HSP Overview VAT introduction

What is VAT Definition and Examples

What is VAT Definition and Examples

VAT Flat Rate scheme TLC Accounting

What is VAT mean VAT Rate Advantages Demerits in the UAE

VAT rates Eezy Kevytyritt 228 j 228 t

Changes to the VAT Flat Rate Scheme Accountants in Leeds Horsforth

Vat Point of View Point of View

US Vat Calculator Calculate Value Added Tax On Purchase

Understanding VAT Rates How They Impact Your Business Success MDH

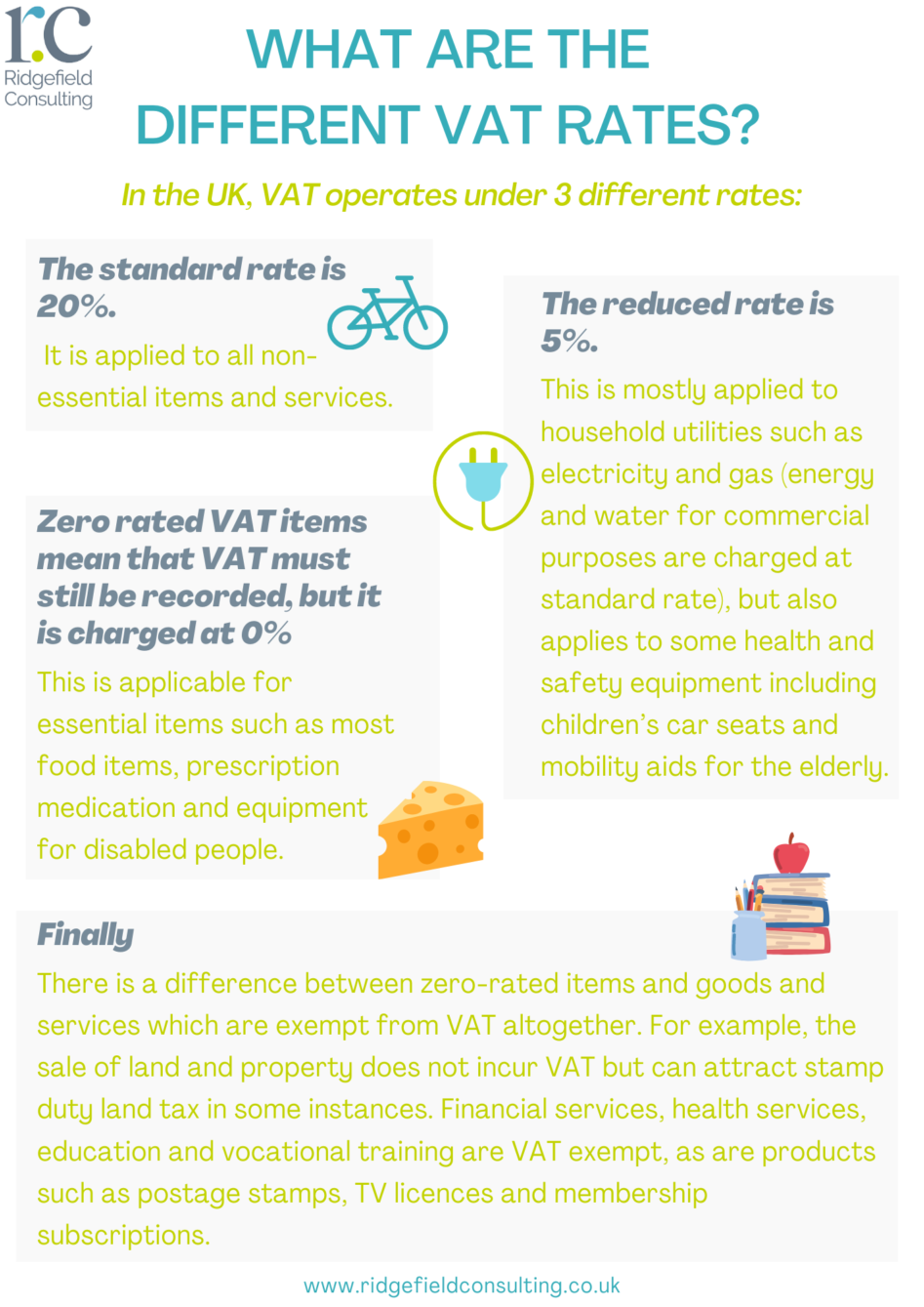

What rate of VAT should you charge FreeAgent

What is VAT How VAT Works in the UK 2024

What is VAT Understanding VAT Principles Implementation theGSTco

Revealed Countries with the highest VAT rates

VAT amp Pricing What Is It I Hate Numbers VAT amp Pricing

Vat to Pay Calculator Find How Much Vat You Have to Pay

VAT Flat Rate Scheme Threshold Explained Q Accountants

Budget 2024 VAT Threshold Increased Towers Gornall

VAT amp Pricing What Is It I Hate Numbers VAT amp Pricing

Spring in China Reduction in VAT Rates Savings in VAT Rates

Vat to Pay Calculator Find How Much Vat You Have to Pay

VAT Flat Rate Scheme Threshold Explained Q Accountants

Budget 2024 VAT Threshold Increased Towers Gornall

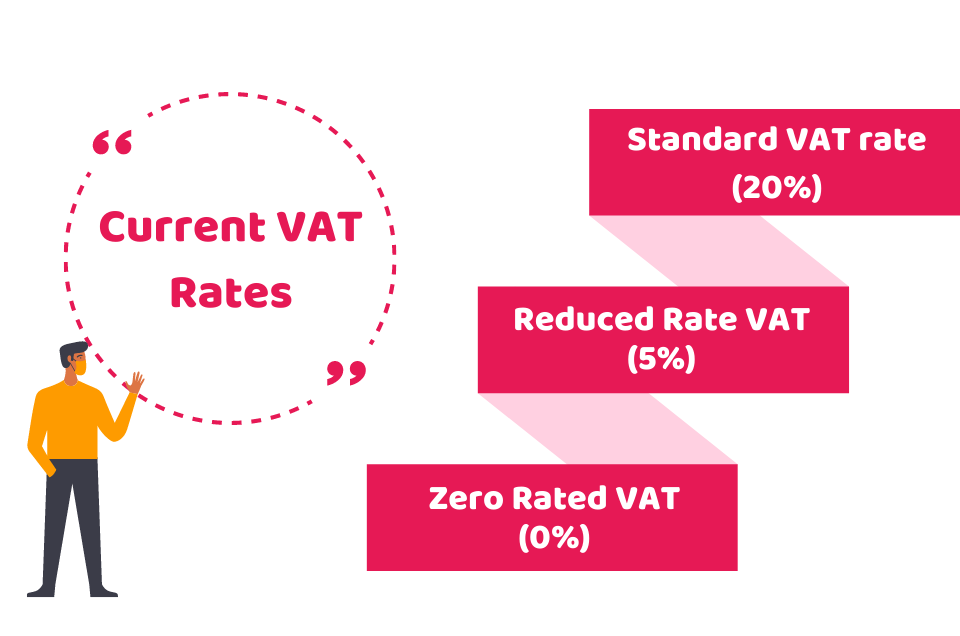

How much is VAT A guide to UK VAT rates

How much is VAT A guide to UK VAT rates

How To Stay Under The VAT Threshold Checkatrade

Everything You Need to Know About VAT Blue dot Corp

Reduction in the rate of VAT PSC Accountants amp Advisors

Find out what the VAT rates are Soft Tehnica

VAT Guide for Small Businesses Understanding and Navigating VAT

What is VAT Its Meaning Features Rates amp Calculation

Different VAT rates amp Exemptions in Construction Cloud Bookkeeping

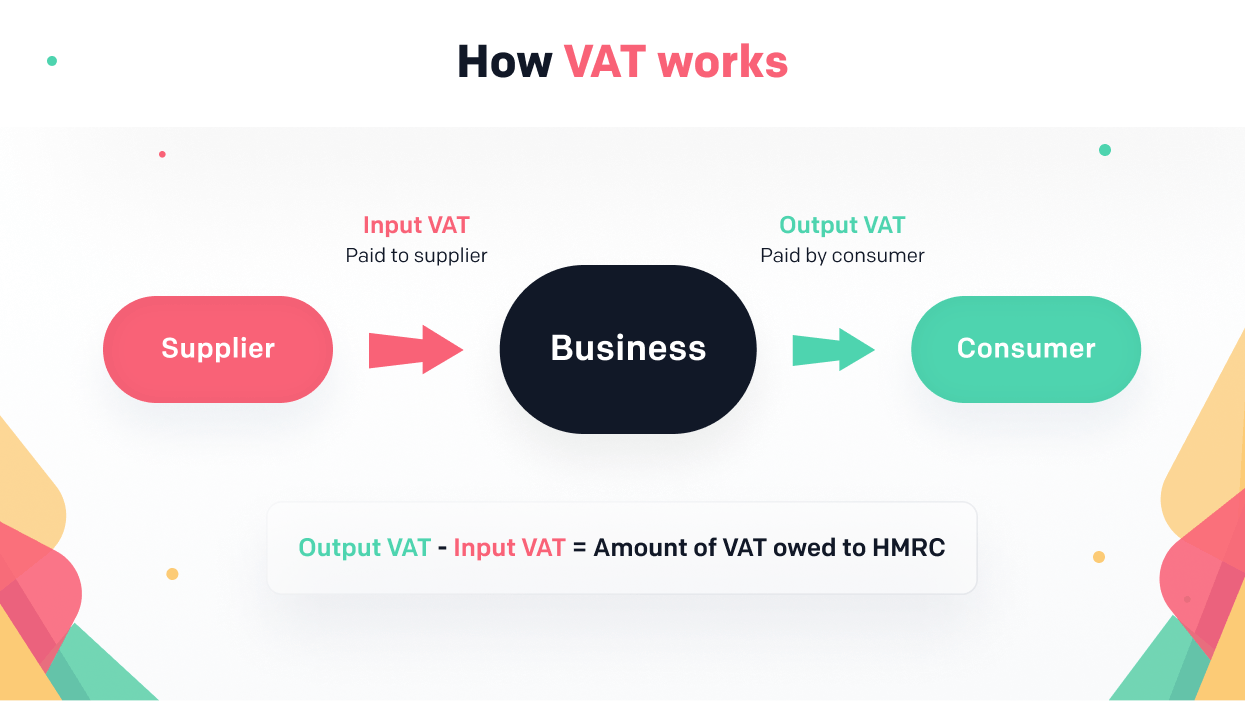

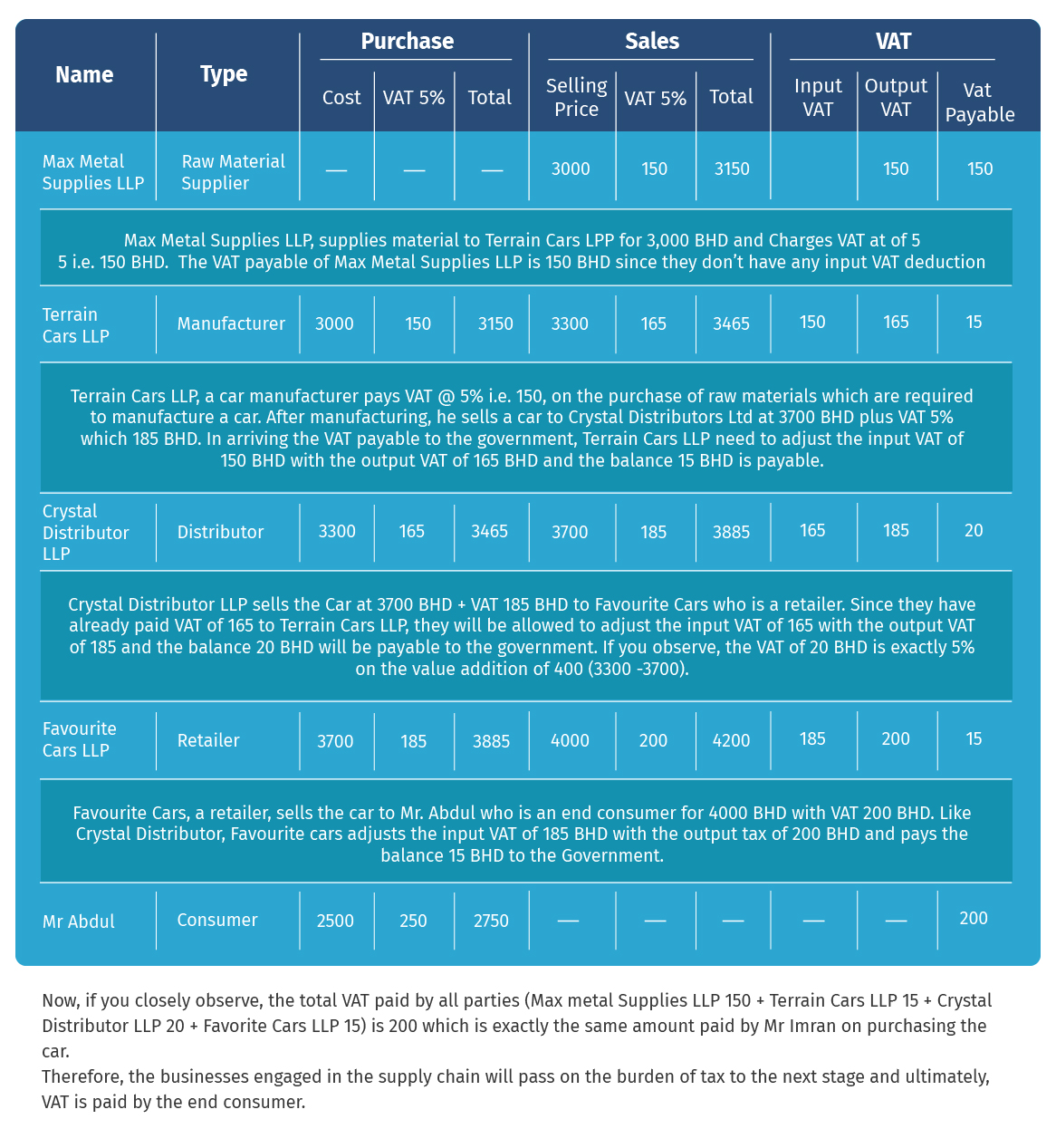

What is VAT and How Value Added Tax in Bahrain Works Tally Solutions

How Does VAT Work in the UK CruseBurke

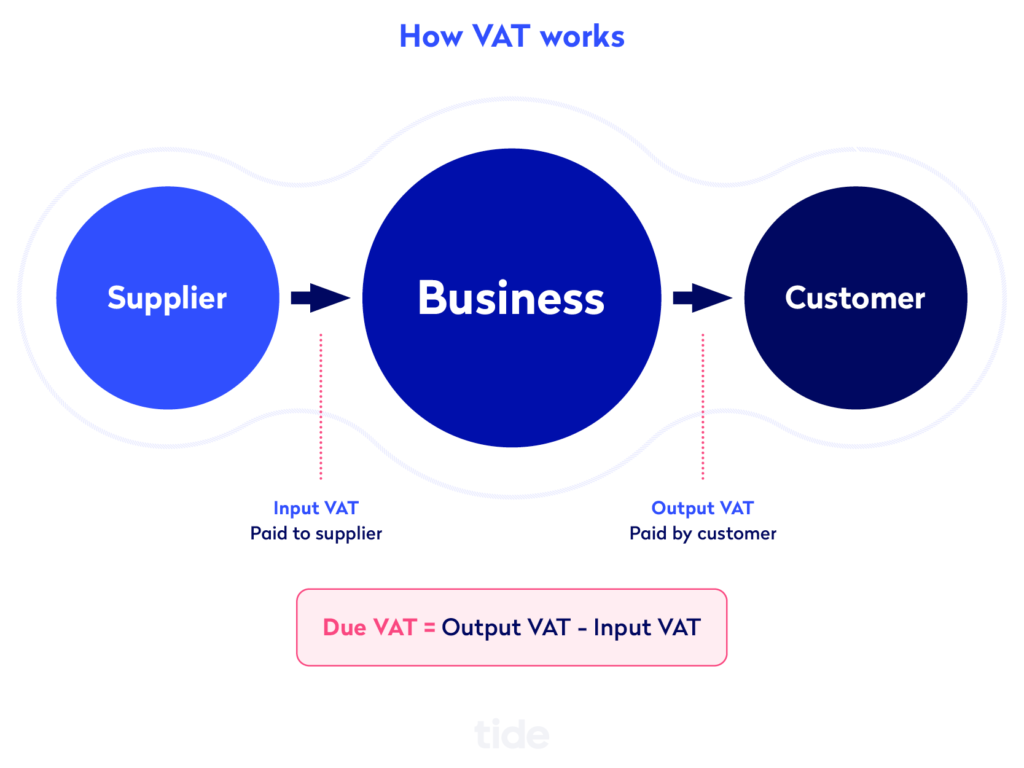

What is VAT how much is it and how much to charge Tide Business

What is VAT how much is it and how much to charge Tide Business

Five Lessons that Introduction of VAT Brought for the GCC

What is VAT and how does it work

Which VAT Pricing Plan Best Suits Your Business Amidst VAT

How To Calculate Customs VAT And Duties Searche

What is the Flat Rate VAT Scheme Magpie Accountancy

Your Quick VAT Guide Plan Insurance Brokers Commercial Insurance

What is VAT A brief guide to consumption tax Qvalia

How to Take VAT Off a Price Calculating Ex VAT Prices

What Is VAT Know How To Calculate the Amount of Value Added Tax

What is VAT A brief guide to consumption tax Qvalia

How to Take VAT Off a Price Calculating Ex VAT Prices

What Is VAT Know How To Calculate the Amount of Value Added Tax

How to Take VAT Off a Price Calculating Ex VAT Prices

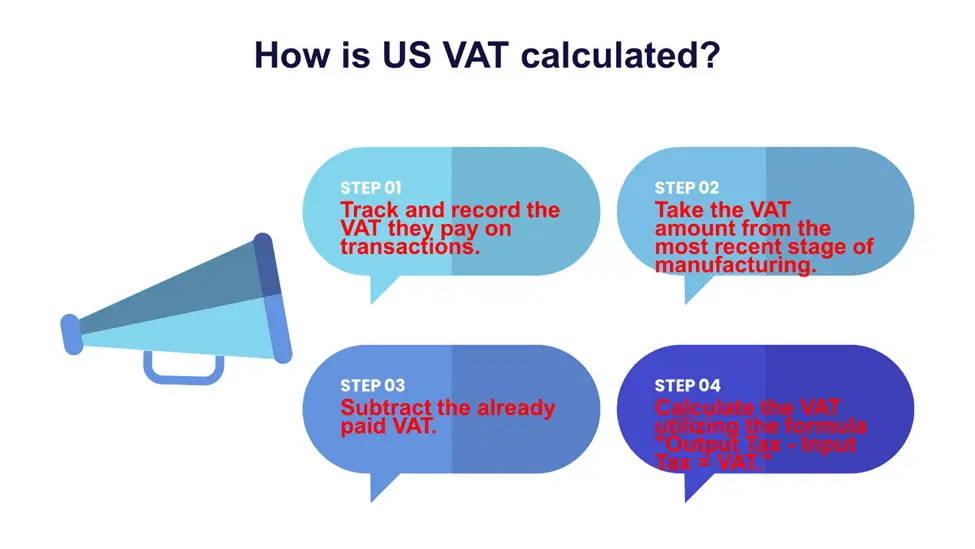

What is Value Added Tax VAT Avalara

Mini VAT Series Part 3 How do you calculate VAT on an import

Unravelling VAT A Comprehensive Understanding

How Much is VAT in UK A Clear Guide to Value Added Tax Rates Dollars

Understanding VAT rates and categories for small businesses Ascendis

VAT Rates by Country A Comprehensive Guide Wafeq

Vietnam Reduces VAT Rate Businesses Allowed to Claim CIT Deductions

New VAT rates has increased rebar prices by 400 TL

Cabinet nod to raise VAT from January 2024

Total costs including VAT for each option to rehabilitate each entire

Estimated VAT Assessments on the Increase BDO

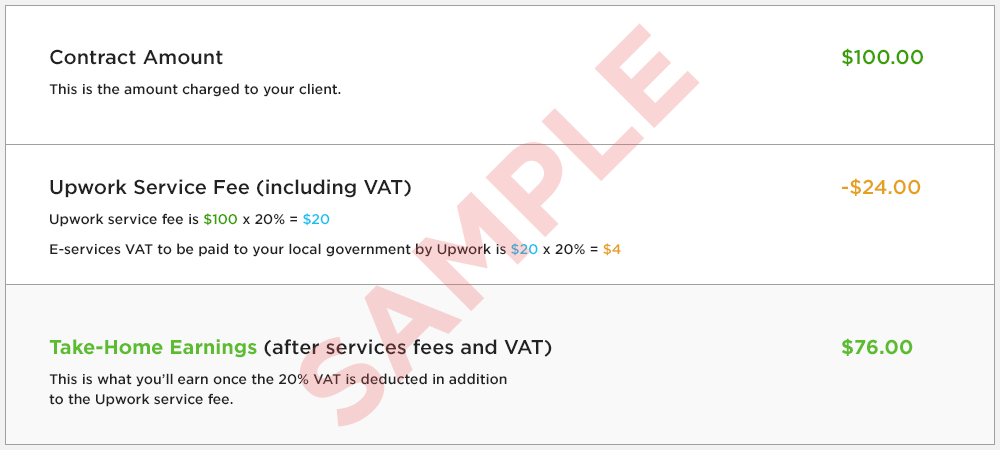

Value Added Tax VAT on Freelancer Fees Upwork Customer Service

What do I need to know about VAT Informi

3 VAT flat rate will not increase prices GRA Prime News Ghana

How Much Is The VAT Rate In South Africa SA Careers

How To Know What VAT Rates to Use HN Magazine

How To Know What VAT Rates to Use HN Magazine

GCC to Introduce VAT What It Means for Businesses Economy and People

How do I pay my VAT bill The Accountancy Partnership

How to remove VAT from a price using a calculator Braindumps co uk

Price and sales effects of standard VAT rate changes Evidence and

What U S Based Businesses Must Know about Value Added Tax VAT

What Is a VAT Tax and Where Will You Find It on a Cruise

What Is Vat Cost - The pictures related to be able to What Is Vat Cost in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

-1920w.jpg)