Vat Domestic Reverse Charge CGA Accountants Tax amp Business

Domestic Reverse Charge VAT What does this mean for you Eque2

Domestic Reverse Charge VAT What does this mean for you Eque2

Domestic Reverse Charge VAT Explained CALA Associates Ltd

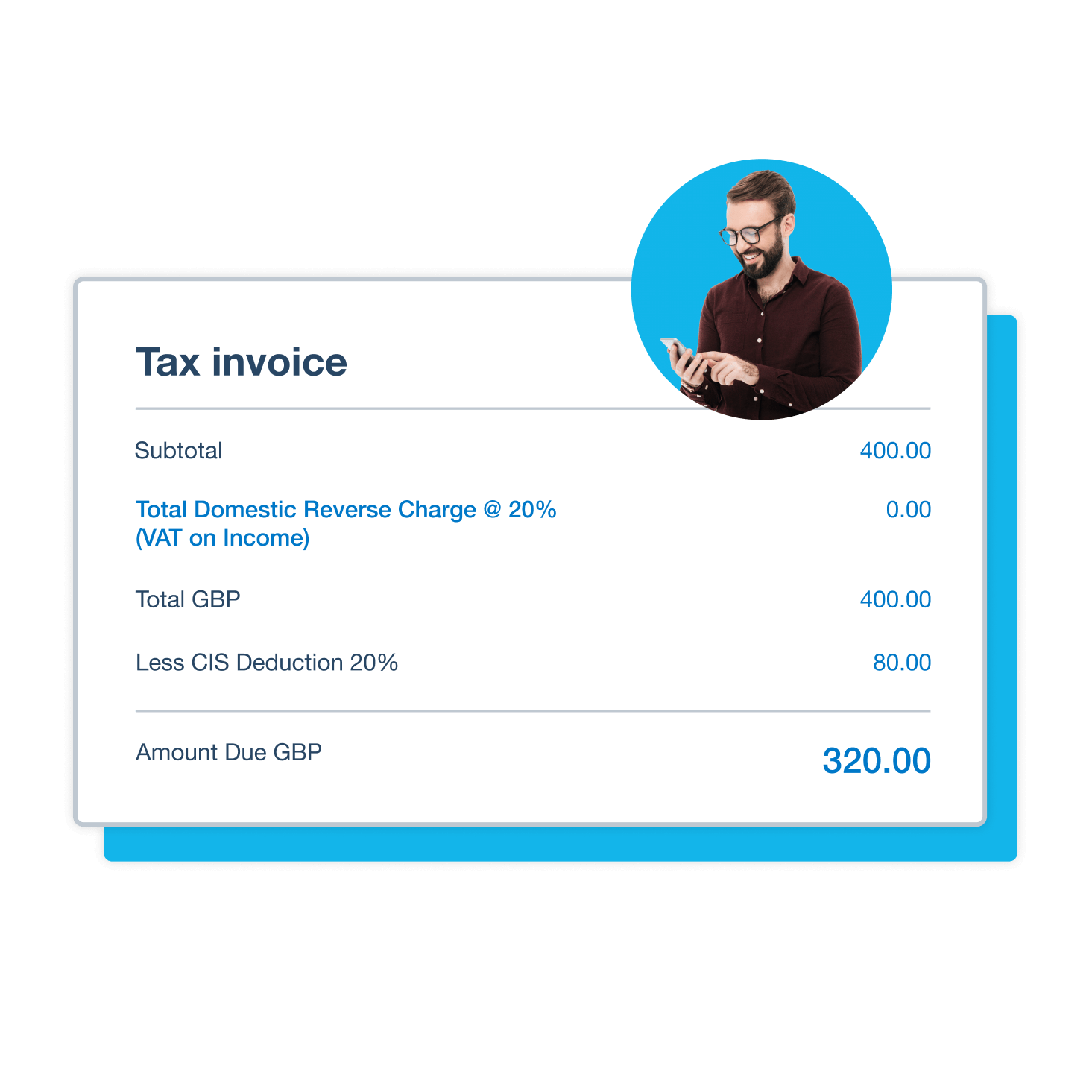

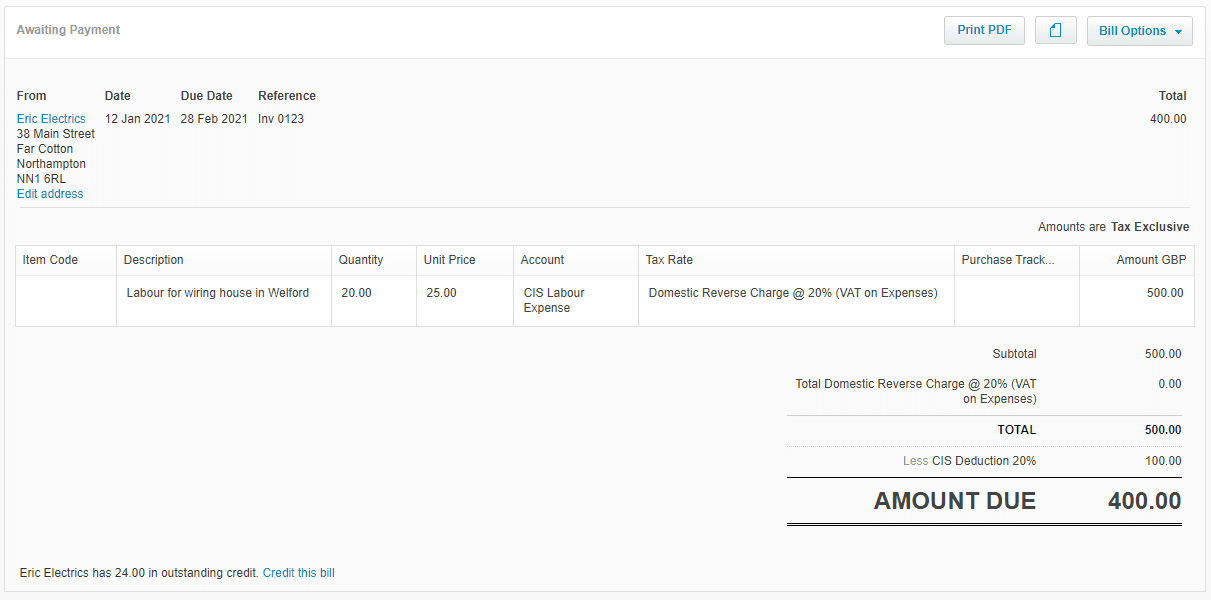

Accounting for Domestic Reverse Charge VAT Xero UK

Periscope Domestic Reverse Charge VAT The Blog

Domestic VAT Reverse Charge for construction services

What is VAT reverse charge Online VAT calculator

What does DRC Stand For VAT Reverse Charge Explained

HMRC s Domestic reverse VAT charge for dummies SME Strategies

How to prepare your business for the VAT domestic reverse charge XU Hub

How to prepare your business for the VAT domestic reverse charge XU Hub

VAT domestic reverse charge for construction What accountants need to

VAT reverse charge Everything you need to know about who pays HMRC

EU domestic Art 194 Reverse Charge becomes optional 2025 VAT in the

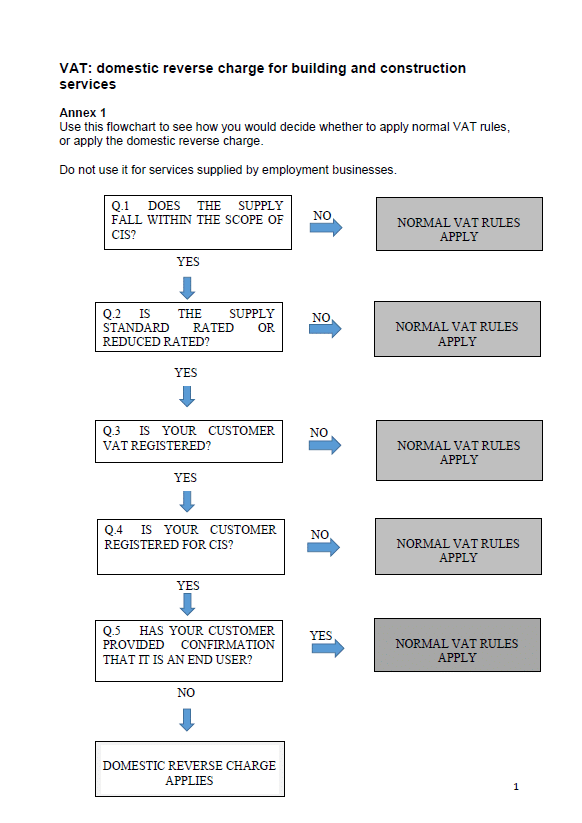

VAT Domestic Reverse Charge For Building And Construction Services

Guide on VAT Domestic Reverse Charge Professional Builder

Taxually Reverse Charge VAT Everything You Need to Know

Your VAT Reverse Charge Questions Answered FreshBooks Blog

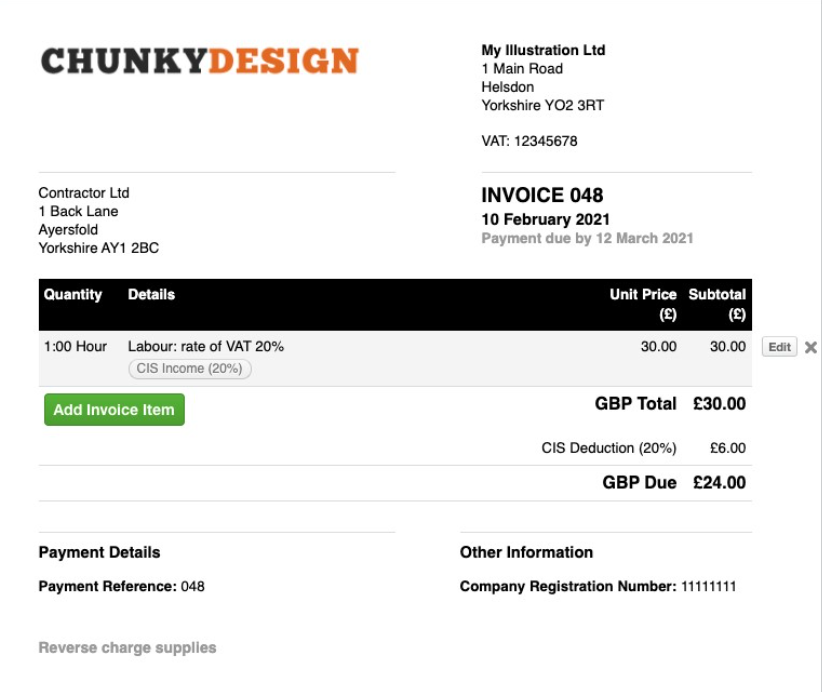

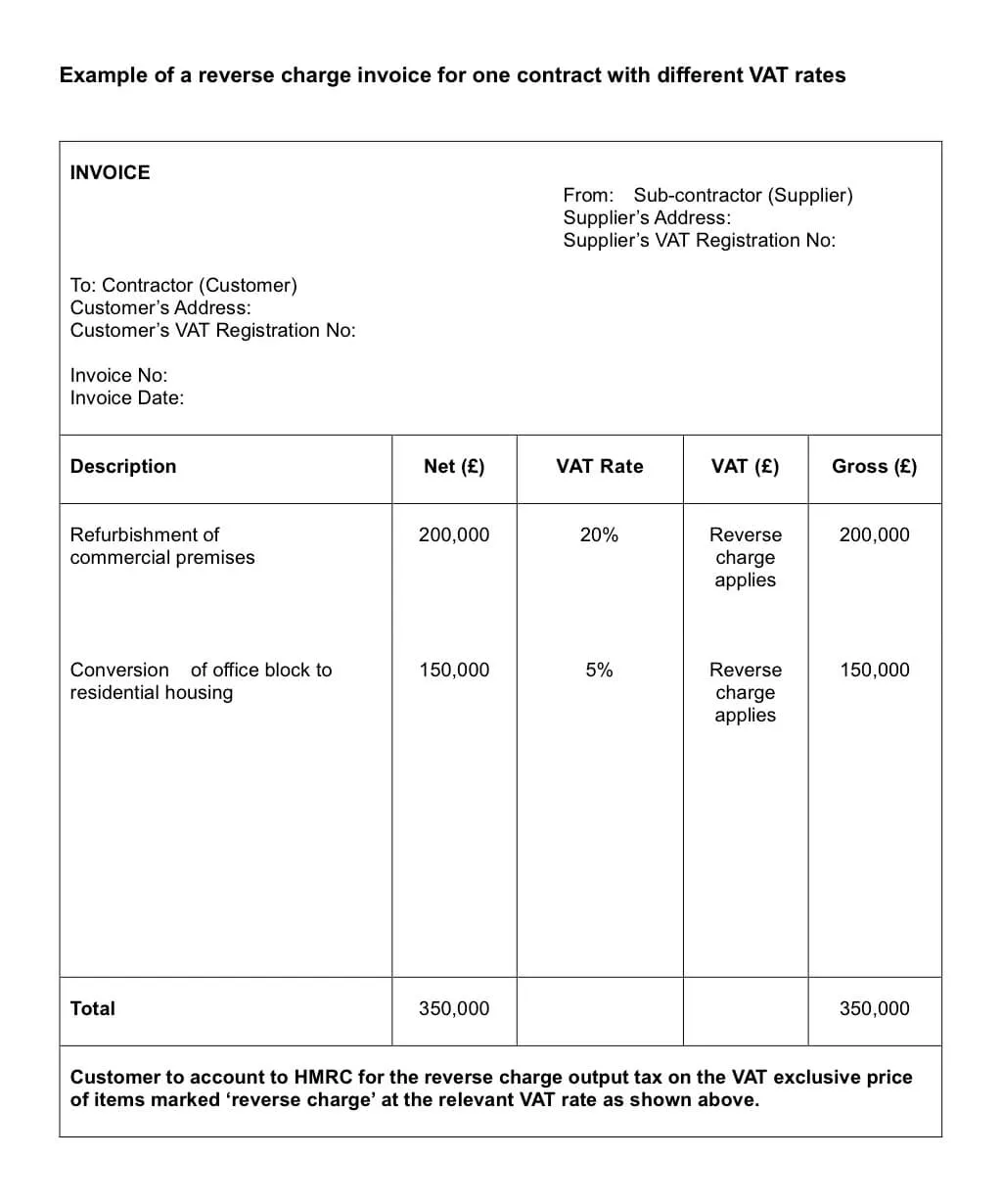

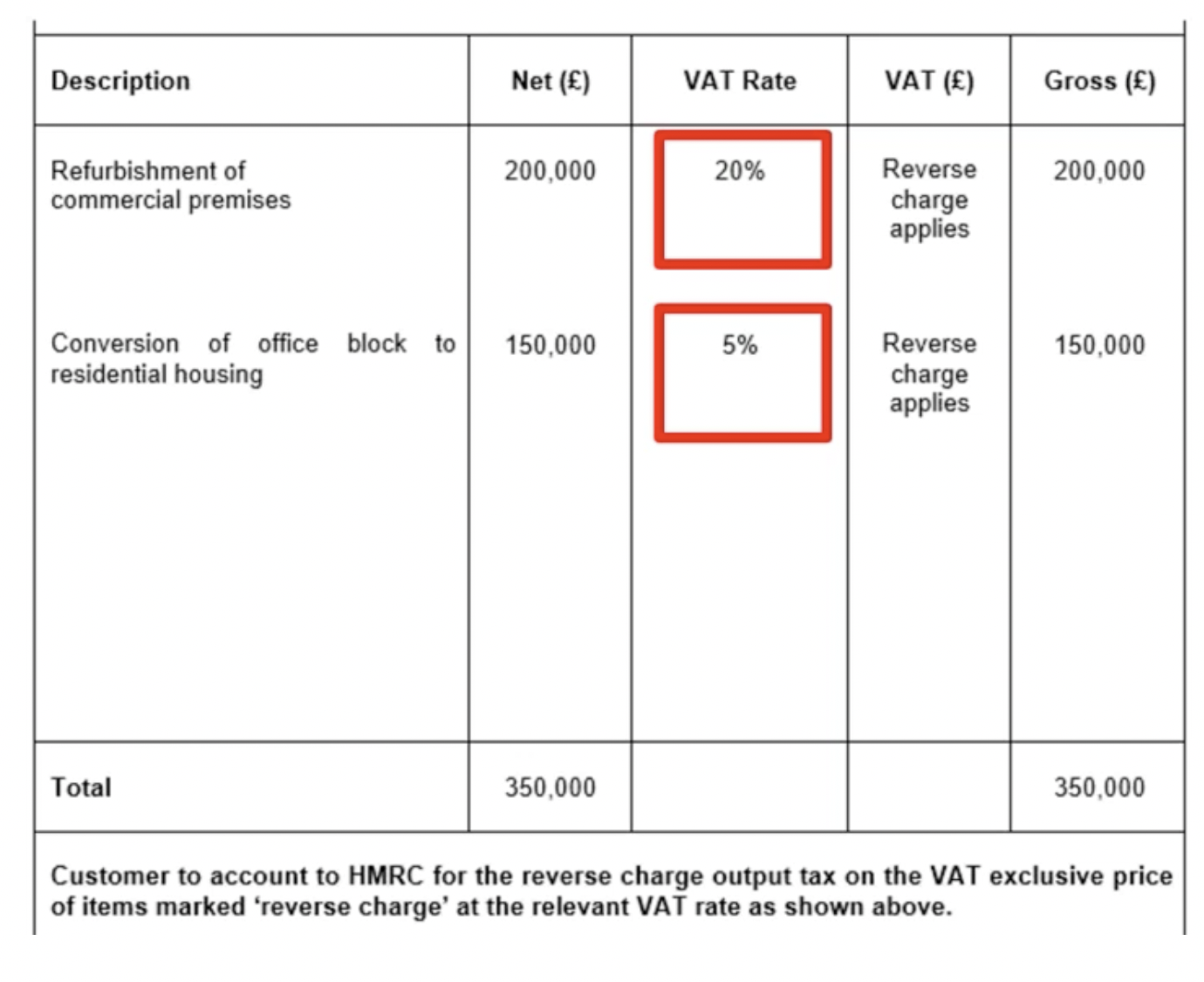

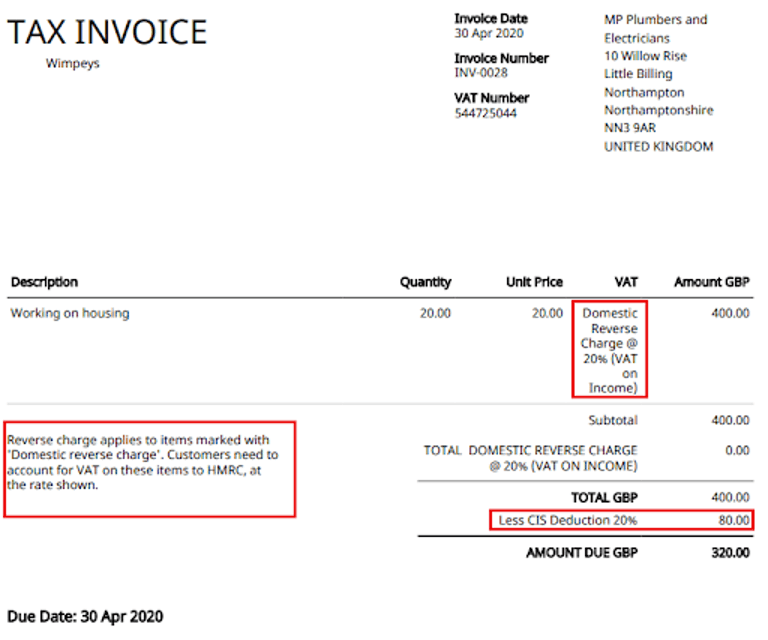

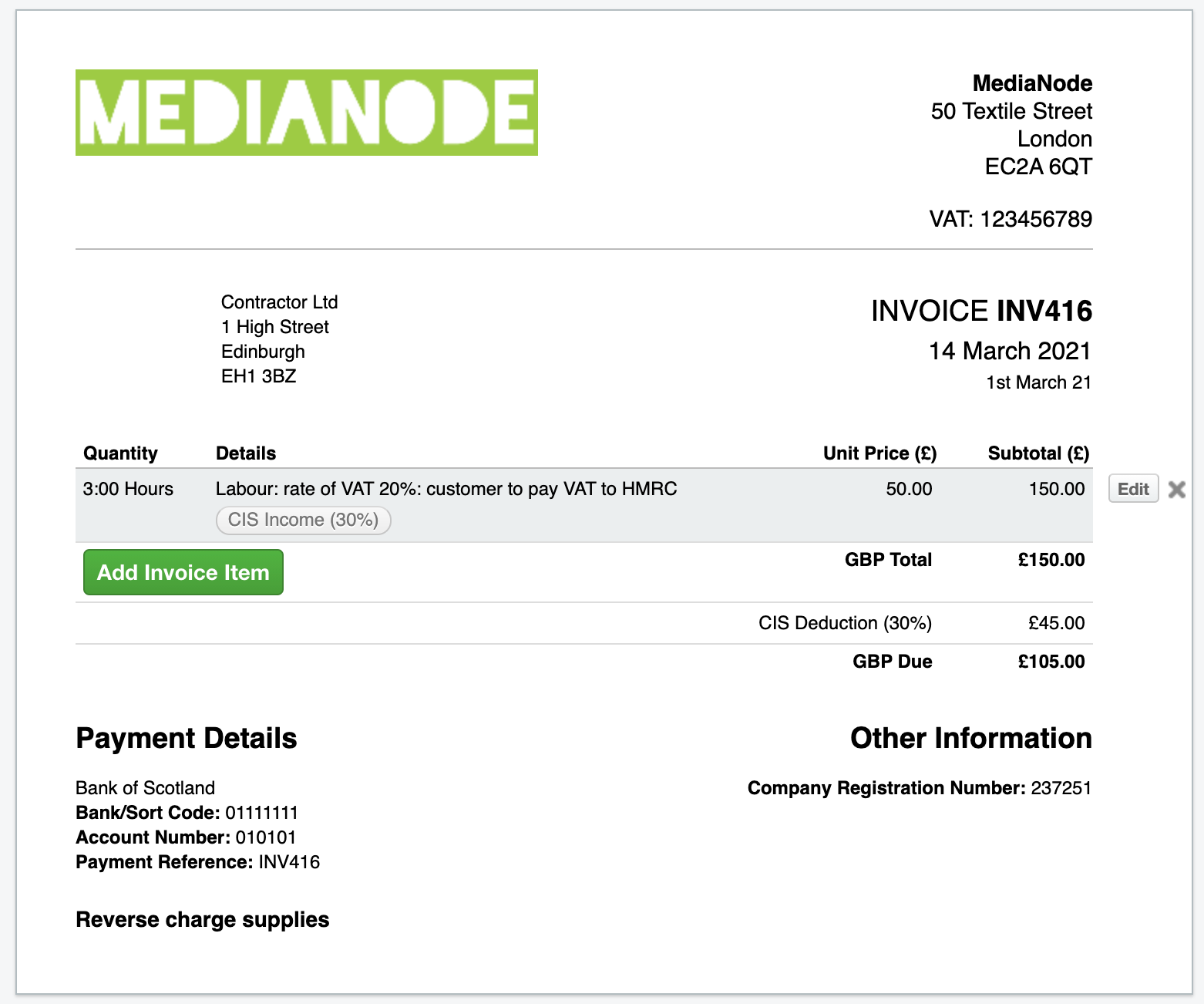

Domestic Reverse Charge Invoice Template Domestic Reverse Charge

VAT reverse charge Everything you need to know about who pays HMRC

EU domestic Art 194 Reverse Charge becomes optional 2025 VAT in the

VAT Domestic Reverse Charge For Building And Construction Services

How to prepare your business for the VAT domestic reverse charge Xero

Guide on VAT Domestic Reverse Charge Professional Builder

Taxually Reverse Charge VAT Everything You Need to Know

Your VAT Reverse Charge Questions Answered FreshBooks Blog

Domestic Reverse Charge Invoice Template Domestic Reverse Charge

VAT Domestic Reverse Charge DRC For The Construction Industry

Vat Reverse Charge Explained When And How It Operates In Ireland Hot

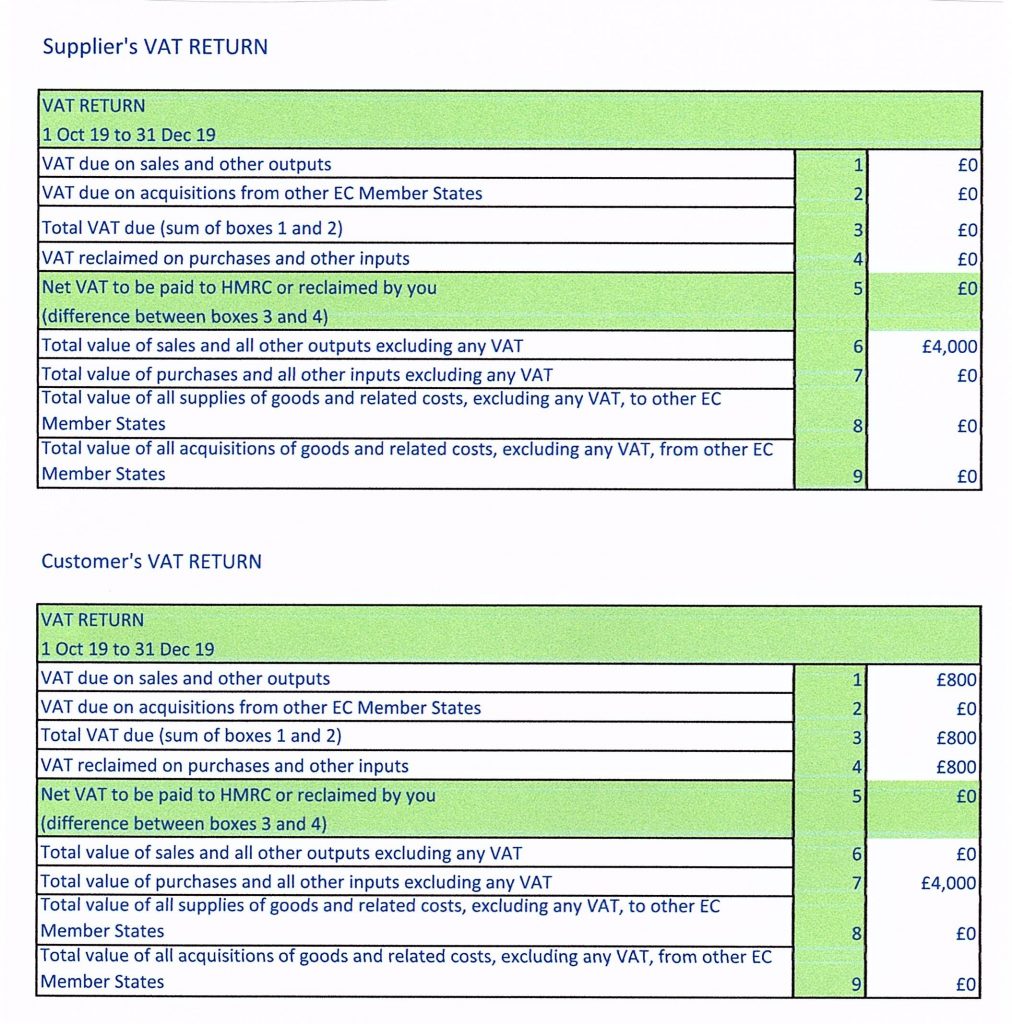

VAT Domestic Reverse Charge

VAT Domestic Reverse Charge now live in Xero AccountingWEB

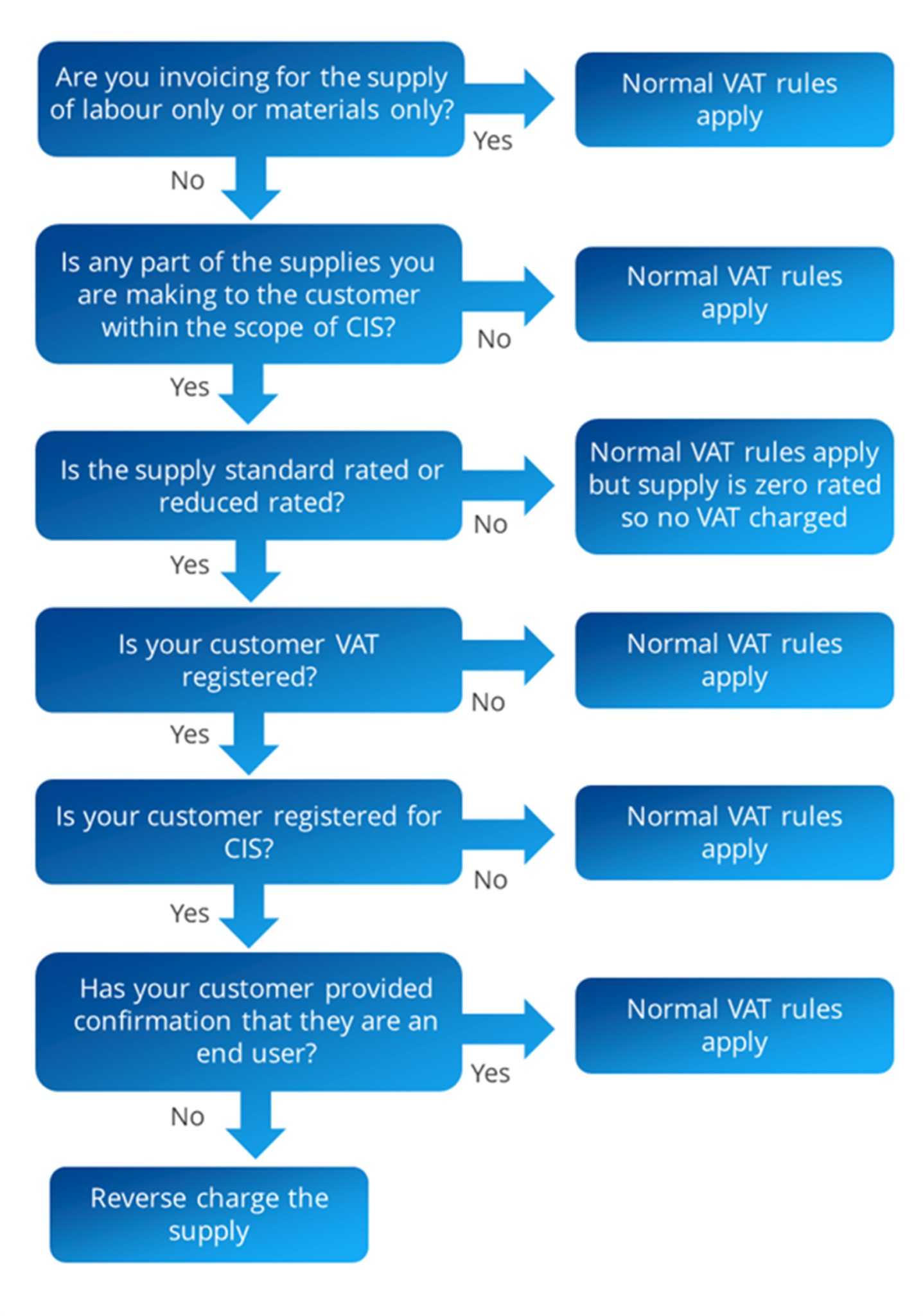

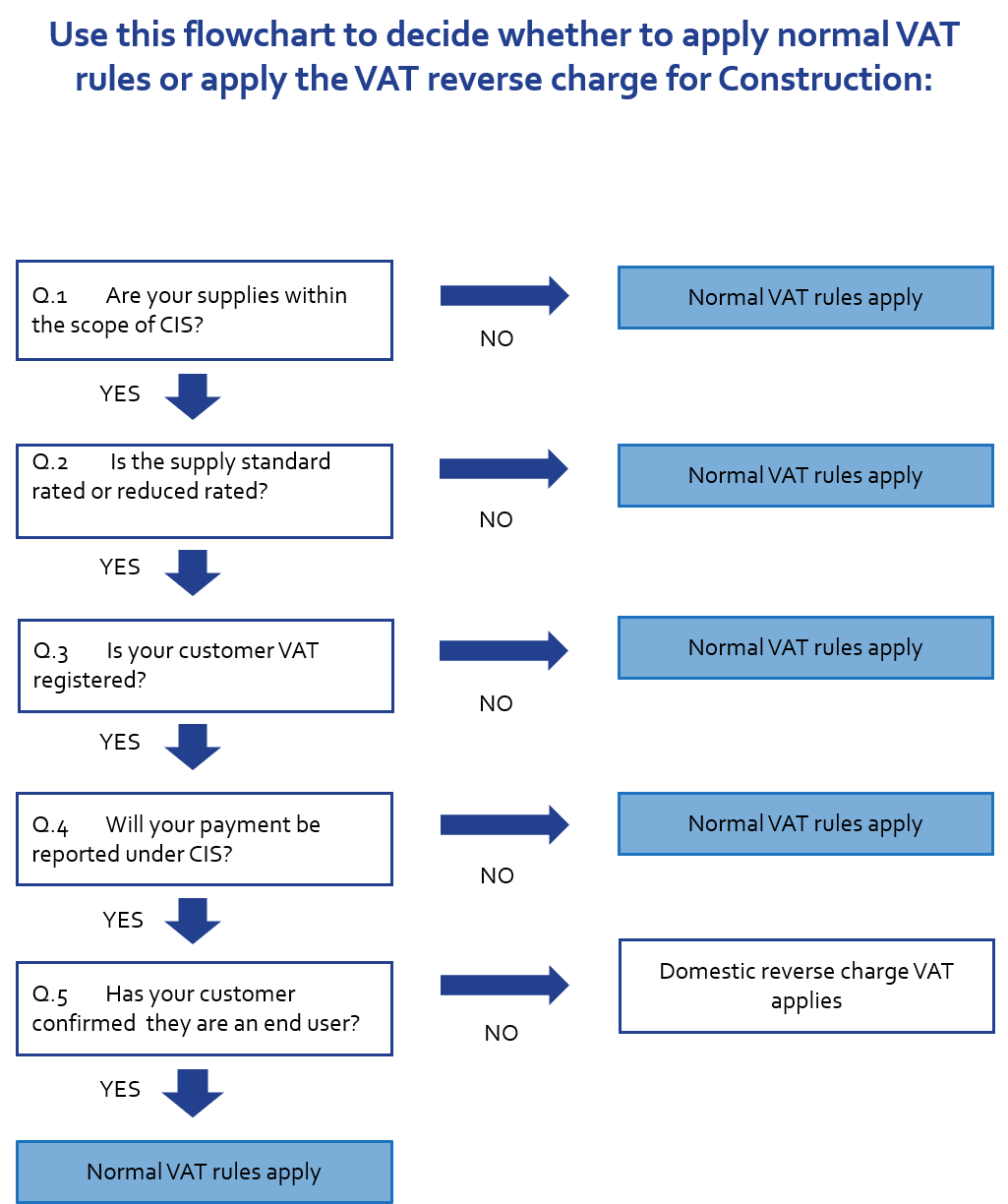

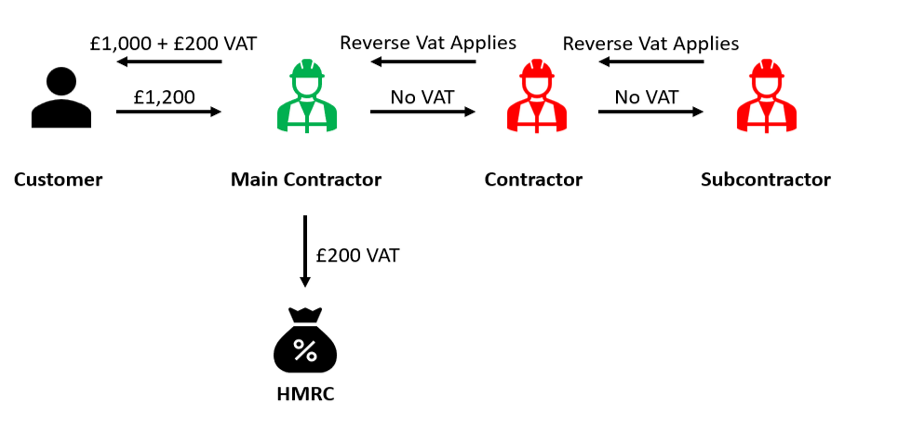

How will the VAT reverse charge for construction work Hawsons

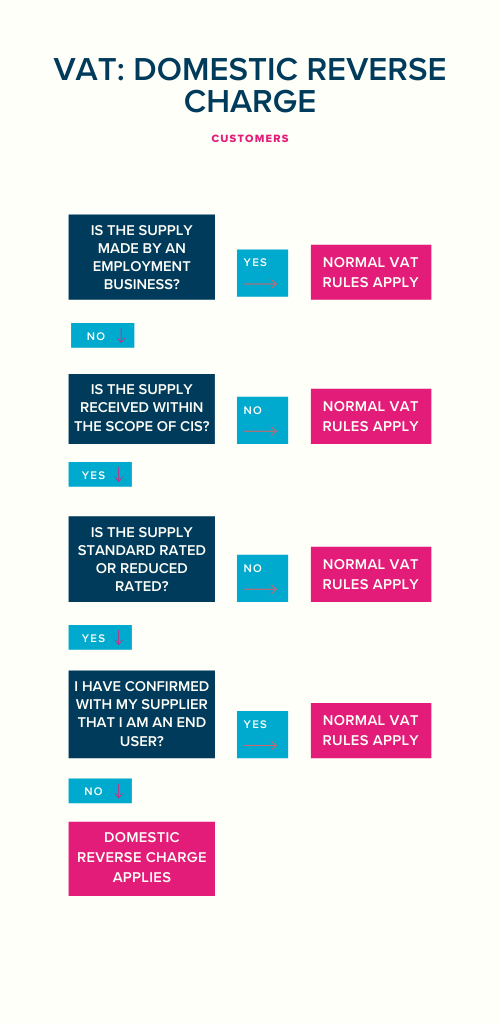

Domestic Reverse Charge for VAT 6 Practical Steps to Prepare HB amp O

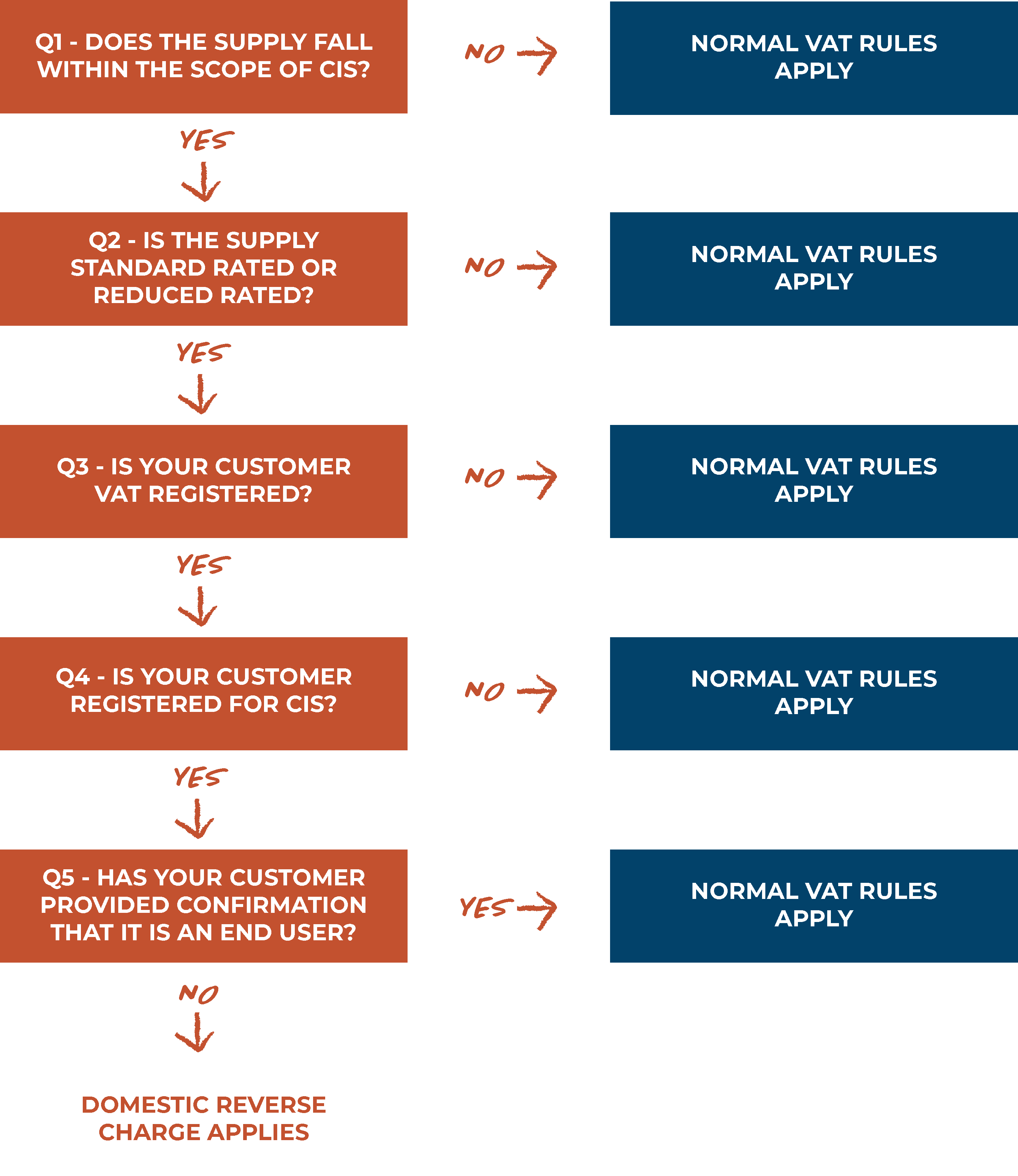

A Guide to the VAT Domestic Reverse Charge in the Construction Industry

Construction VAT Reverse Charge What are the new rules Rouse

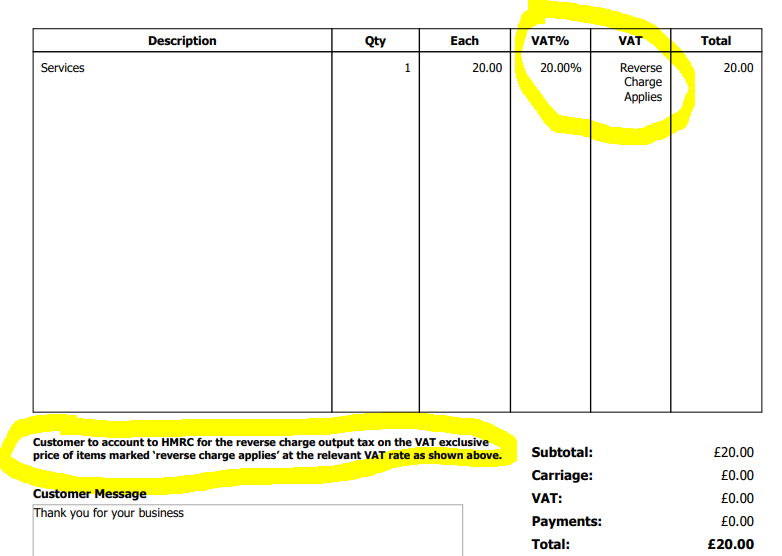

UK HMRC VAT Reverse Charge Support SliQ Invoicing Online Help

A guide to domestic VAT reverse charges Tide Business

A guide to domestic VAT reverse charges Tide Business

A guide to domestic VAT reverse charges Tide Business

VAT Reverse Charge For Building And Construction Services

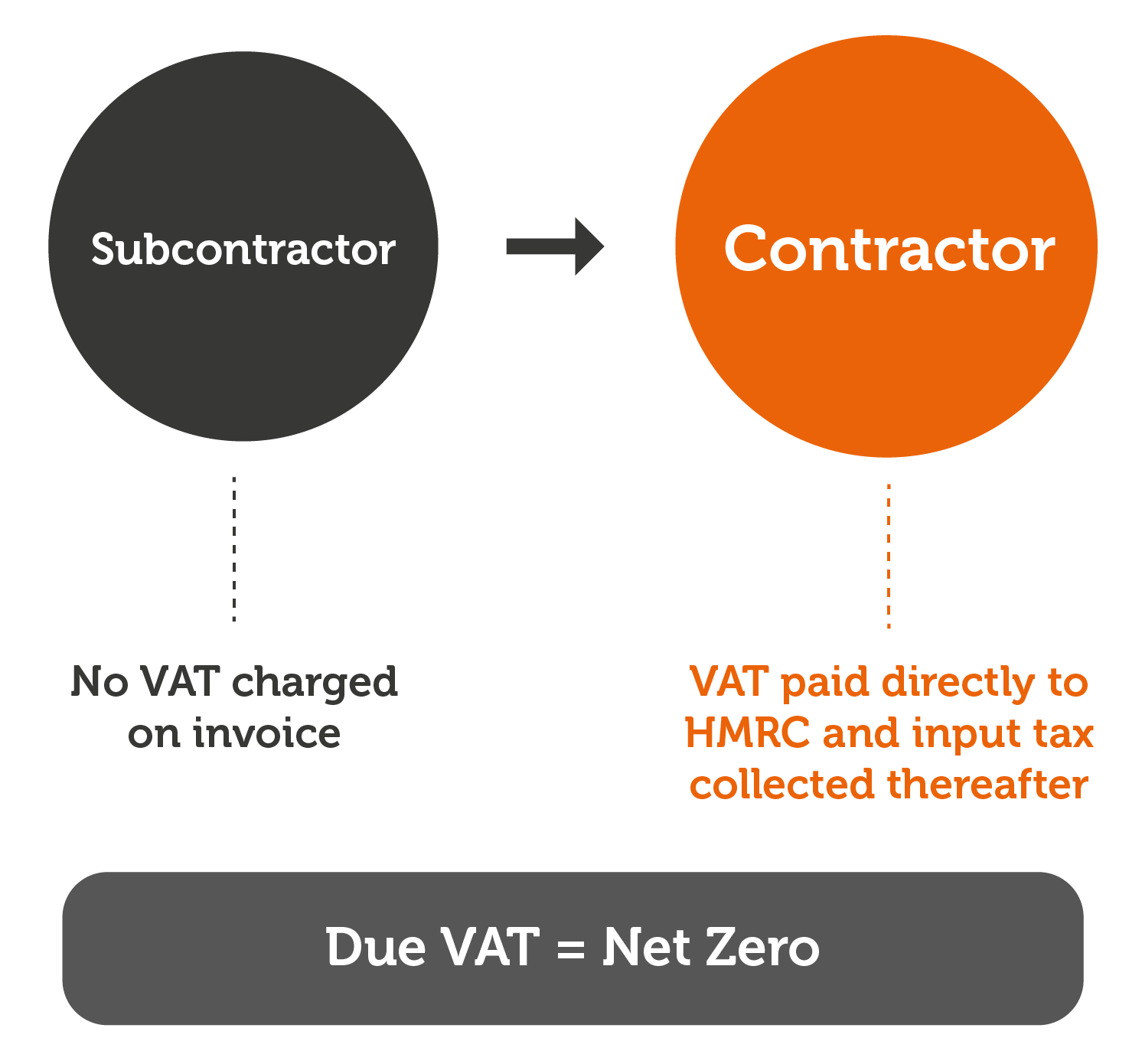

Reverse charge VAT CTA Profit First Accountants

Cis Domestic Reverse Charge Invoice Template Words That End In Vat

Domestic Reverse Charge for CIS VAT QuickFile

VAT Reverse Charge for Construction All You Need to Know

What is a VAT Reverse Charge in South Africa Searche

A guide to domestic VAT reverse charges Tide Business

A guide to domestic VAT reverse charges Tide Business

VAT Reverse Charge For Building And Construction Services

Reverse charge VAT CTA Profit First Accountants

Cis Domestic Reverse Charge Invoice Template Words That End In Vat

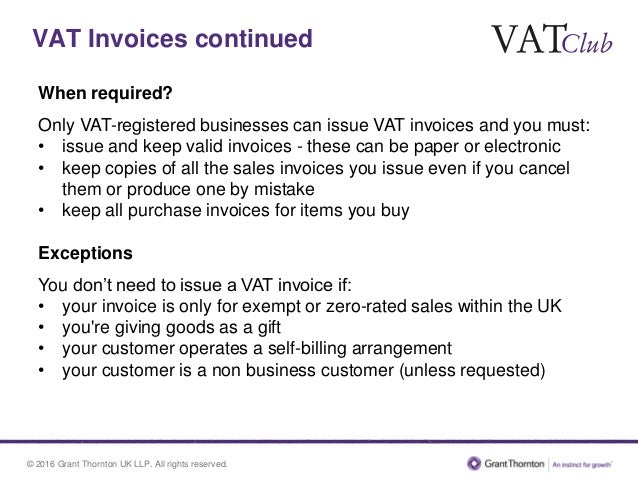

Back to Basics VAT invoicing amp the reverse charge

Domestic Reverse Charge for CIS VAT QuickFile

VAT Reverse Charge for Construction All You Need to Know

What is a VAT Reverse Charge in South Africa Searche

What Is The VAT Reverse Charge BusinessFinancing co uk

VAT Domestic Reverse Charge Set to Affect 1 2 m Construction Workers

VAT domestic reverse charge for construction 23 things you need to

The new VAT reverse charge the essentials you need to know Quick

CIS How FreeAgent handles the domestic VAT reverse charge for

Construction Industry Scheme CIS Domestic Reverse Charge Blog

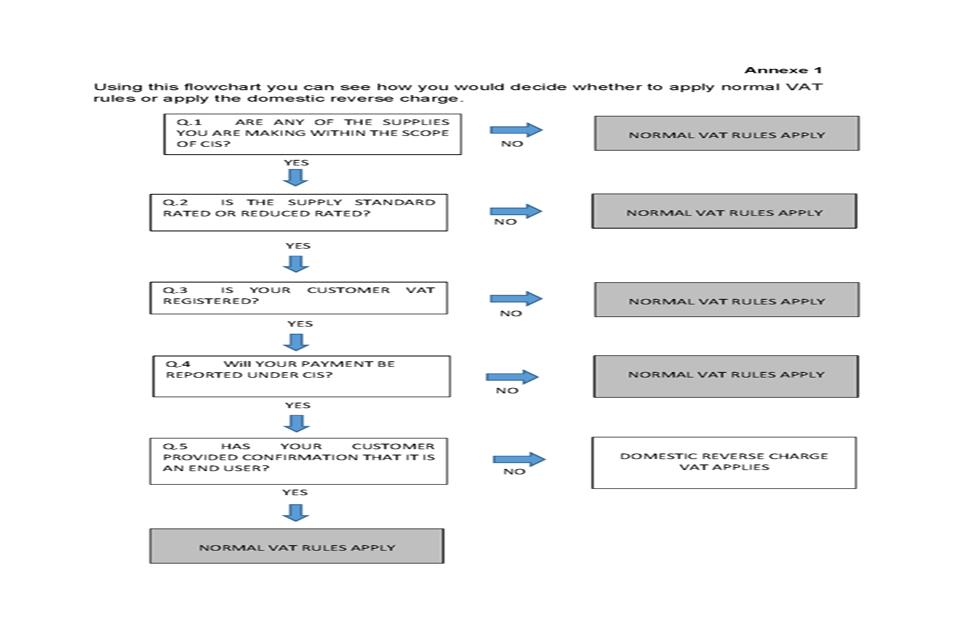

Introduction of VAT reverse charge on the construction sector HMRC

Reverse charge VAT what is it and how do you account for it Inlogica

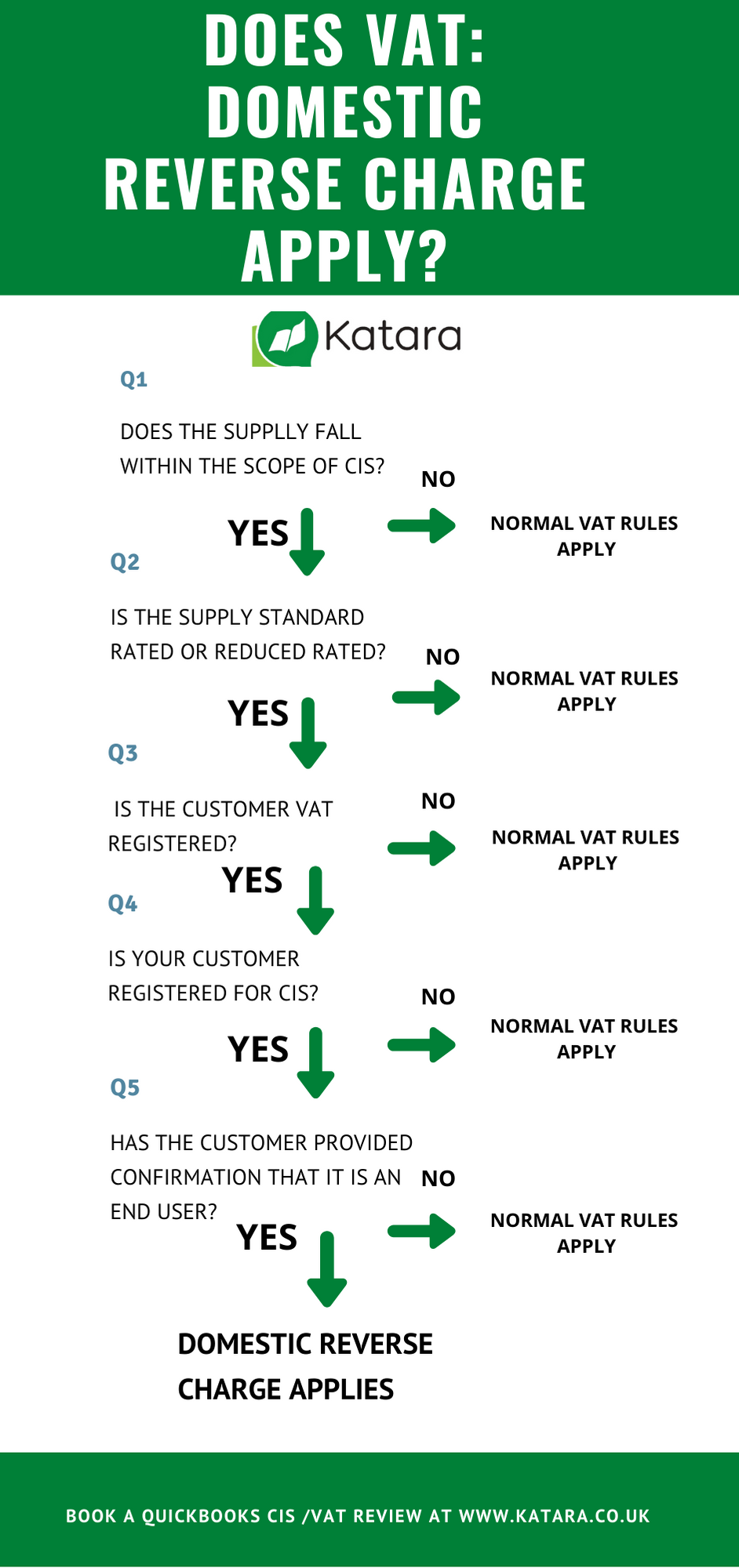

CIS Vat Rule changes will impact VAT in QuickBooks Katara QuickBooks

The VAT Reverse Charge YouTube

What is the VAT domestic reverse charge and who will it affect YouTube

Invoice Software Easy Invoicing Software by SliQTools

What Is Vat Domestic Reverse Charge - The pictures related to be able to What Is Vat Domestic Reverse Charge in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.