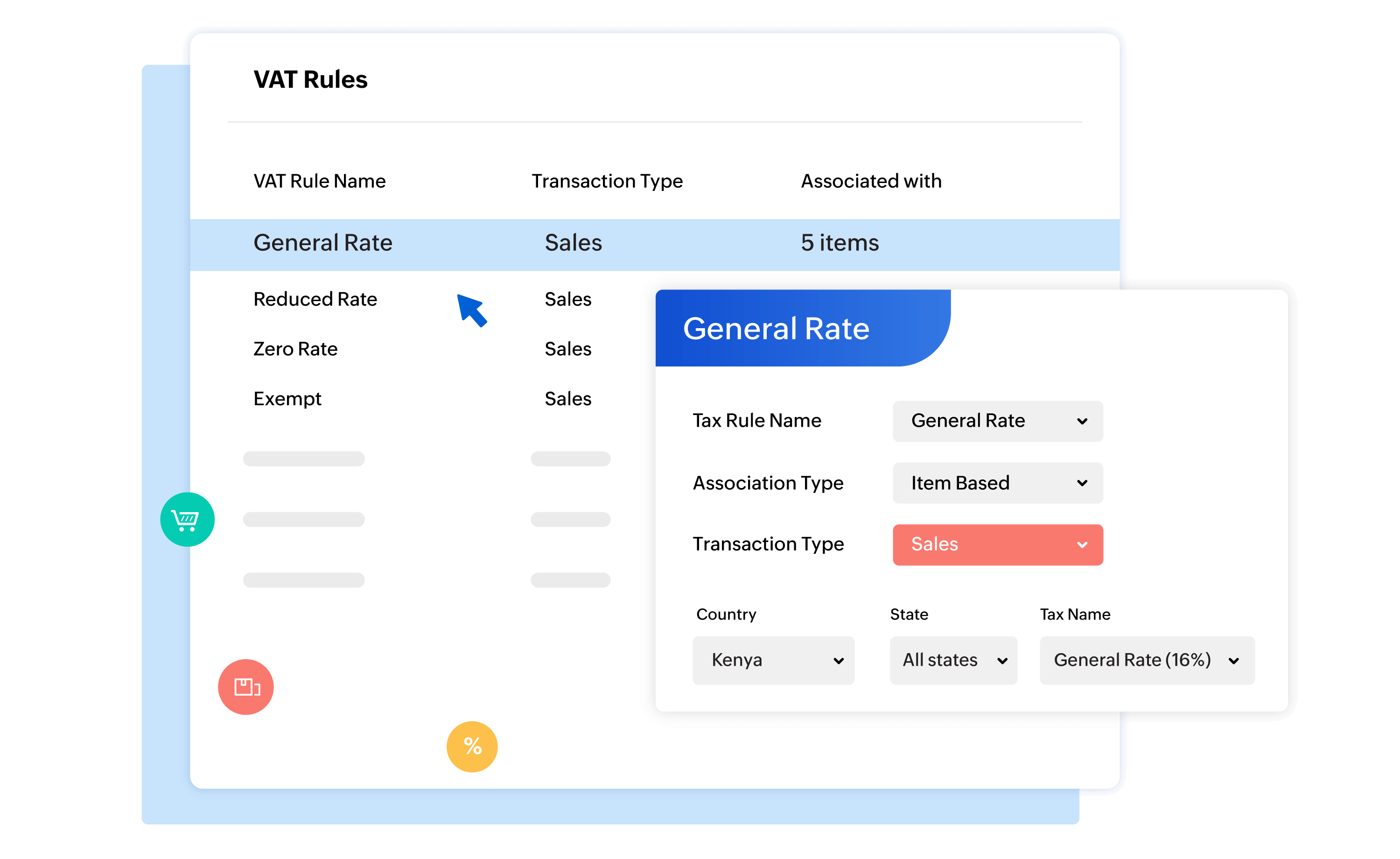

VAT Software Online Accounting amp VAT Returns Filing Zoho Books UK

VAT Accounting in the UAE fn consultancy

VAT Accounting Services 1Stop Accountants

Invoice vs cash accounting UK VAT schemes simplified FreeAgent

VAT Accounting In UAE VATBOX Tax Agency

Is your Accounting System is Ready for VAT in GCC Countries Global iTS

VAT Accounting Services in Bahrain VAT Accounting in Bahrain

Accounting For VAT Getting Your Business Ready

Intellitax Accounting Services London VAT Accounting Schemes

How Does VAT Work in Accounting A Clear Explanation Accounting for

VAT accounting schemes Money Donut

Postponed VAT accounting from the 1st January 2021

Guide to VAT The Accounting Studio

Accounting for VAT Training Courses Meirc

VAT Annual Accounting Scheme Accountants etc

VAT accounting schemes Brown amp Co Chartered Accountants Lancashire

VAT and Accounting Staying Compliant Southside Accountants Wimbledon

VAT Accounting Schemes Xero

VAT accounting schemes The Accountancy Partnership

Guide to VAT The Accounting Studio

Accounting for VAT Training Courses Meirc

VAT Annual Accounting Scheme Accountants etc

VAT accounting schemes Brown amp Co Chartered Accountants Lancashire

VAT and Accounting Staying Compliant Southside Accountants Wimbledon

VAT Accounting Schemes Xero

VAT accounting schemes The Accountancy Partnership

Accounting Entries Vat Accounting Entries

VAT Submission Tally Prime Accounting Software

VAT 101 Accounting Solution

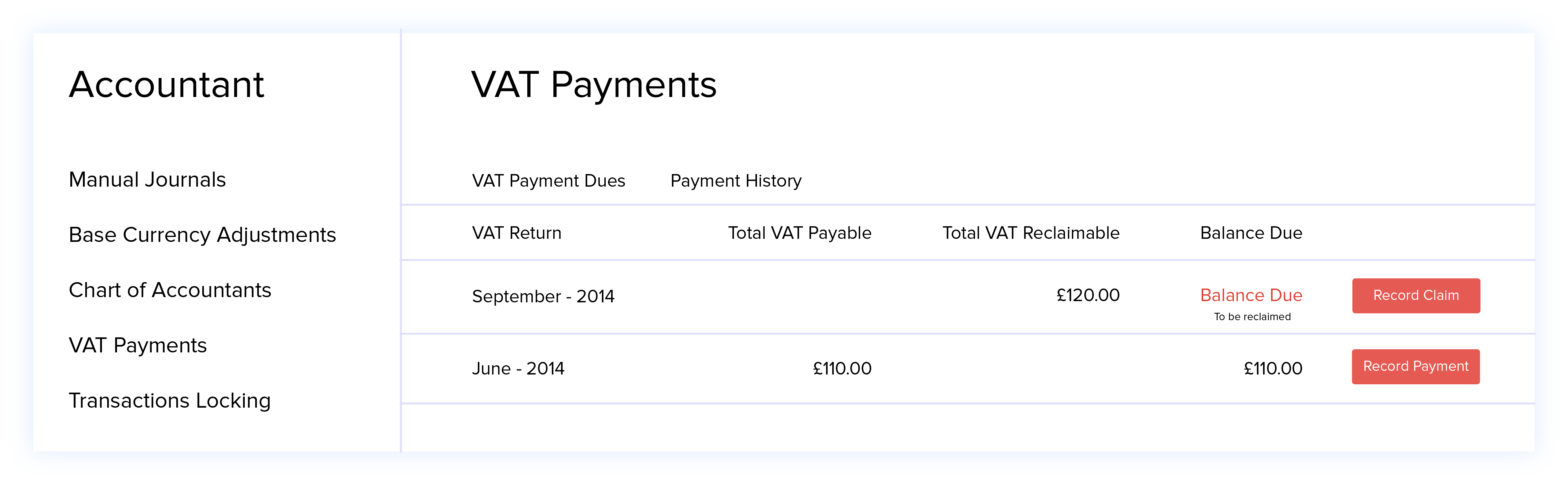

VAT cash accounting versus standard VAT accounting An Accounting Gem

Postponed VAT accounting from the 1st January 2021

VAT Implementation And Registration Services In The UAE

Value Added Tax Scheme Annual Accounting VAT

VAT accounting schemes explained Thomson Cooper Accountants

What is VAT and How Does It Work in Singapore Paul Wan amp Co

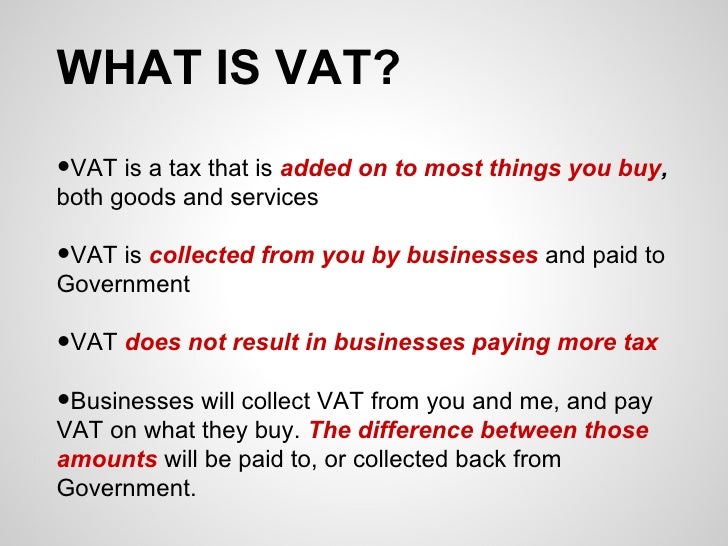

What is VAT A Clear Explanation for Businesses and Consumers

Vat Business Financial Accounting Tax VAT Finance Calculation Financial

Everything You Need to Know About VAT

What does Including VAT mean Vatcalonline

What is the VAT Annual Accounting Scheme CHW Accounting

What is VAT Accountancy Services in UK

What is VAT Definition and Examples

What is VAT Definition and Examples

A Brief History of VAT Sufio

What exactly is VAT Chartered Accountants

VAT Tax Advice amp Services Saint amp Co Chartered Accountants

A Brief History of VAT Sufio

What exactly is VAT Chartered Accountants

VAT Tax Advice amp Services Saint amp Co Chartered Accountants

How to Choose the Right VAT Accounting Scheme British Association of

VAT Explained What You Need to Know TaxClimate com Global

What is VAT mean VAT Rate Advantages Demerits in the UAE

VAT Invoices Explained What Needs To Be Included In A VAT Invoice

VAT Invoice Definition amp Rules for VAT Invoicing

Postponed VAT accounting and why it makes good commercial sense for

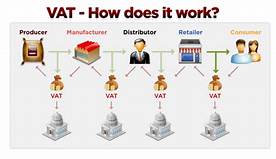

What is VAT amp How Does It Work Tally Solutions

What is VAT Understanding VAT Principles Implementation theGSTco

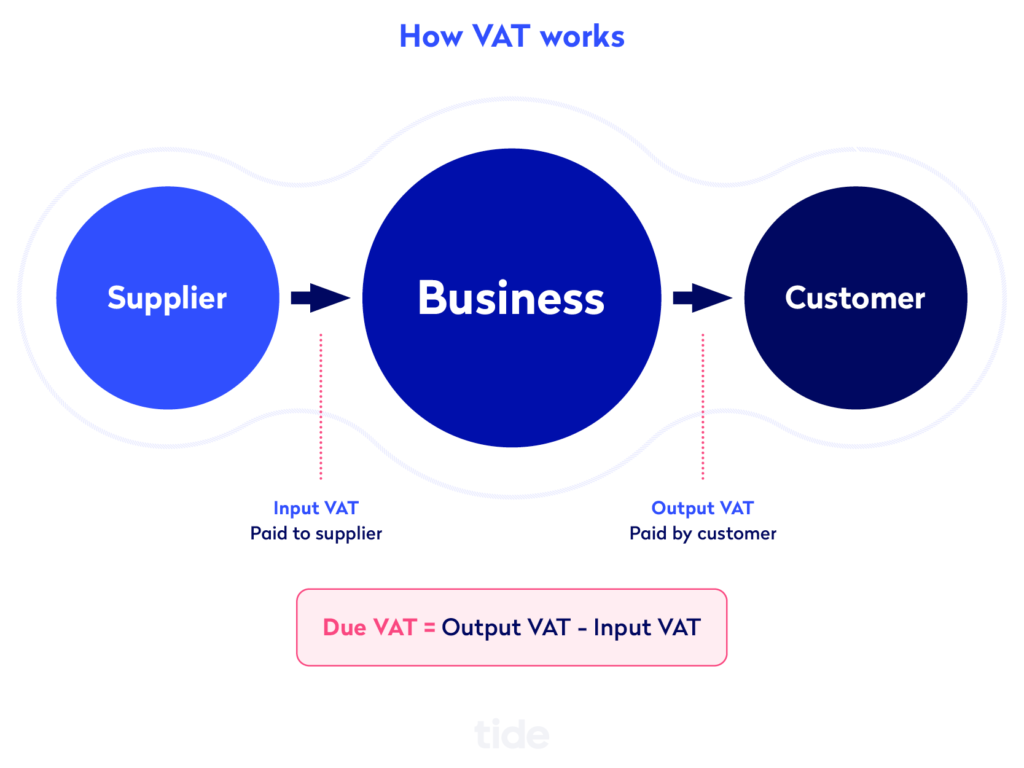

how to calculate vat input and output Wiring Work

The VAT Flat Rate Scheme explained FreeAgent

What is VAT Why is the company recommended to register for VAT

What is VAT how much is it and how much to charge Tide Business

Easy Guide To VAT Helpful Liverpool Accountant

Five Lessons that Introduction of VAT Brought for the GCC

What is VAT and how does it work

The 163 85k VAT Threshold 19 Things You Need to Know about VAT

VAT tax in India Types features and objectives

What is VAT UK VAT Value Added Tax in the UK

VAT Account Rules Of What A VAT Account Should Look Like Accountants

VAT Accountant Roles Understanding What They Do UK Guide

What You Need To Know About VAT How To Quickly Become An Expert In VAT

PPT VAT Tax Refund in the UK Proactive Consultancy Group PowerPoint

A Comprehensive Guide to Understanding VAT What It Is and How It Works

How Does VAT Work and What Does it Mean for Your Company

VAT 1 Over view of VAT Definition VAT is a form of sales tax

What Is Vat Accounting - The pictures related to be able to What Is Vat Accounting in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.