Withholding VAT VAT Deducted at Source VDS 2024 BDesheba Com

Zero rated Exempt VAT supplies Al Ard Aljadeeda Accounting

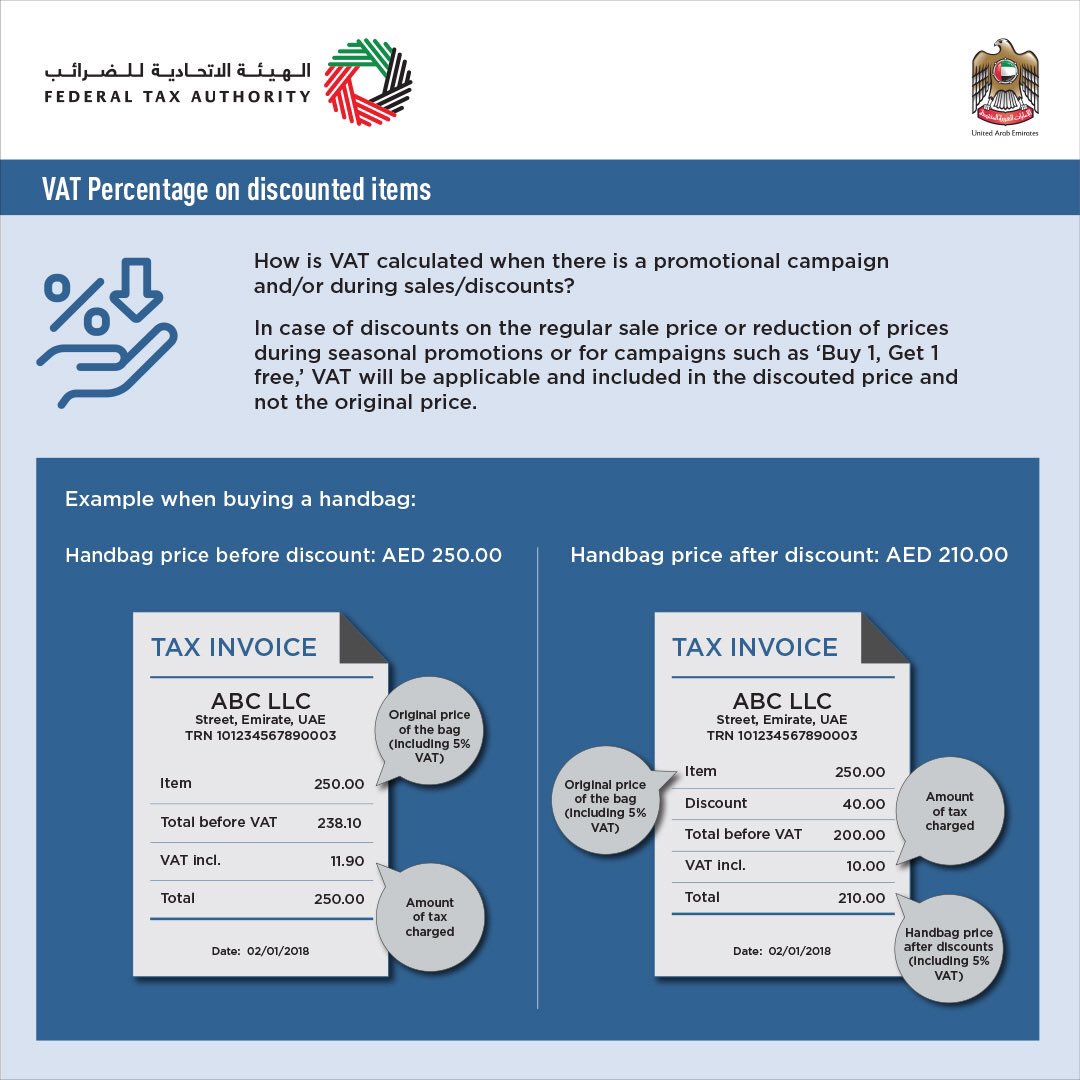

VAT Percentage on discounted items

All About VAT Exemptions in the UAE and Zero Rate MyBayut

Are Headshots Tax Deductible David J Martin Headshot Photography

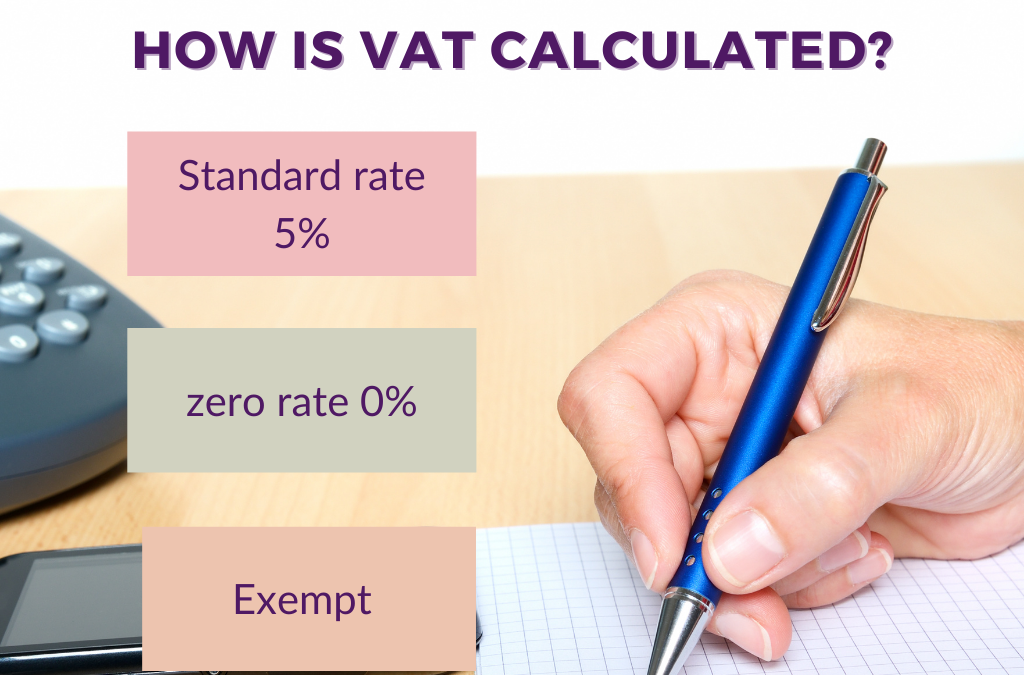

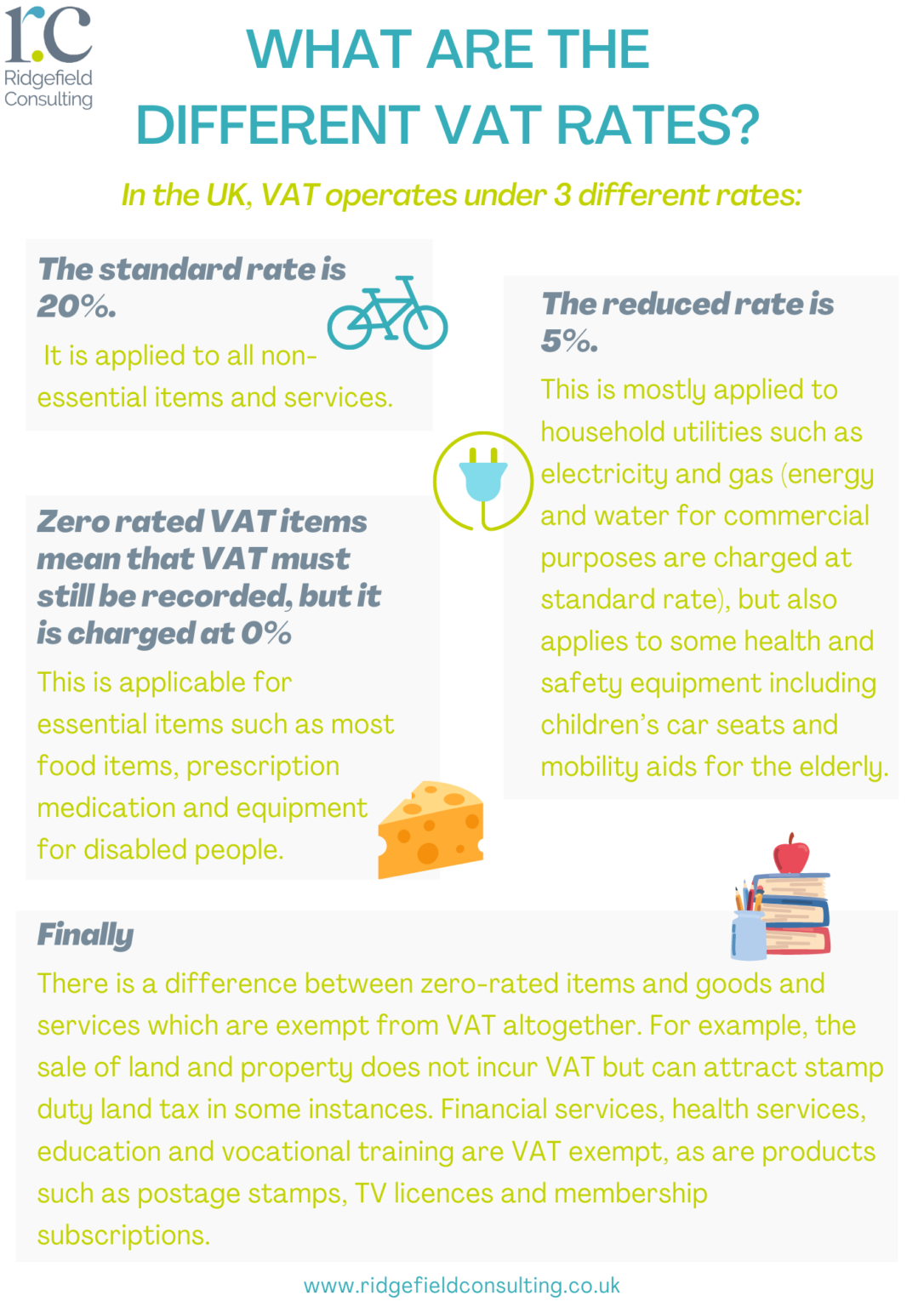

What are the three types of VAT Online VAT Calculate

What is VAT Definition and Examples

VAT Expenses What proof does HMRC need to allow maximum deduction

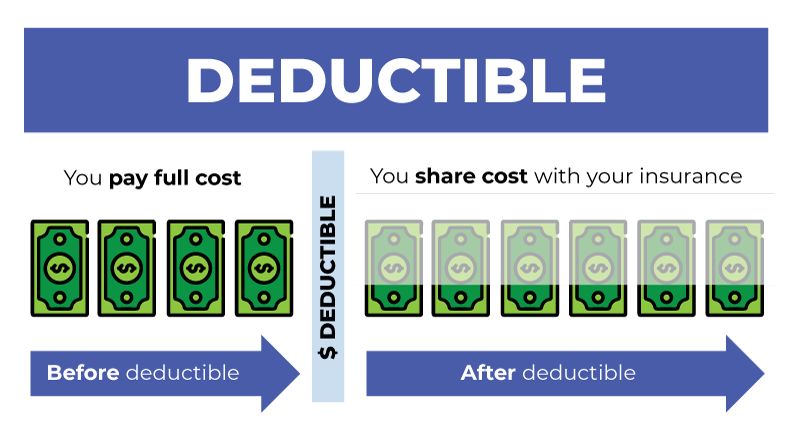

Tax Deductible Definition Expenses Examples

Tax Deductible Definition Expenses Examples

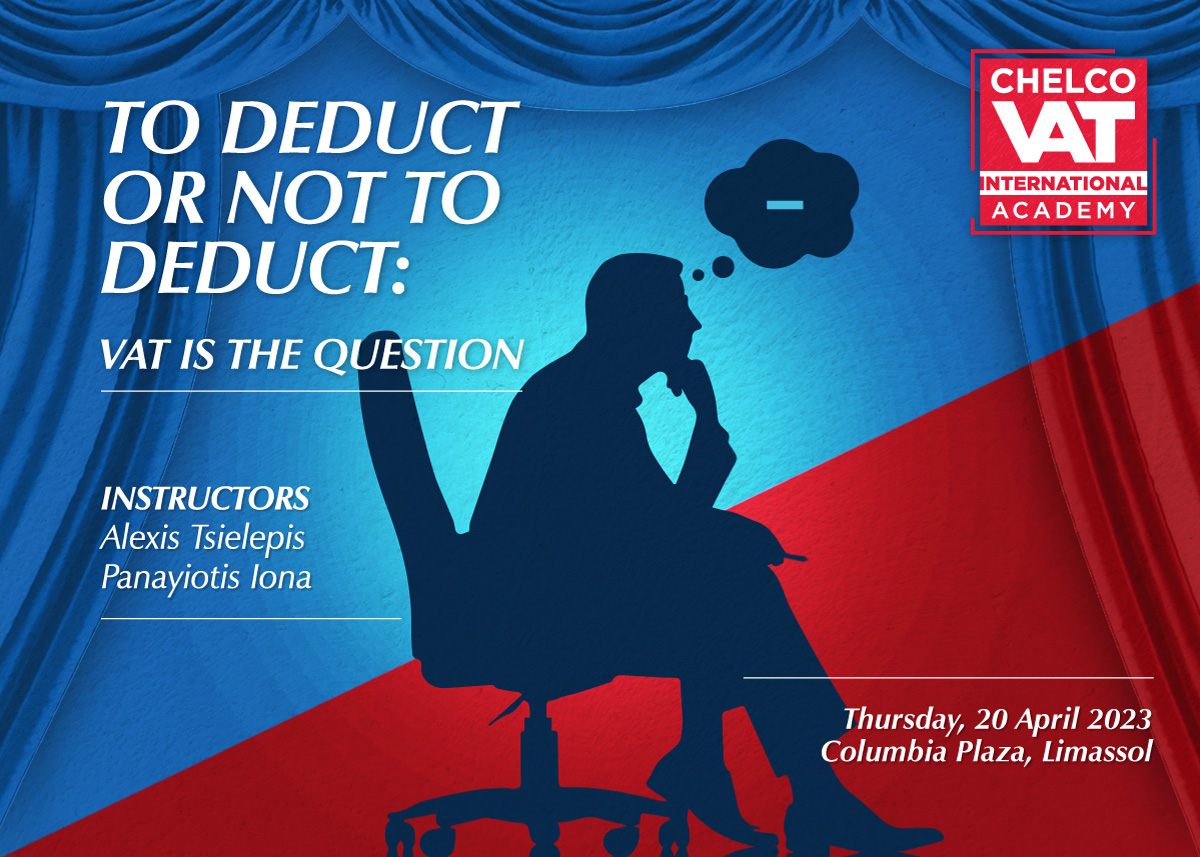

The Right To Deduct VAT Chelco VAT

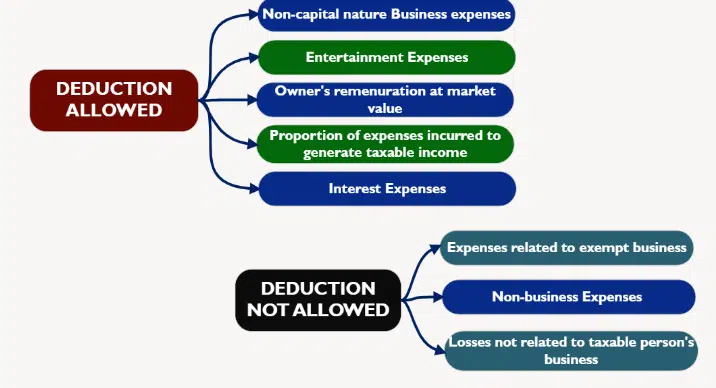

Deductible Non deductible Expenses Corporate Income Tax UAE

What Does Tax Deductible Mean

ARTICLE 29 of the unified GCC Value added Tax law VAT provides

Tax deductible Expenses What Are They

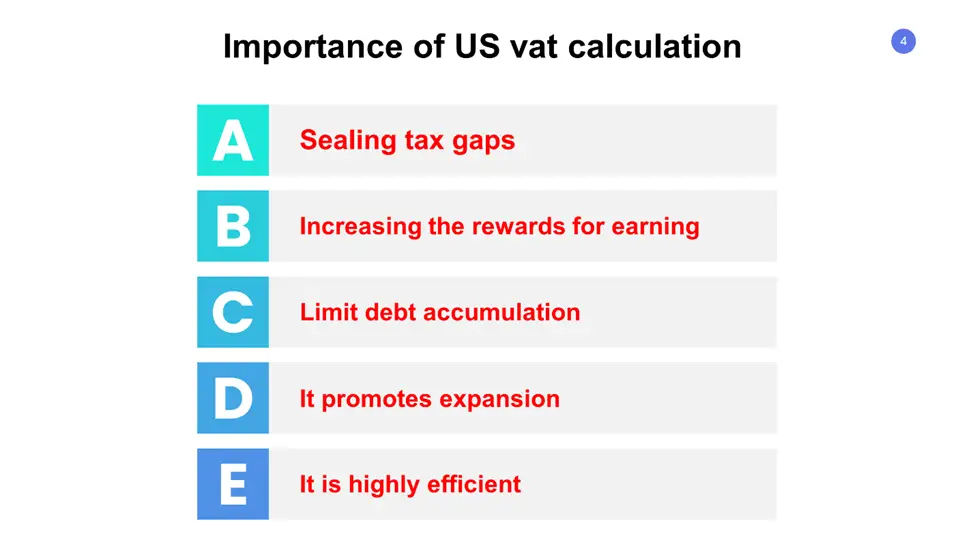

US Vat Calculator Calculate Value Added Tax On Purchase

How To Calculate VAT Recommended Guide

What does tax deductible mean 2 Sisters Accounting

Have You Met Your Deductible

Have You Met Your Deductible

VAT Exemptions When not to charge VAT Legend Financial

What is Tax Deductible A Complete Guide

Comment Calculer La Tva Deductible Image to u

VAT Deduction at Source PPT

VAT Exempt VATZero LECTURE NOTES ON VAT EXEMPT VAT ZERO Value Added

Understanding VAT Deductibles in South Africa Express Registration

Vat to Pay Calculator Find How Much Vat You Have to Pay

Are Credit Card Fees Tax Deductible for Businesses Five Star

The right of VAT deduction

What Does Tax Deductible Mean and How Do Deductions Work

VAT Treatment Of Reimbursement And Disbursement Of Expenses XB4 UAE

How To Check VAT Registration Status Searche

How To Stay Under The VAT Threshold Checkatrade

What Purchases Are Tax Deductible A Quick Guide CPA Firm Accounting

What Is VAT Tax Insurance Noon

What does vAT deduct mean

What Does It Mean When Something Is Tax Deductible Business Partner

What is VAT how much is it and how much to charge Tide Business

What is VAT and how does it work

A deep dive into your company s VAT requirements Simpson Accounting

What is actually tax deductible

To Deduct or Not to Deduct VAT is the Question Chelco VAT

What is VAT A brief guide to consumption tax Qvalia

What Is VAT Know How To Calculate the Amount of Value Added Tax

What Can I Claim VAT Back On Kinore

Unravelling VAT A Comprehensive Understanding

What is VAT A brief guide to consumption tax Qvalia

What Is VAT Know How To Calculate the Amount of Value Added Tax

What Can I Claim VAT Back On Kinore

Unravelling VAT A Comprehensive Understanding

The VAT deduction tax benefit for a new corporate car by typical model

VAT deduction for a branch KPMG Belgium

Full lists of VAT liable and exempted items released

Deductible expenses for determining taxable income

PPT VAT Tax Refund in the UK Proactive Consultancy Group PowerPoint

AskTheTaxWhiz VAT or non VAT taxpayer

VAT deduction cannot be denied because of the domestic civil law

What U S Based Businesses Must Know about Value Added Tax VAT

Value Added Tax Handbook Everything You Need to Know About VAT Law in

VAT deduction can be denied because the company has not reached a

A Comprehensive Guide to Understanding VAT What It Is and How It Works

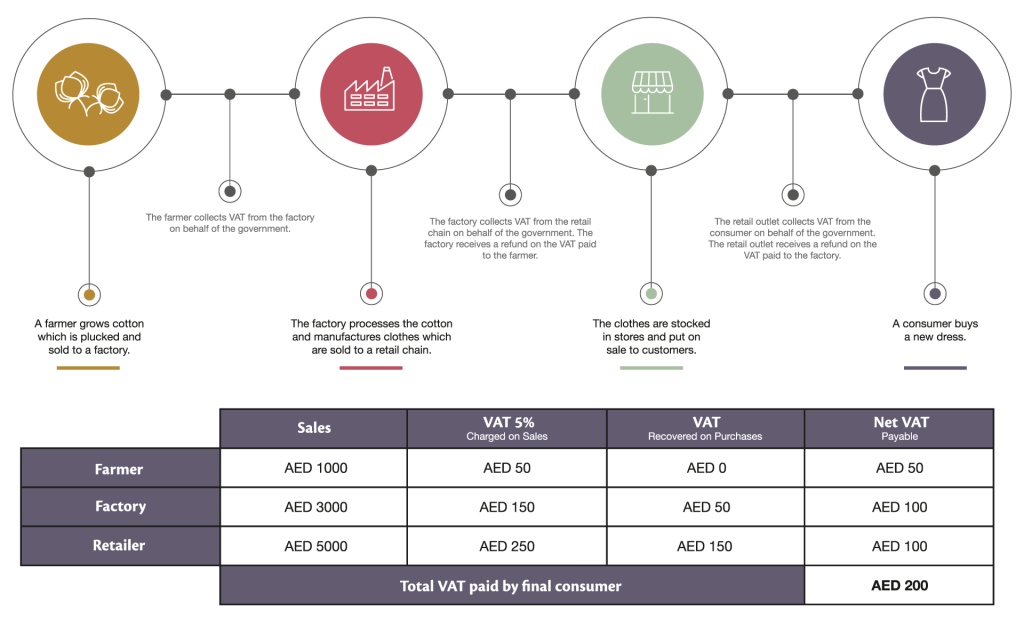

This is how VAT works Its a tax that no one can escape even if you re

VAT 1 Over view of VAT Definition VAT is a form of sales tax

Tax Deduction Planning Concept Expenses Account VAT Income Tax

Vat deductibility for holding companies The information in this

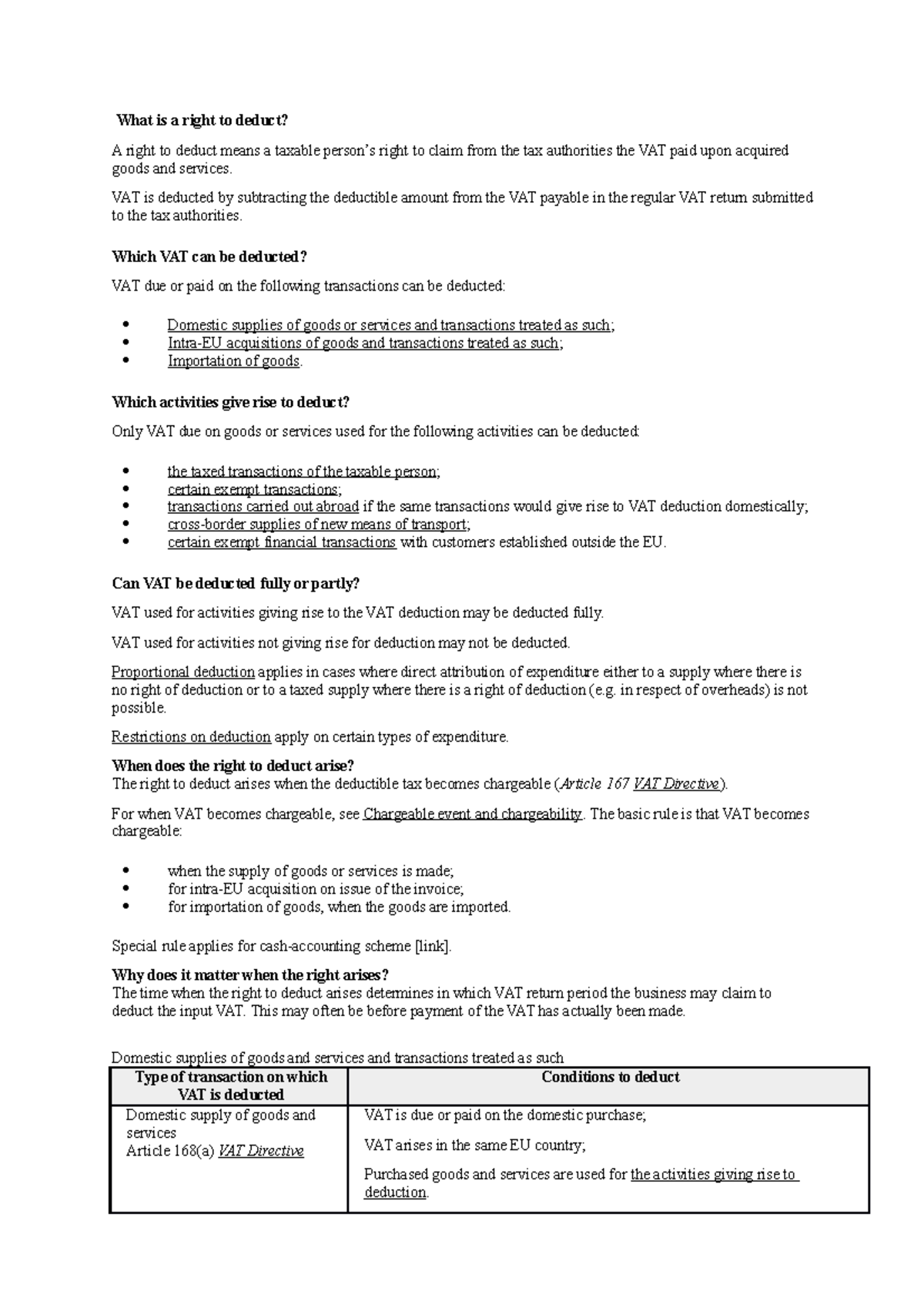

VAT deductions What is a right to deduct A right to deduct means a

Do you know what is VAT and how does it affect you A value added tax

The Simple Guide to Understanding VAT Deduction at Sources FM SKILL

VAT Liability Explained A Beginner s Guide to Understanding Your Tax

deductible Google Search Health snacks for work Health smoothies

Value Added Tax VAT information

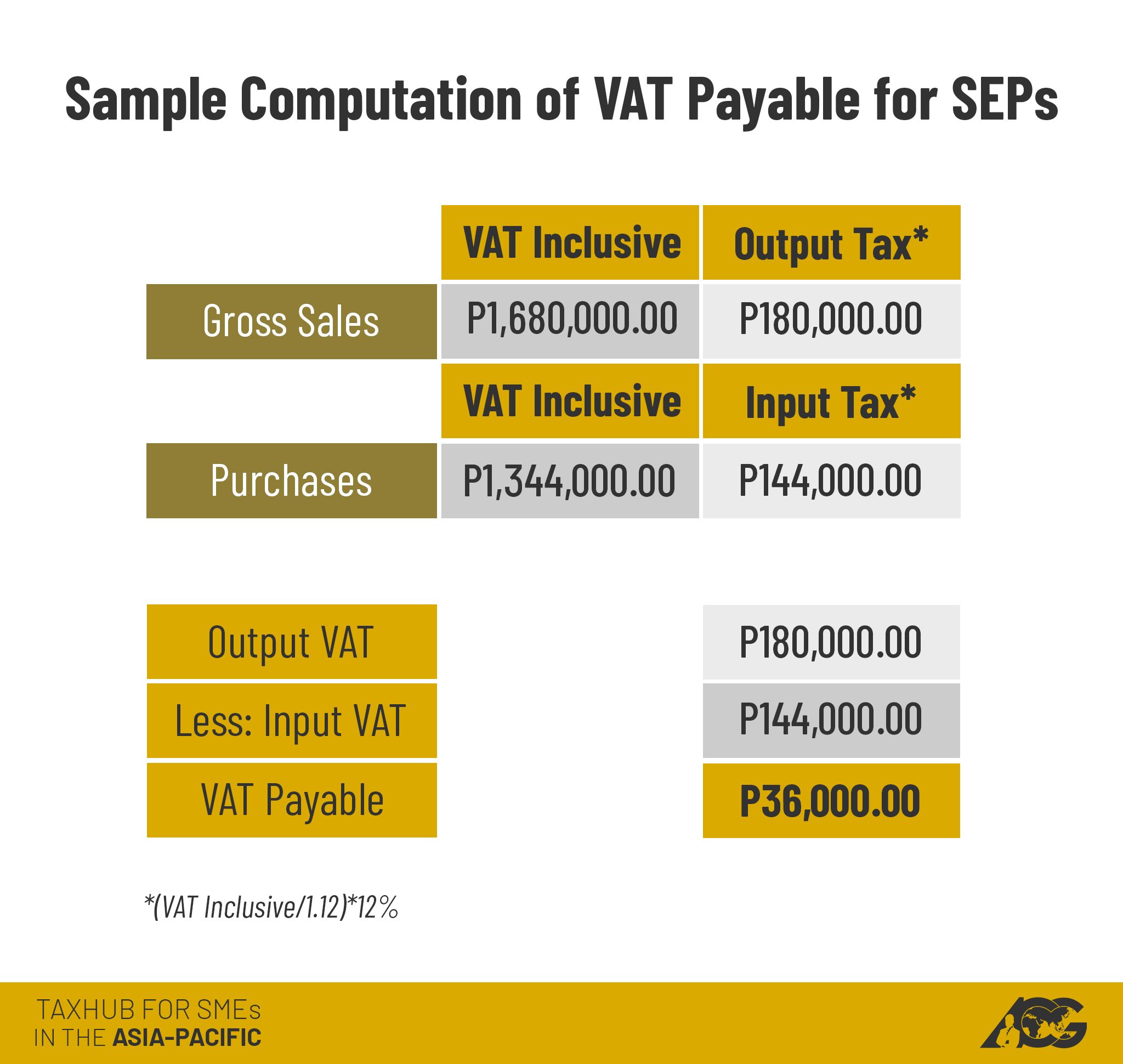

Value Added Tax Calculation of VAT Liability Calculation of Input VAT

What Is Vat Deductible - The pictures related to be able to What Is Vat Deductible in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.