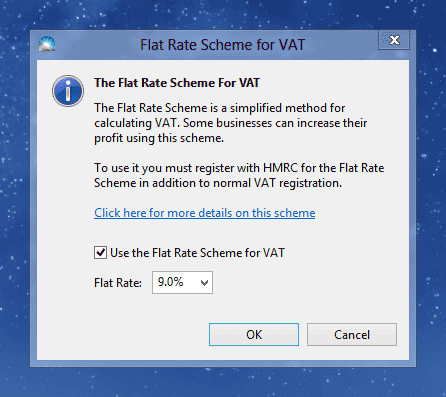

Notes on the Flat Rate Scheme for VAT Solar Accounts Help

What is the VAT Flat Rate Scheme FRS

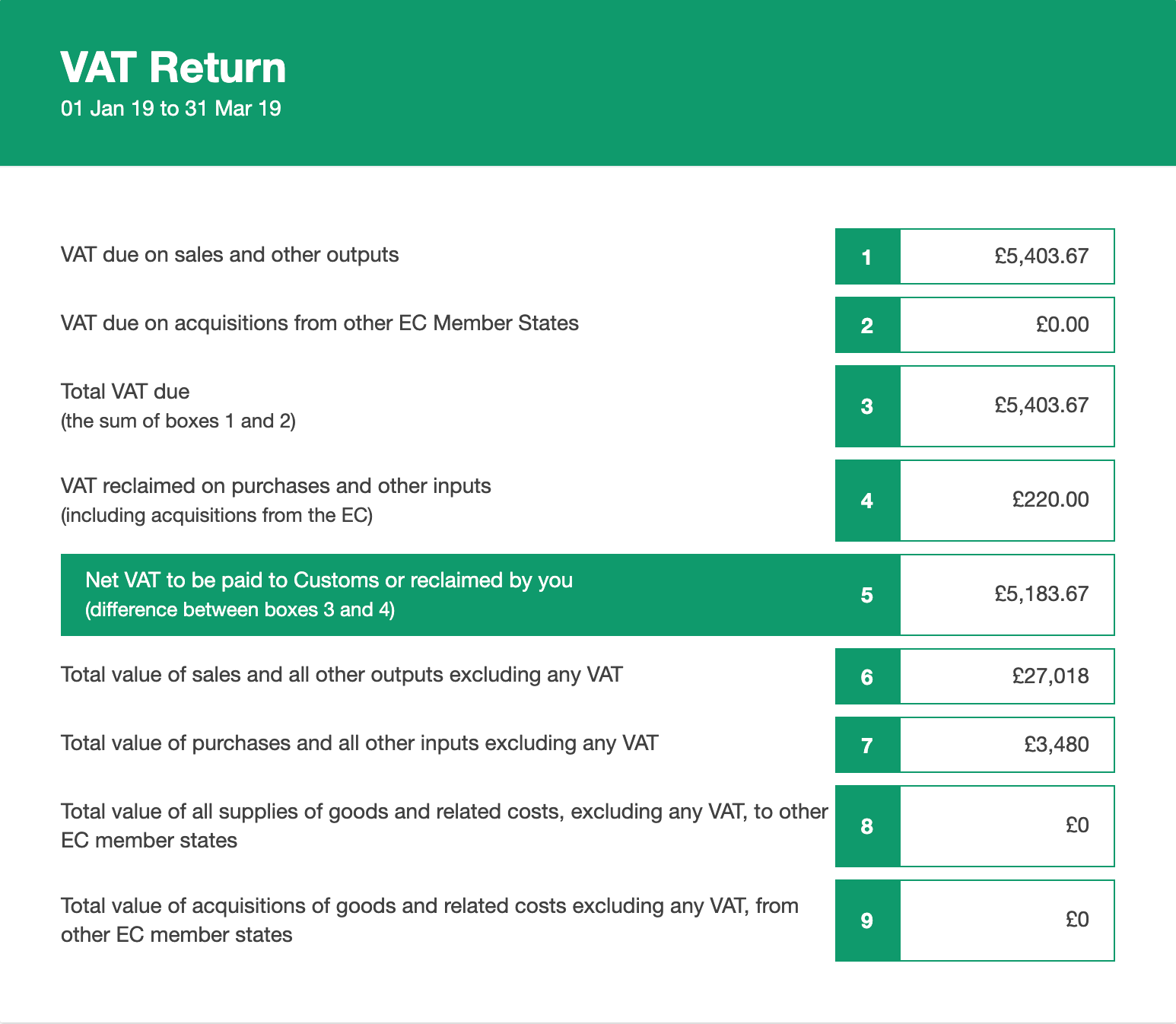

Guide to VAT The flat rate scheme

Notes on the Flat Rate Scheme for VAT Solar Accounts Help

The pros and cons of the VAT flat rate scheme AccountWise

Flat Rate VAT Scheme Low Cost Trader Gloucestersphere

Flat Rate Scheme for VAT Who is it for by Makesworth Accountants

VAT Flat Rate Scheme What Is It All About Schemes Flat rate Rate

VAT Flat rate scheme is it for me

Pros And Cons of The VAT Flat Rate Scheme Accounting Firms

What is the Flat Rate VAT Scheme and What are the Benefits ChadSan

Virgate Why The VAT Flat Rate Scheme Is No Longer Beneficial For Many

The VAT Flat Rate Scheme and Company Benefits

The VAT Flat Rate Scheme FRS A Boost for E commerce Businesses

Flat Rate VAT changes for small businesses explained Crunchers

Combining the Flat Rate VAT amp Annual Accounting

How FreeAgent supports the VAT Flat Rate Scheme FRS FreeAgent

Do the flat rate Value Added Tax VAT changes affect you Johnston

The Different Types of VAT Accounting Schemes The Accountancy Partnership

8 Different VAT Schemes in UK To Choose From

VAT Flat Rate Scheme Calculator YouTube

What Is Vat Flat Rate Scheme - The pictures related to be able to What Is Vat Flat Rate Scheme in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.