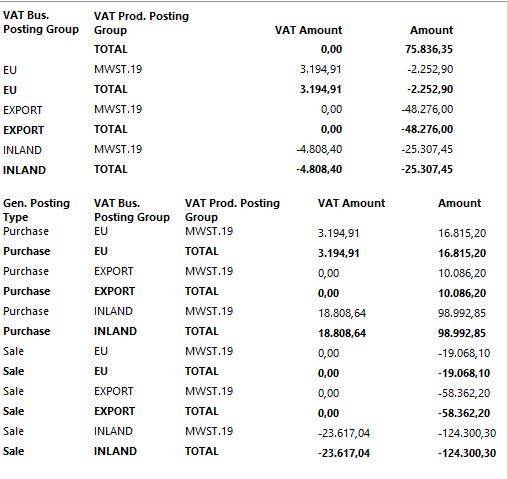

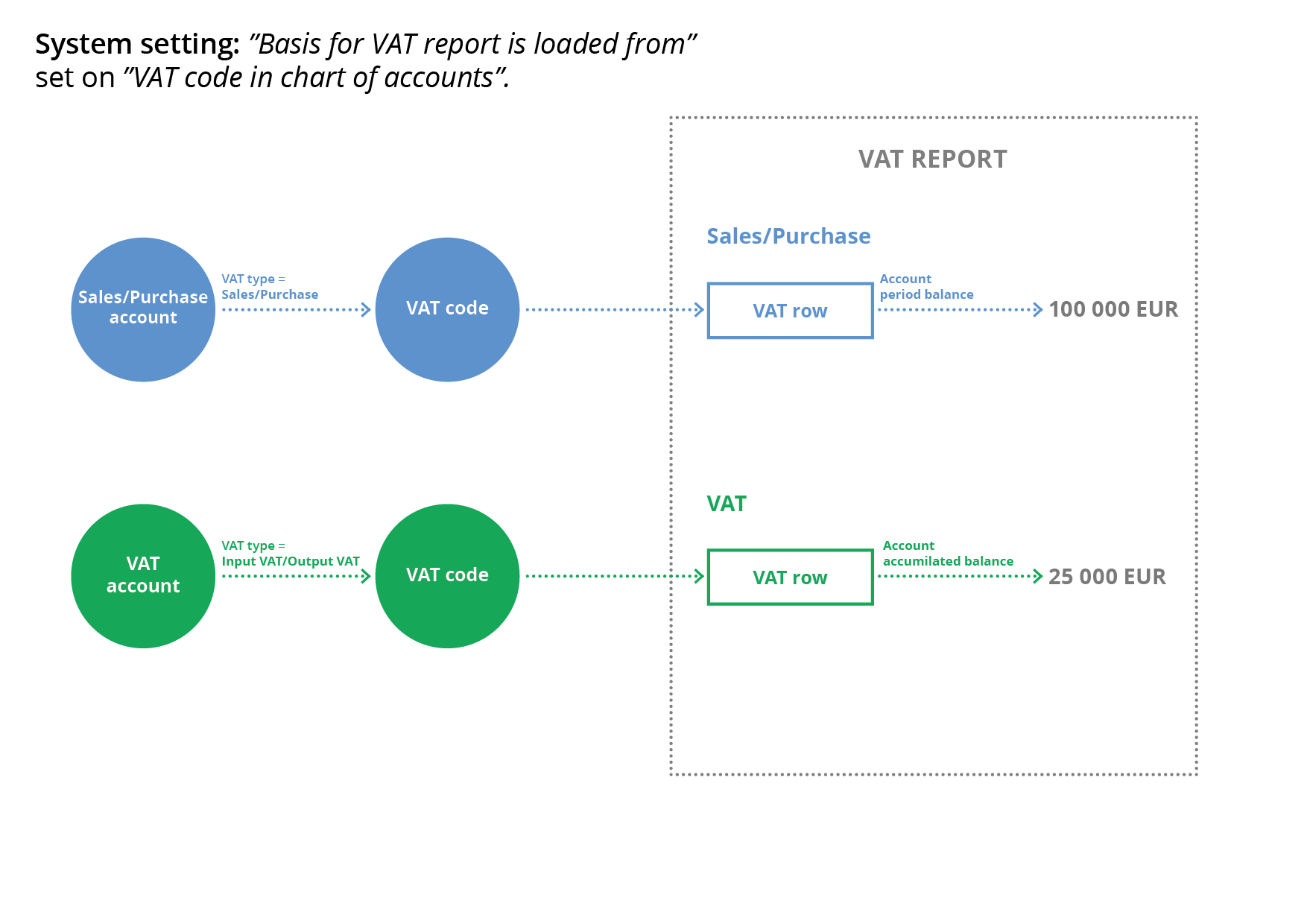

EU VAT control and document preview eFaktura nl

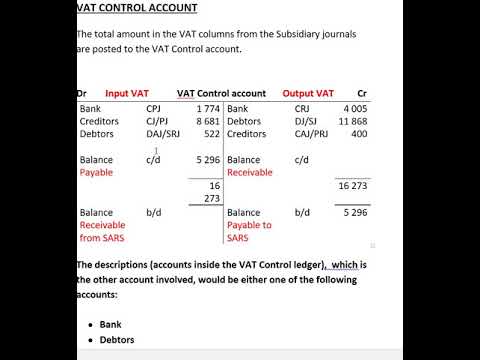

VAT Control Account And VAT Suspense Account

VAT Control Account And VAT Suspense Account

VAT Control Account Fastaccountant co uk

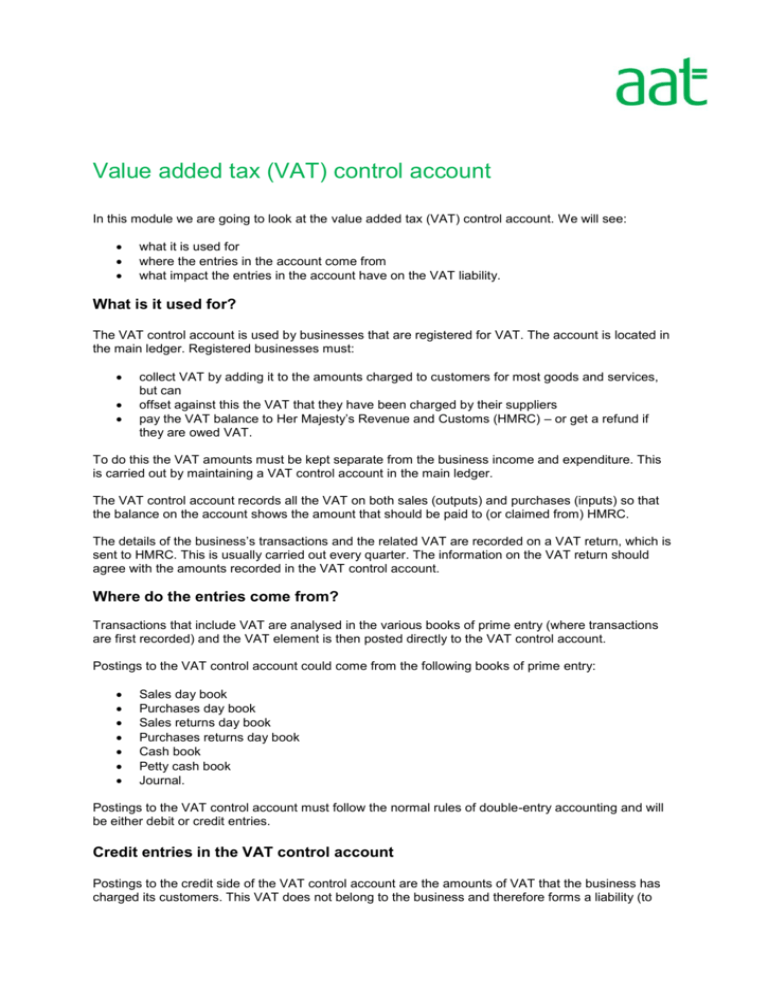

Value added tax VAT control account

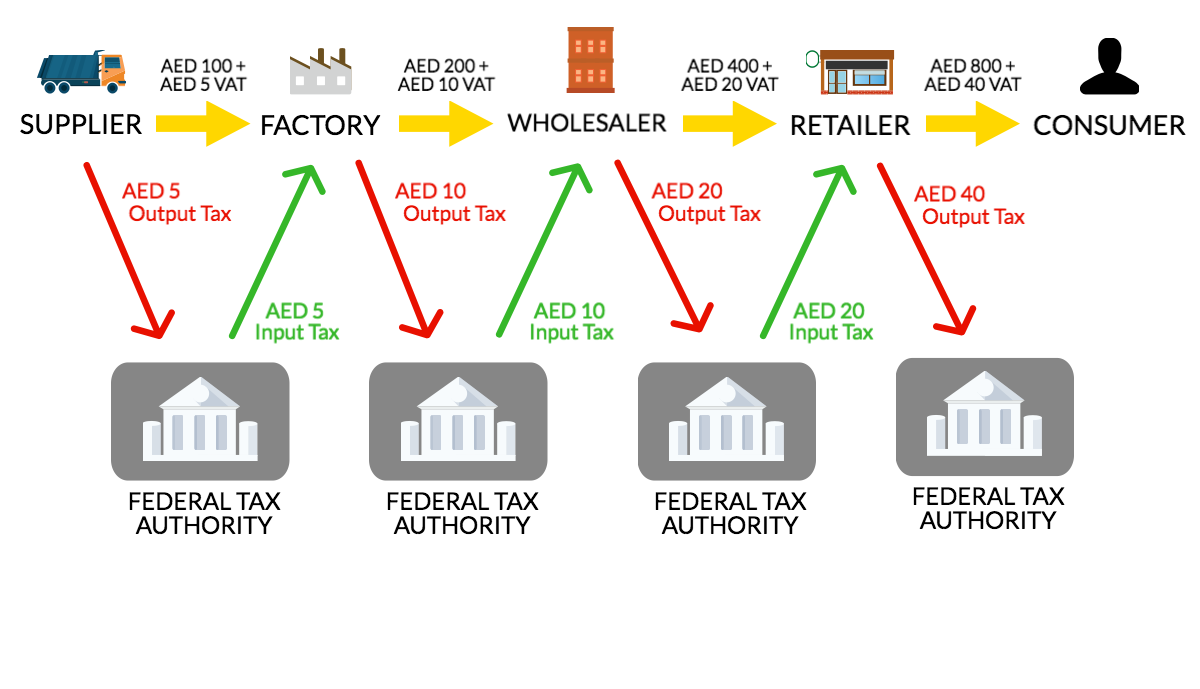

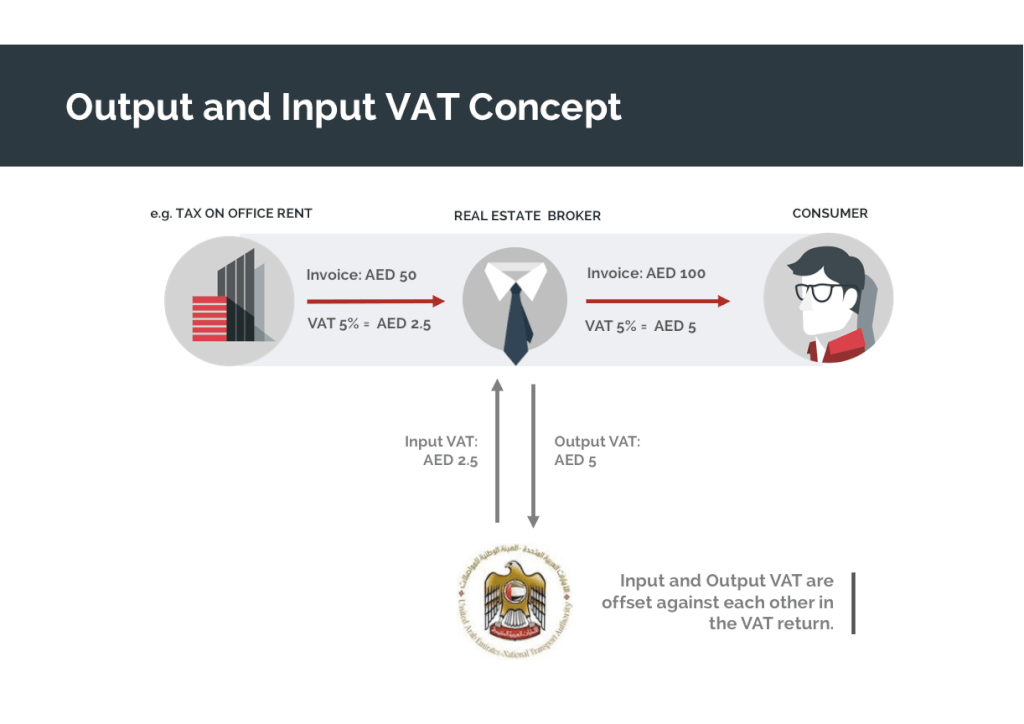

VAT Explained VatMan Gulf Tax Specialists

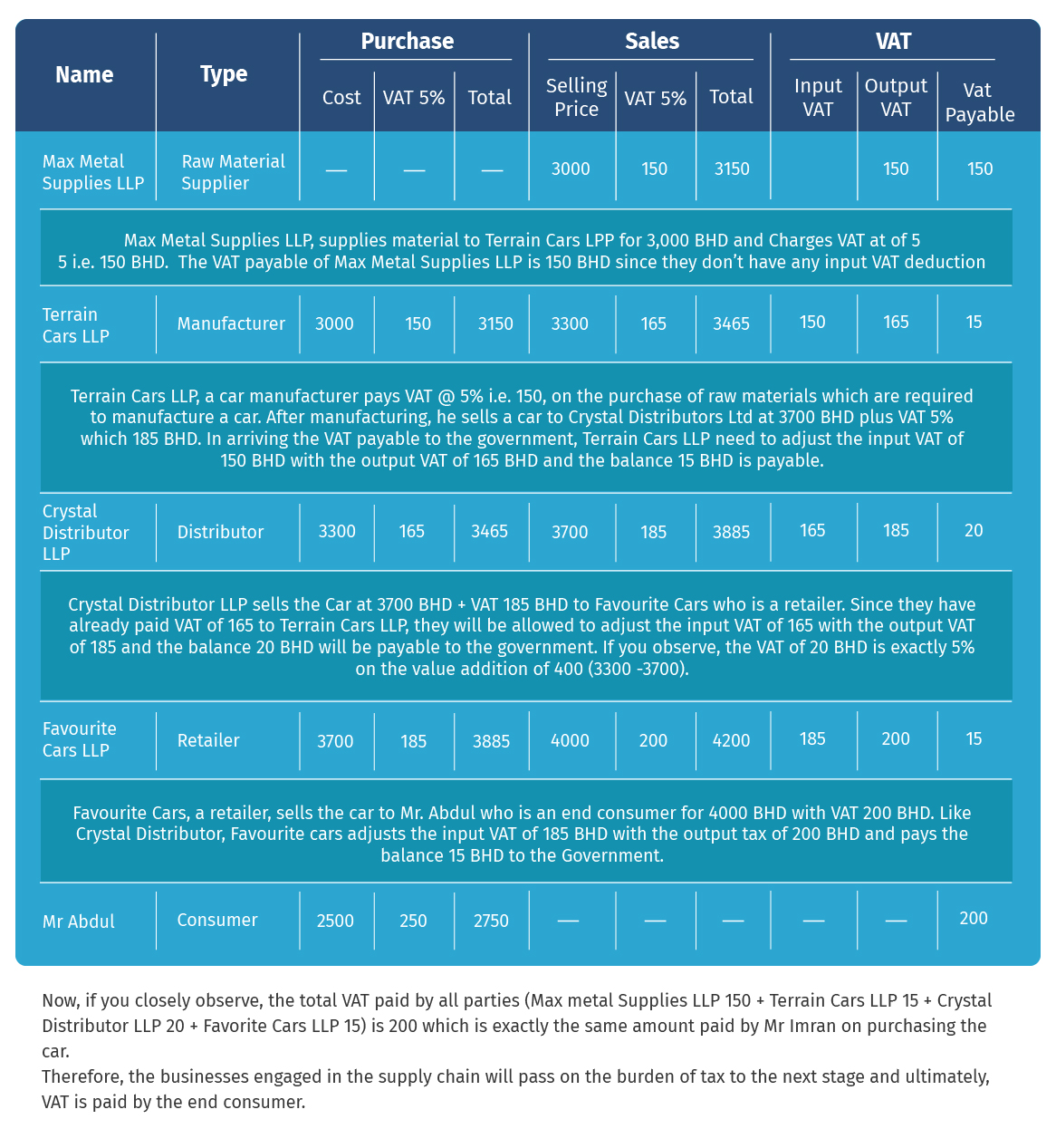

What is VAT and How Value Added Tax in Bahrain Works Tally Solutions

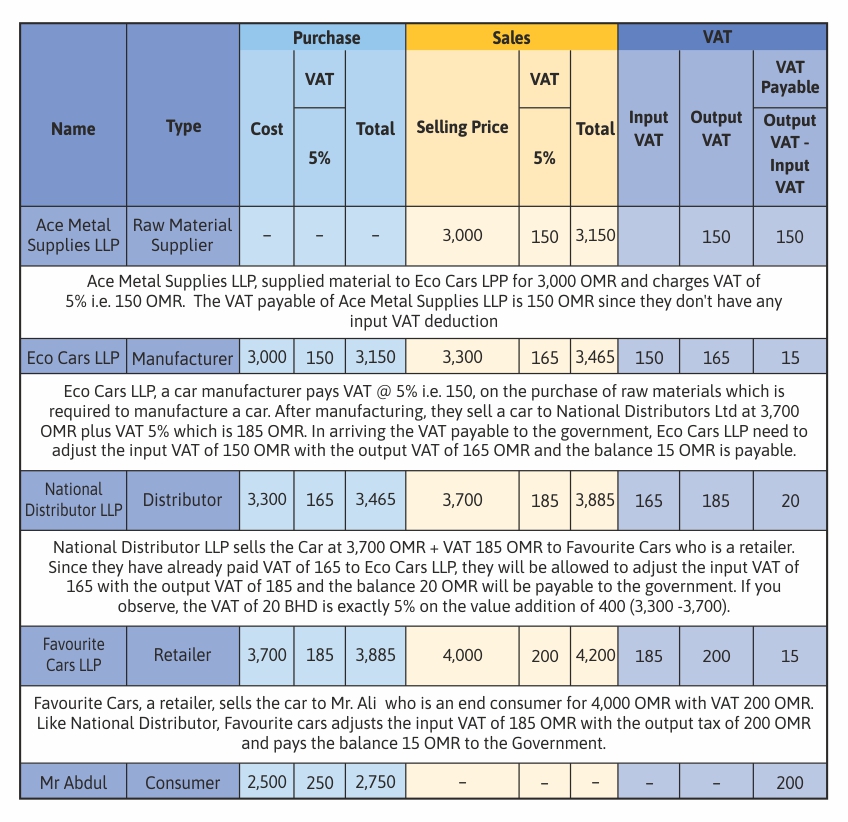

What is VAT mean VAT Rate Advantages Demerits in the UAE

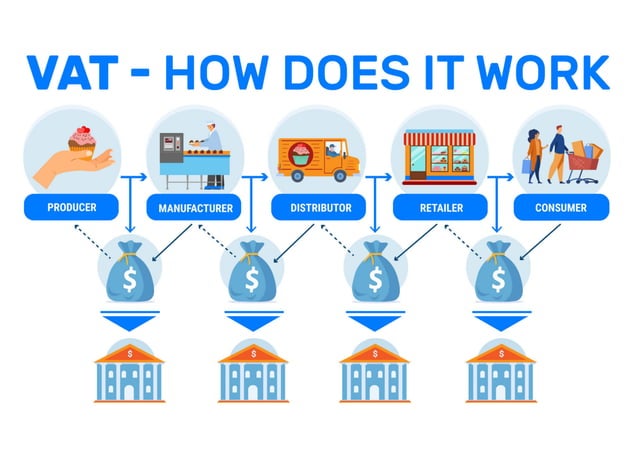

What is VAT amp How Does It Work Tally Solutions

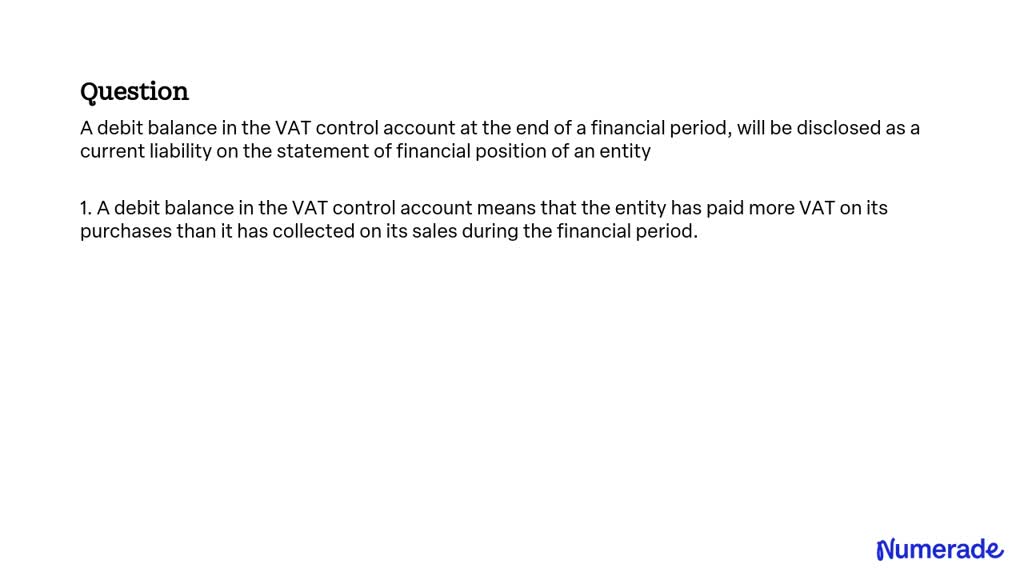

SOLVED A debit balance in the VAT control account at the end of a

VAT Saint amp Co Chartered Accountants Accountants in Cumbria and

What is VAT Understanding VAT Principles Implementation theGSTco

VAT Management System Helping Businesses Skylark Soft Limited

VAT Management System Helping Businesses Skylark Soft Limited

VAT Management System Helping Businesses Skylark Soft Limited

Application of VAT Policy Lawfirm SBLaw

VAT and Its Procedures in 2024 Accounting services Tax consulting

What is VAT Understanding VAT Principles Implementation theGSTco

VAT Management System Helping Businesses Skylark Soft Limited

VAT Management System Helping Businesses Skylark Soft Limited

VAT Management System Helping Businesses Skylark Soft Limited

Application of VAT Policy Lawfirm SBLaw

VAT and Its Procedures in 2024 Accounting services Tax consulting

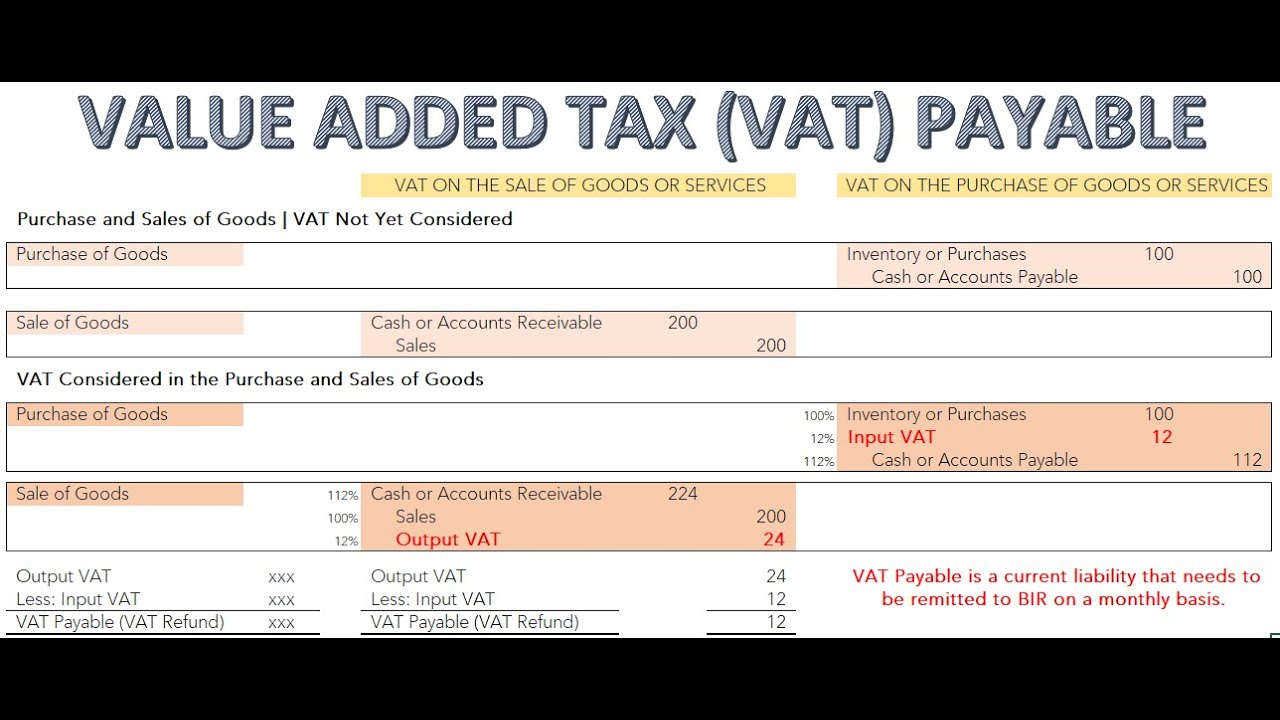

how to calculate vat input and output Wiring Work

Equip SAP with automated VAT Controls SAP add on for VAT

Vat Implementation In our modern world the average person by The

PPT How the VAT system works PowerPoint Presentation free download

How To Stay Under The VAT Threshold Checkatrade

Is your Accounting System is Ready for VAT in GCC Countries Global iTS

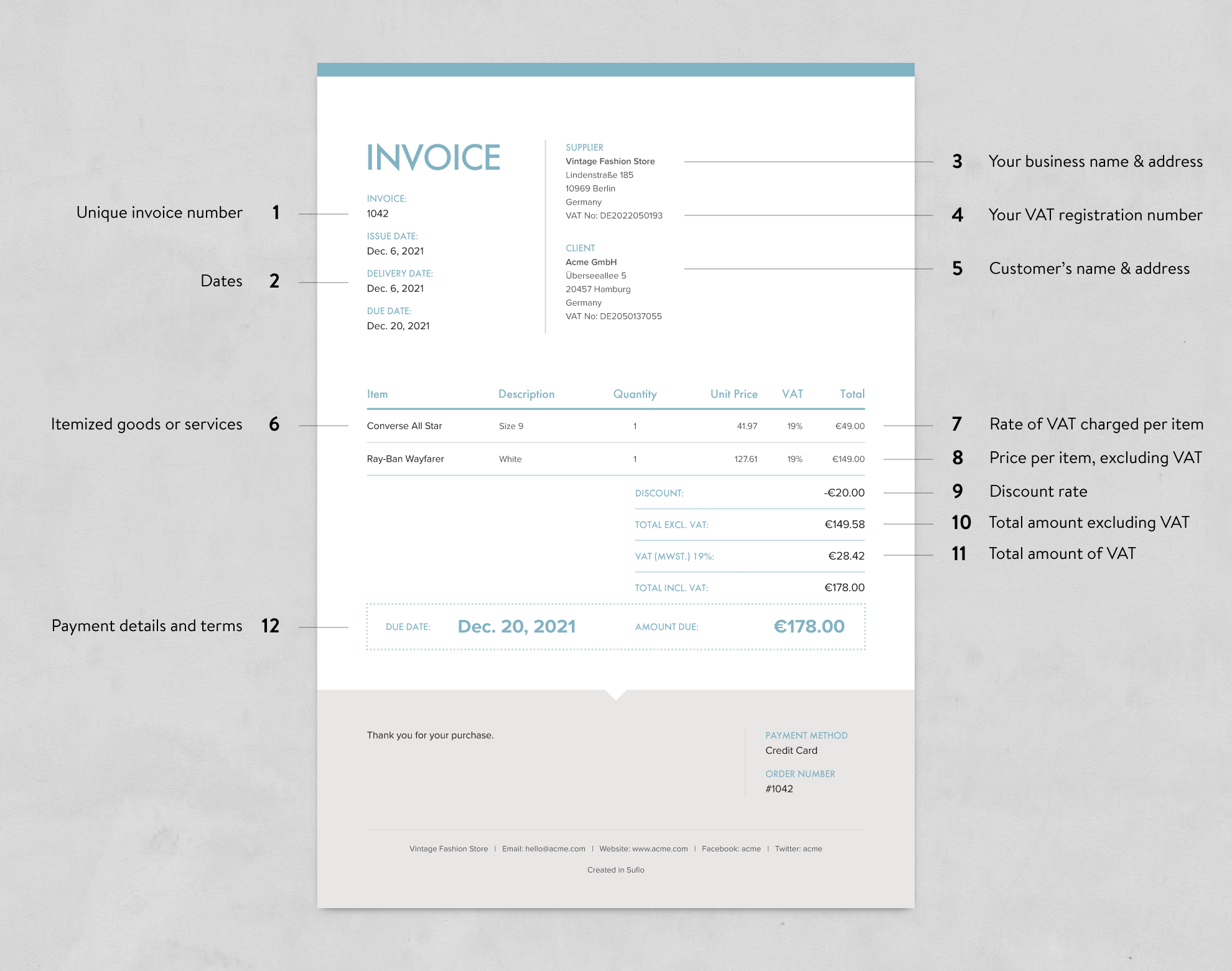

Understanding VAT Checklist amp Templates

Reduction in the rate of VAT PSC Accountants amp Advisors

Top VAT Registration amp Compliance Polaris Accountants

Maximizing Business Growth Through Effective VAT Management

What is VAT Why is the company recommended to register for VAT

VAT implementation in the coming period The Middle East Observer

The importance of VAT compliance AJM Tax

Case Study Implementing VAT in the UAE

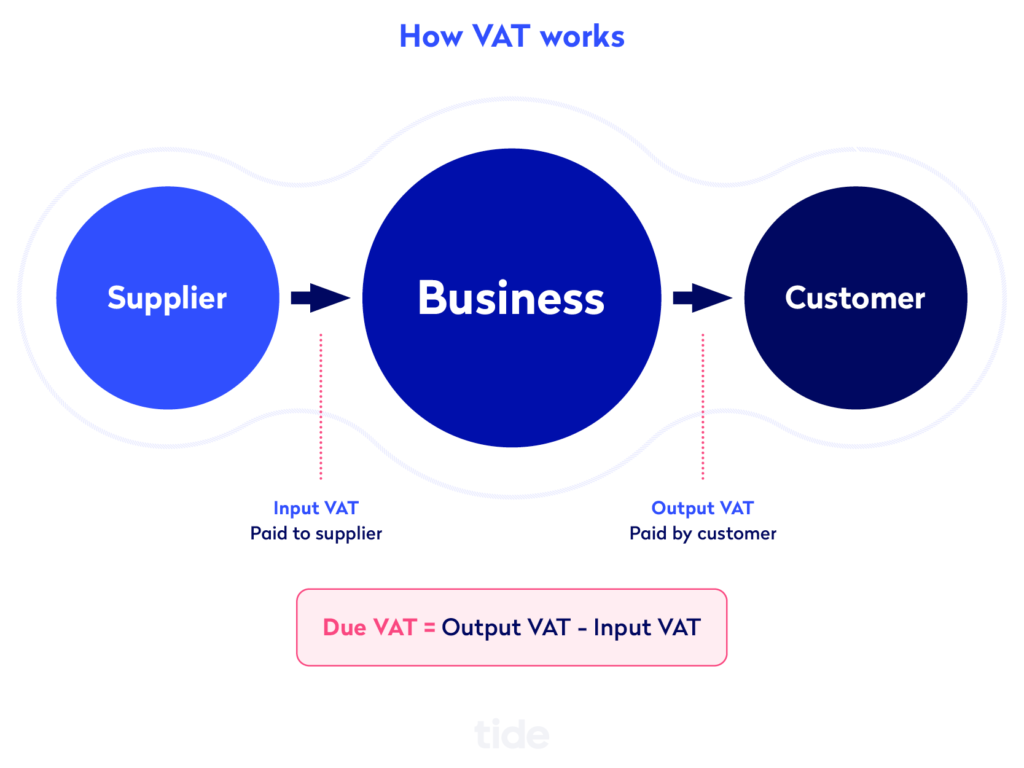

What is VAT how much is it and how much to charge Tide Business

VAT What you need to know now

Five Lessons that Introduction of VAT Brought for the GCC

What is VAT and how does it work

What are the key VAT implications for the education sector in the UAE

Principles and basics of VAT in the United Arab Emirates ECPA

VAT GST sales and other consumption taxes EY Singapore

Five Lessons that Introduction of VAT Brought for the GCC

What is VAT and how does it work

What are the key VAT implications for the education sector in the UAE

Principles and basics of VAT in the United Arab Emirates ECPA

VAT GST sales and other consumption taxes EY Singapore

10 Essential Tips for Successful VAT Compliance and Audits in UAE

Expert Tips for Efficient VAT System Implementation Insight Partners

Managing VAT Compliance For E Commerce Businesses In The UAE Creation

Entering your Opening Balances Cash VAT Method

Mastering VAT Compliance Organizing Your Bookkeeping for Seamless

The Importance of VAT Formation

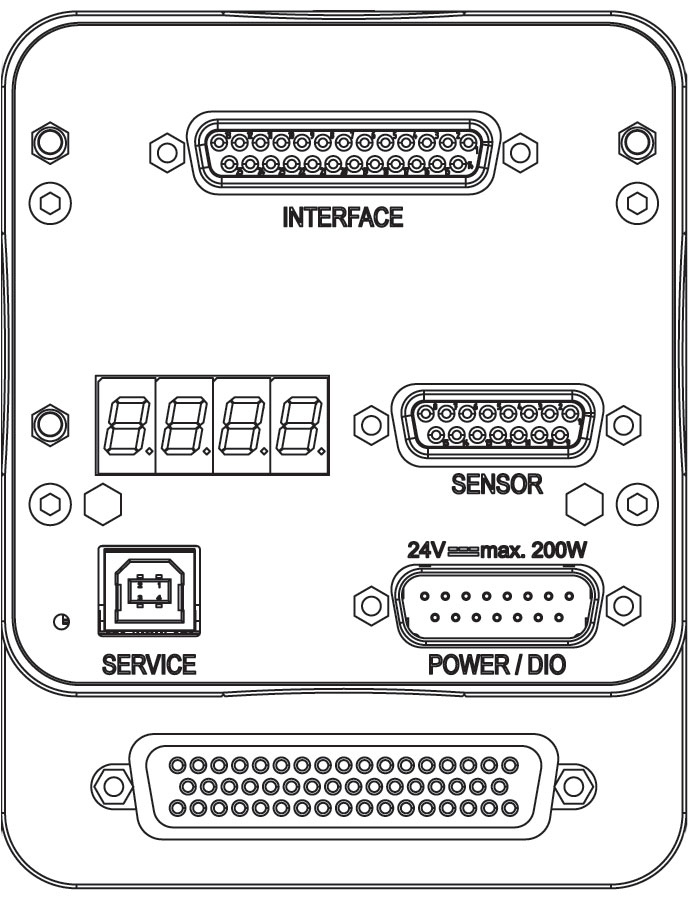

VAT Controller and Interface Options for Mechatronic Vacuum Control

AAT L3 Accountancy The VAT return chapter 4 Flashcards Quizlet

How is VAT carried out on Electronics Services in the UAE Inspire MS

Is Input Vat Claimable On Bank Charges In South Africa at Sharlene

GCC to Introduce VAT What It Means for Businesses Economy and People

Managing VAT in the UAE Gearing up for end of year input tax

VAT Understanding VAT Compliance and Accounting Services in Dubai

UAE VAT Health Check Avoid Tax Penalties with Expert Tips

Understanding the VAT regime and how it affects your business V amp R

Upcoming changes in VAT legislation that you need to know about RG

What is the Purpose of Stock Control Cloud Commerce Pro

Certyfikat VAT Control Intertek Poland

VAT Control Account Question YouTube

Vat Control Account explained YouTube

VAT Control Account YouTube

VAT Control Account YouTube

Normative VAT Control YouTube

What Is Vat Control - The pictures related to be able to What Is Vat Control in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.