VAT Threshold Frozen Until 2020 PKB Accountants

What is the VAT Threshold in the UK London Local News

What is the VAT threshold Small Business UK

UK raises VAT registration threshold to 163 90 000 vatcalc com

Guide About What is the VAT Threshold CruseBurke

UK VAT Threshold is 163 90 000 A Complete Guide for UK Businesses

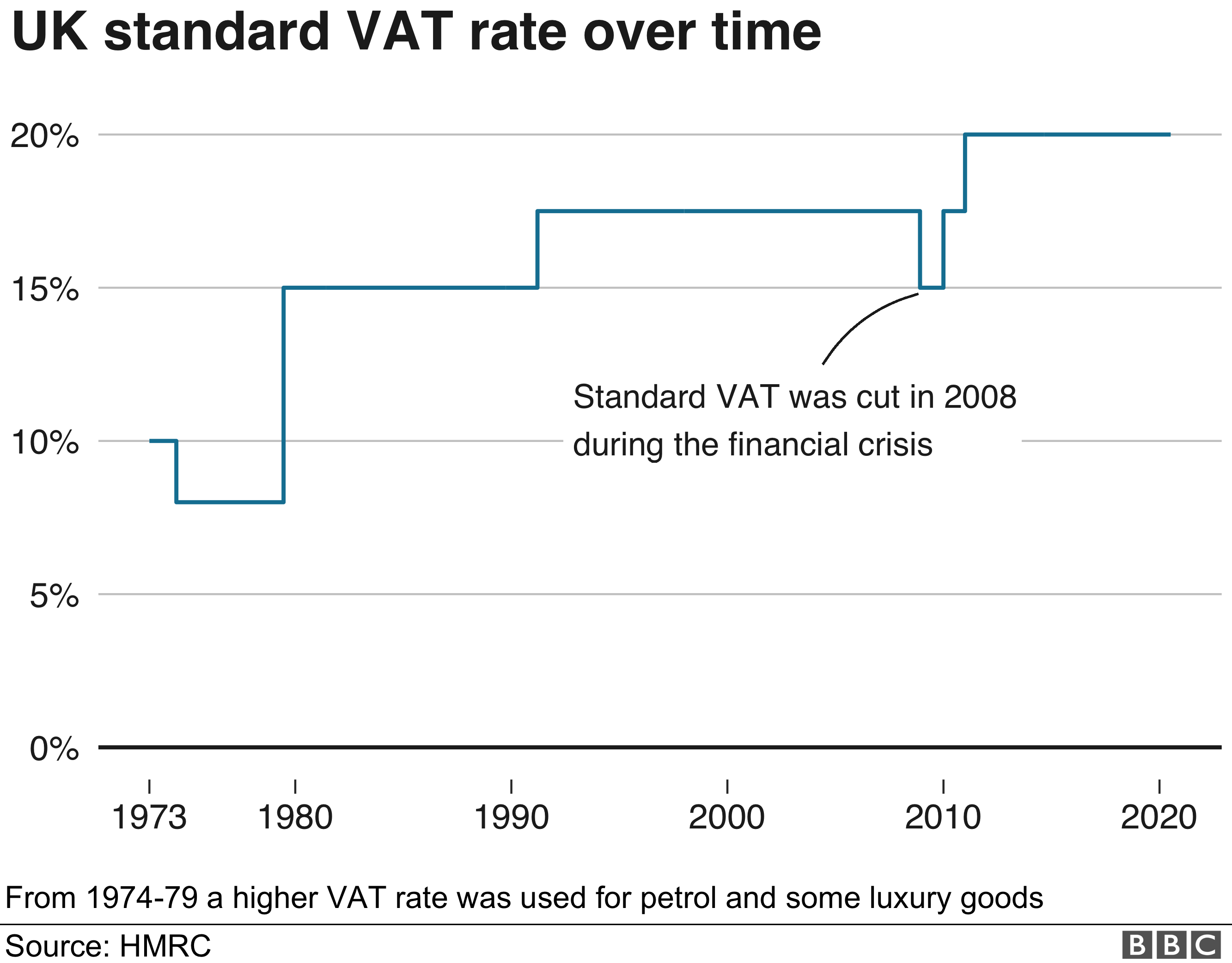

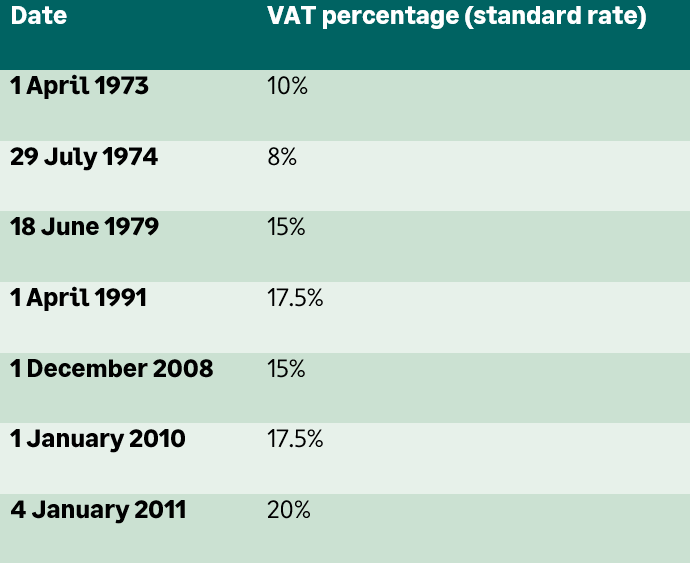

VAT in the UK Information about VAT in the UK

VAT Threshold What is it and how does it work in UK Government

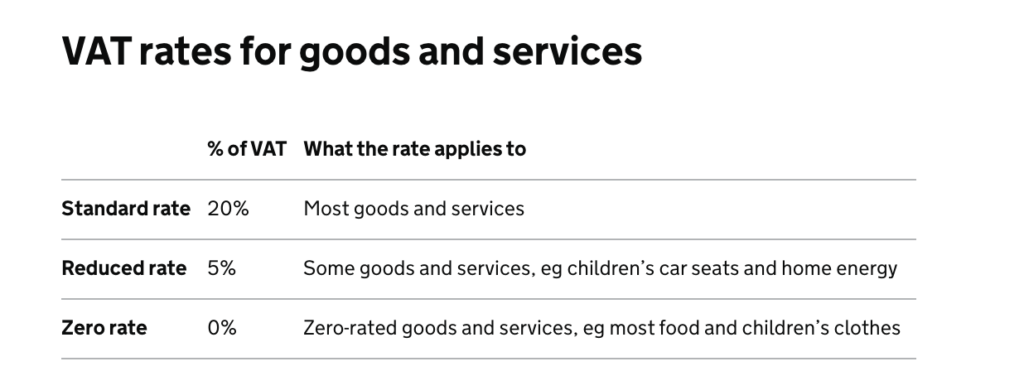

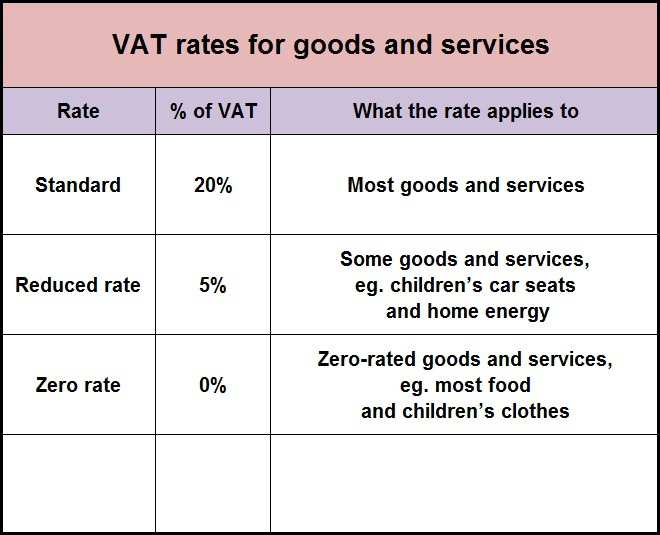

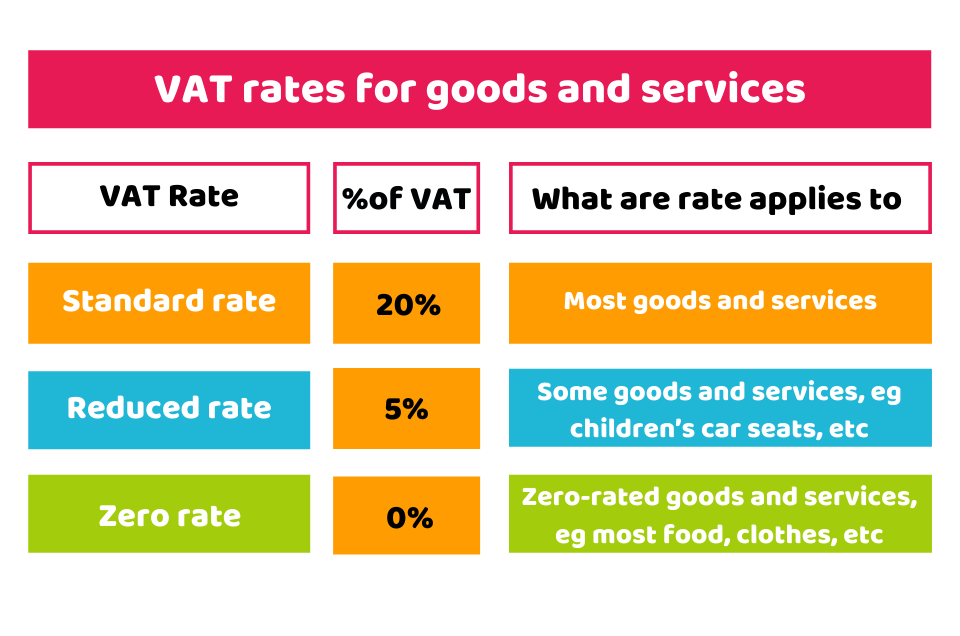

How much VAT in the UK VAT Rates and More Vatcalonline

What is the VAT Threshold and When do you have to register for VAT in

What is the VAT Threshold and When do you have to register for VAT in

Everything You Need To Know About The UK VAT Threshold 360 Company

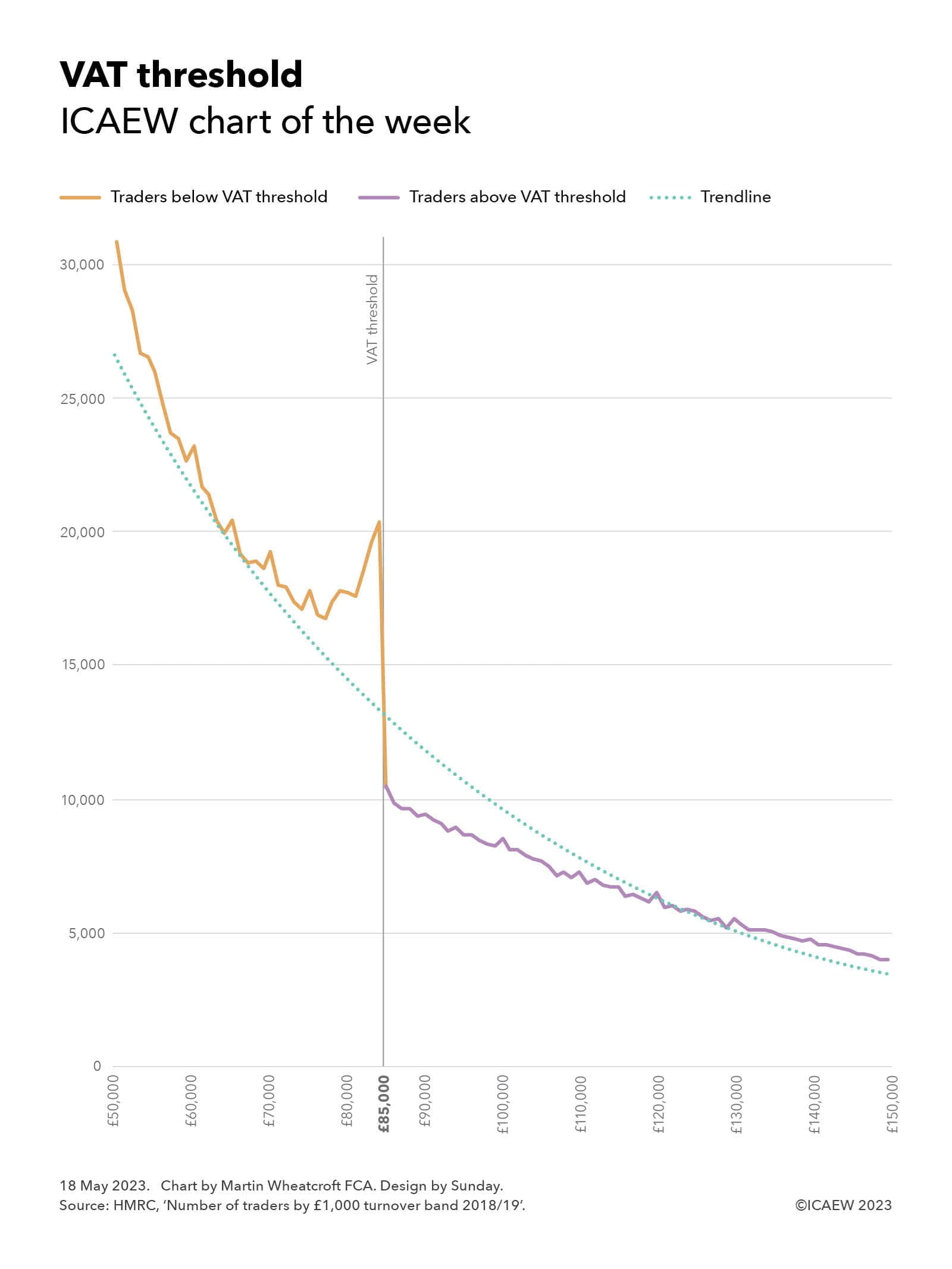

Is the VAT threshold in the UK too high

Is the VAT threshold in the UK too high

The 163 85k VAT Threshold 19 Things You Need to Know about VAT

The 163 85k VAT Threshold 19 Things You Need to Know about VAT

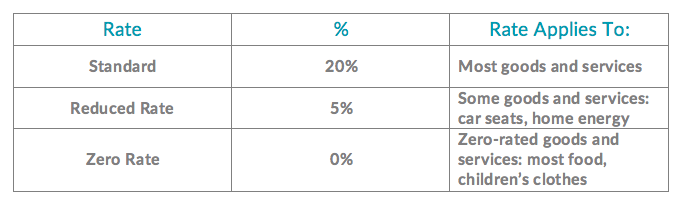

Understand VAT Rate in the UK An Easy to Understand Guide

VAT in the UK 2024 Taxology

How Much Is the VAT Threshold Searche

UK VAT Rates and VAT Schemes All You Need to Know About It

The 163 85k VAT Threshold 19 Things You Need to Know about VAT

Understand VAT Rate in the UK An Easy to Understand Guide

The 163 85k VAT Threshold 19 Things You Need to Know about VAT

VAT in the UK 2024 Taxology

How Much Is the VAT Threshold Searche

UK VAT Rates and VAT Schemes All You Need to Know About It

UK VAT Rates amp Rules Post Brexit Your Complete Guide

UK VAT Rates amp Rules Post Brexit Your Complete Guide

Understanding UK VAT Regulations What You Need to Know

Uk vat rates and vat faqs The Tech Brunch

Vat Rate In Uk 2024 Viola Jessamyn

Everything you need to know about the VAT threshold

Is the VAT threshold in the UK too high

VAT RATES UNITED KINGDOM UK Pocket Guide

How much is VAT A guide to UK VAT rates

VAT Explained For Beginners in the UK

Customs Regulations and VAT label co uk

The 163 85k VAT Threshold 19 Things You Need to Know about VAT 2023

Understanding VAT in the UK A Comprehensive Guide Megri Accounting UK

What Is The Uk Vat Rate 2024 Clair Mellisa

How much is vat in UK What You Need to Know

How much is vat in UK What You Need to Know

UK VAT Rates Essential Guide To Correct VAT Calculations Business

UK VAT Rate 2021 Change Hurts Restaurants as They Recover Eater London

Understanding VAT Rates and Exemptions for 2023 2024

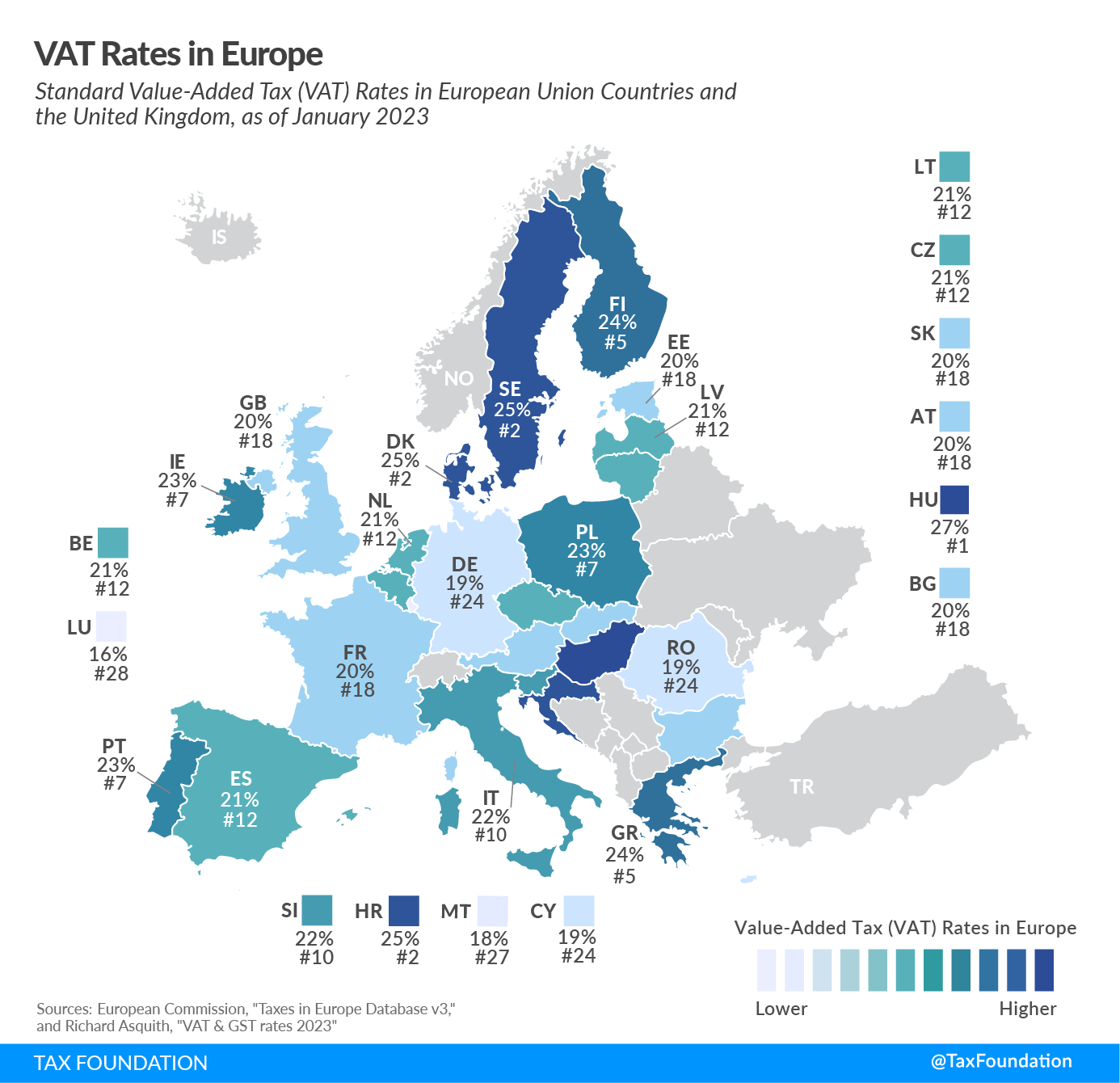

VAT rates in the EU for all 27 member states eClear AG

A Comprehensive Guide For UK VAT How VAT Works In The UK Business

A Comprehensive Guide For UK VAT How VAT Works In The UK Business

How much is vat in UK What You Need to Know

UK VAT Rates Essential Guide To Correct VAT Calculations Business

UK VAT Rate 2021 Change Hurts Restaurants as They Recover Eater London

Understanding VAT Rates and Exemptions for 2023 2024

How Much is VAT in the UK Complete Guideline CruseBurke

VAT rates in the EU for all 27 member states eClear AG

A Comprehensive Guide For UK VAT How VAT Works In The UK Business

A Comprehensive Guide For UK VAT How VAT Works In The UK Business

UK VAT rates and VAT FAQs Sage Advice United Kingdom

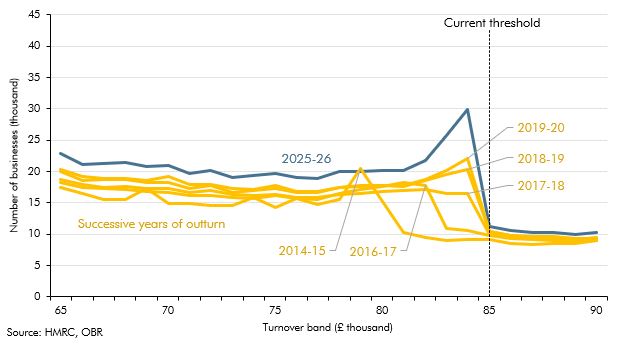

Why VAT may be a brake on UK growth and how to fix it Tax Policy

What Is VAT And Do Dropshippers Have To Pay It

UK VAT rates and thresholds 2022 23 FreeAgent

A comprehensive guide to UK VAT for businesses

How Much is VAT in UK A Clear Guide to Value Added Tax Rates Dollars

How Much is VAT in UK A Clear Guide to Value Added Tax Rates Dollars

Complete Guide to EU VAT Invoice Requirements

Chart of the week VAT threshold ICAEW

United Kingdom VAT Guide Taxback International

Basics of VAT thresholds and schemes set by HMRC Business account

A Simple Guide to Value Added Tax VAT in the UK Ceres Shop

VAT Schemes In The UK Ultimate Guide For Entrepreneurs Business

VAT exemption Everything you need to know Tide Business

What is VAT and how does it work BBC News

VAT UK Goods Services Tax UK Value Added Tax

What is a VAT threshold and what will happen when I cross it YouTube

United Kingdom vatcalc com

What Is Uk Vat Threshold - The pictures related to be able to What Is Uk Vat Threshold in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

/VAT_exemption_threshholds.png)