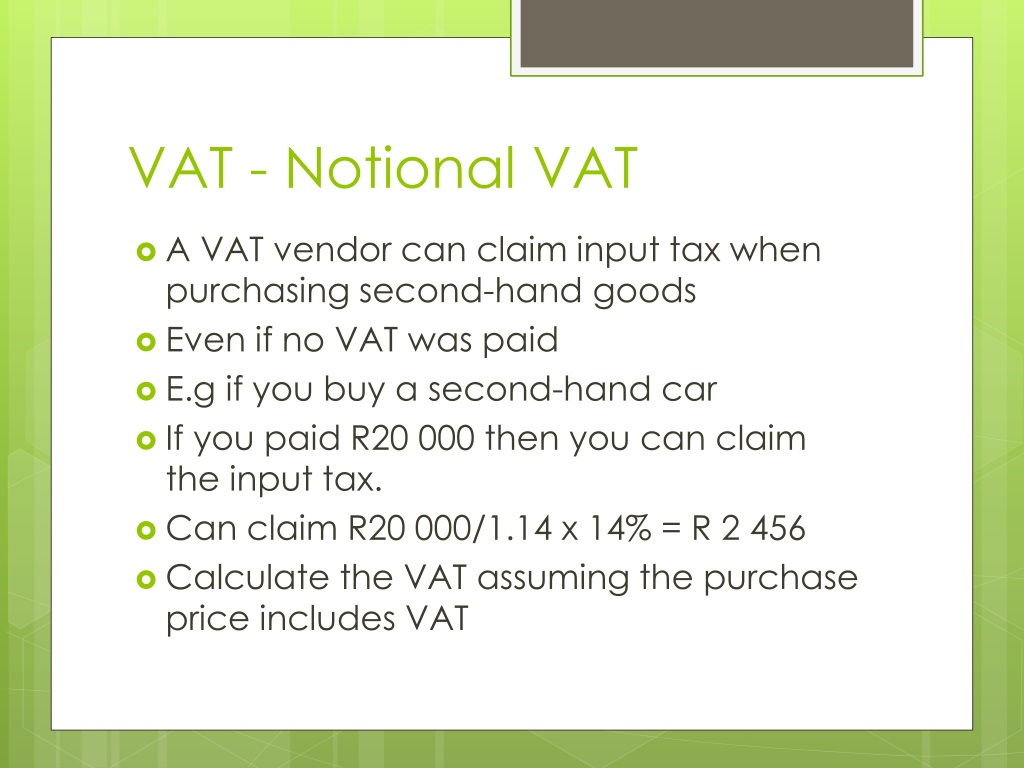

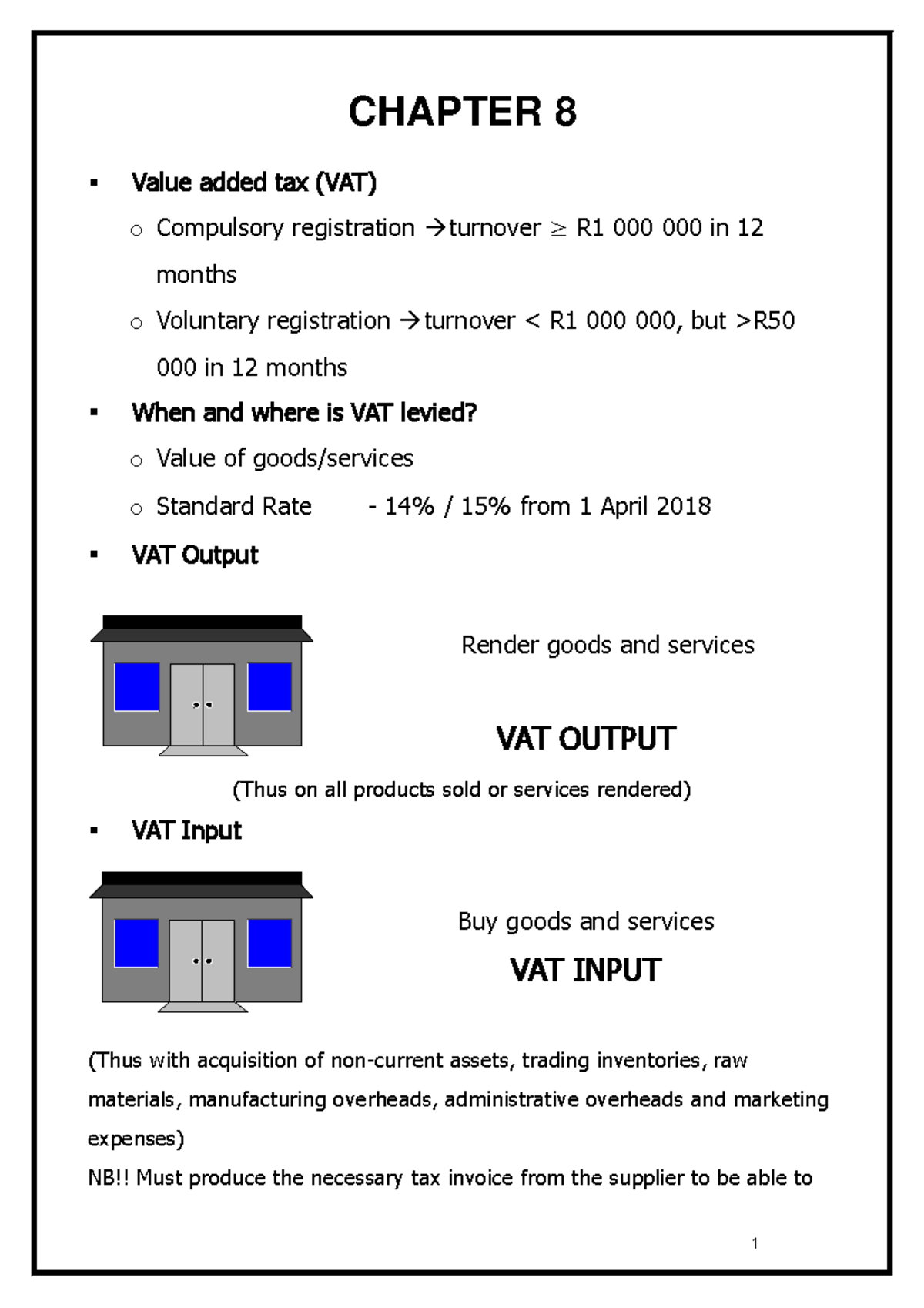

VAT deduction. In short, the answer is, it depends but there is a potential VAT claim. If the hurdles are cleared that the buyer is a vendor acquiring second-hand goods and will use the goods acquired for VAT registration: Compulsory registration. The registration threshold is ZAR 1m (± USD66,500). If a person’s total annual value of taxable supplies has exceeded this

The company would be entitled to a notional input tax deduction on the acquisition of second-hand goods (the trailers) (see section 16(3)(a)(ii)(aa) of the VAT Act read with the definition of “second-hand goods” in The reverse charge is a tax mechanism that requires the buyer or receiver of the service to account for and pay VAT for the transaction. If the buyer is entitled to VAT recovery, the buyer claims an input VAT credit for the self

Related Posts of What Is Notional Vat :

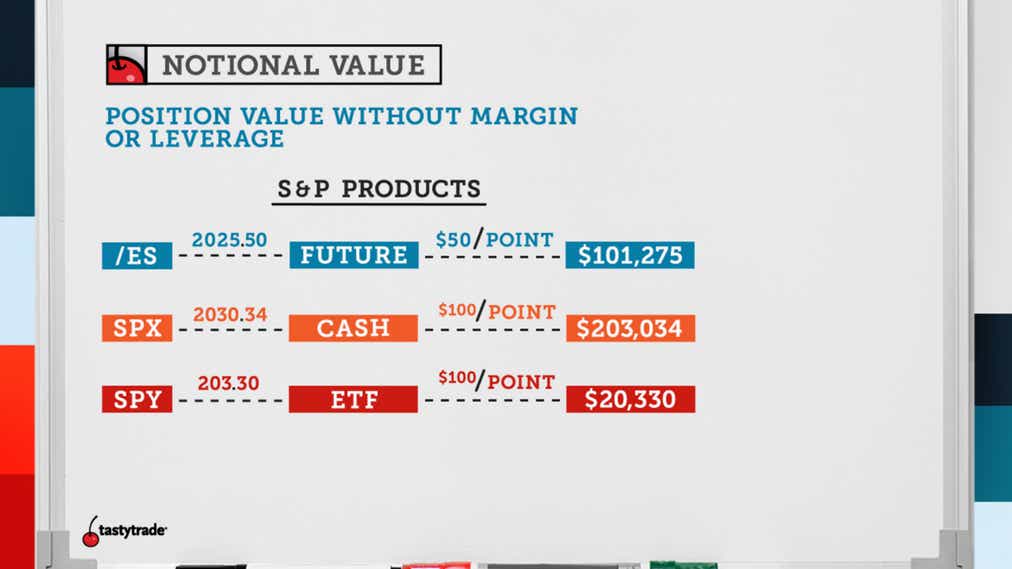

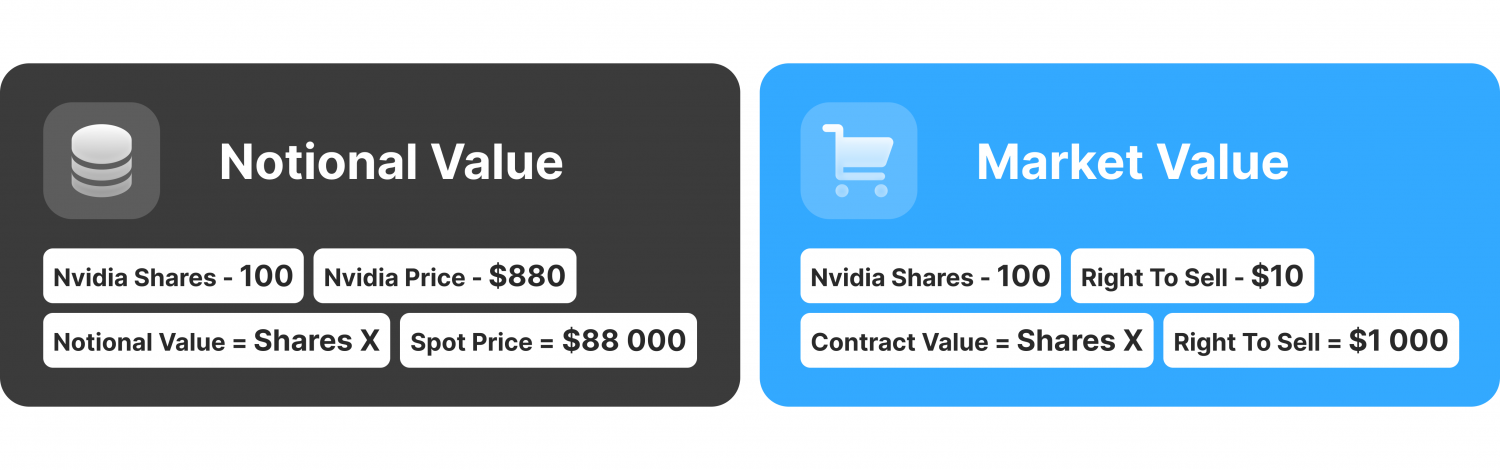

Notional Value Meaning Formula How to Calculate it Examples

Notional Value AwesomeFinTech Blog

Purchase of Capital Goods Taxable at Notional Rate VAT

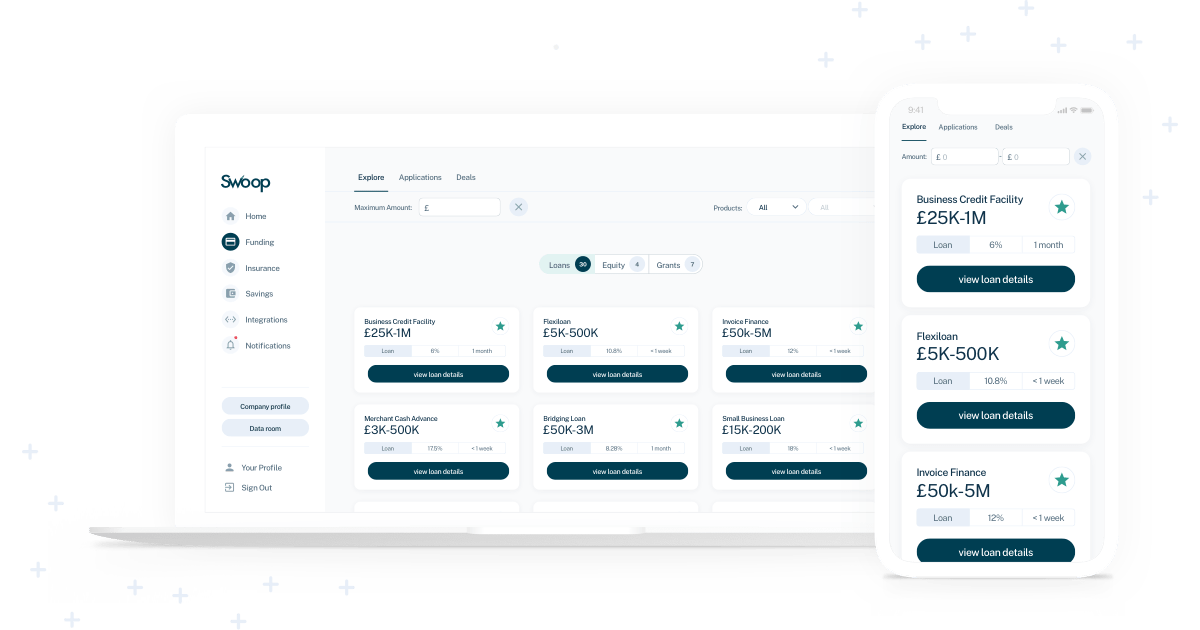

Notional value What is it amp how to calculated it Swoop US

Notional value What is it amp how to calculated it Swoop US

What Is Notional Input Vat And When Can It Be Claimed at Eleanor Stanek

What Is Notional Input Vat And When Can It Be Claimed at Eleanor Stanek

What is VAT Online VAT Calculate

How to Record Reversal of Notional Tax Credit VAT TallyHelp

What is Notional Value Understanding Notional Value tastylive

The Difference Between VAT and Non VAT

Value added tax Definition Example Types

A Guide To Understanding VAT

What is VAT Definition and Examples

Difference Between VAT and Non VAT

VAT Full Form Complete Guide To Understanding Value Added Tax And Its

Vat And Its Applications PPT

Value added tax Definition Example Types

A Guide To Understanding VAT

What is VAT Definition and Examples

What are the three types of VAT Online VAT Calculate

Difference Between VAT and Non VAT

VAT Full Form Complete Guide To Understanding Value Added Tax And Its

Vat And Its Applications PPT

How to understand VAT for your business KLOUDAC

VAT on Second hand goods What is Notional VAT MaxProf

What is VAT Understanding VAT Principles Implementation theGSTco

Elements of VAT and types of VAT neutrality Download Scientific Diagram

Vat meaning PDF Free Download

PPT What is VAT PowerPoint Presentation free download ID 9836399

VAT Exempt VATZero LECTURE NOTES ON VAT EXEMPT VAT ZERO Value Added

What is the Notional Value and How to Calculate It

PPT VAT value added tax PowerPoint Presentation free download ID

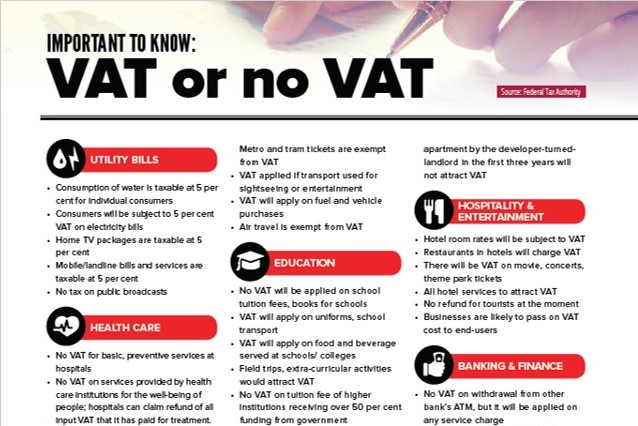

Important to know VAT or no VAT products and services in the UAE The

What is a VAT Number Quaderno Medium

What Does Net Of VAT Mean In The UK 2025 Guide

What Are Zero Rated VAT Items Searche

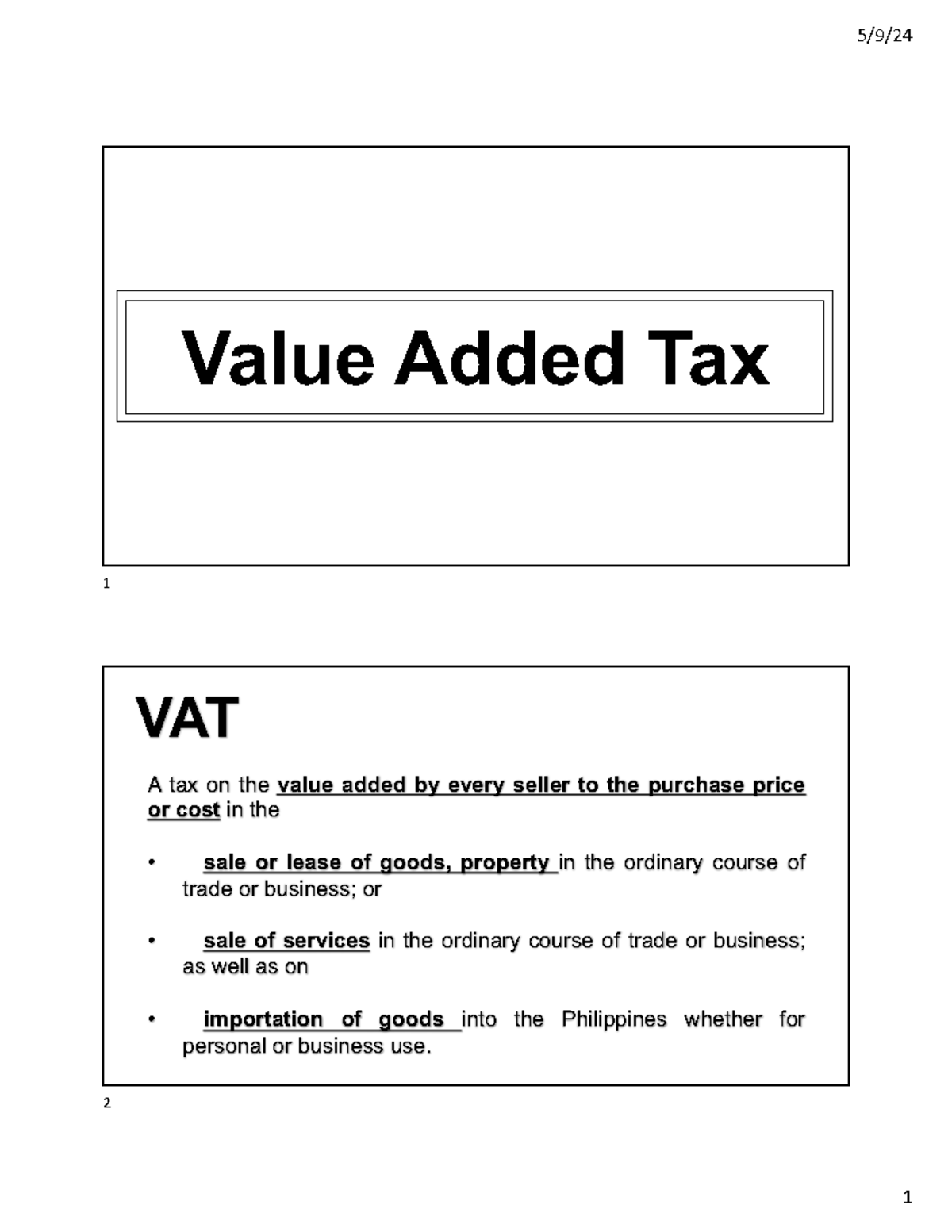

Coverage Nature Basis and Rate of Value Added Tax VAT PTABCP

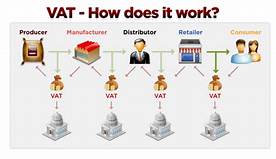

What is VAT and how does it work

Learn the Specific Nuance of VAT and Income Tax

How To Calculate Customs VAT And Duties Searche

VAT declaration and deduction for non merchant imported goods are

What is VAT and how does it work

Learn the Specific Nuance of VAT and Income Tax

How To Calculate Customs VAT And Duties Searche

VAT declaration and deduction for non merchant imported goods are

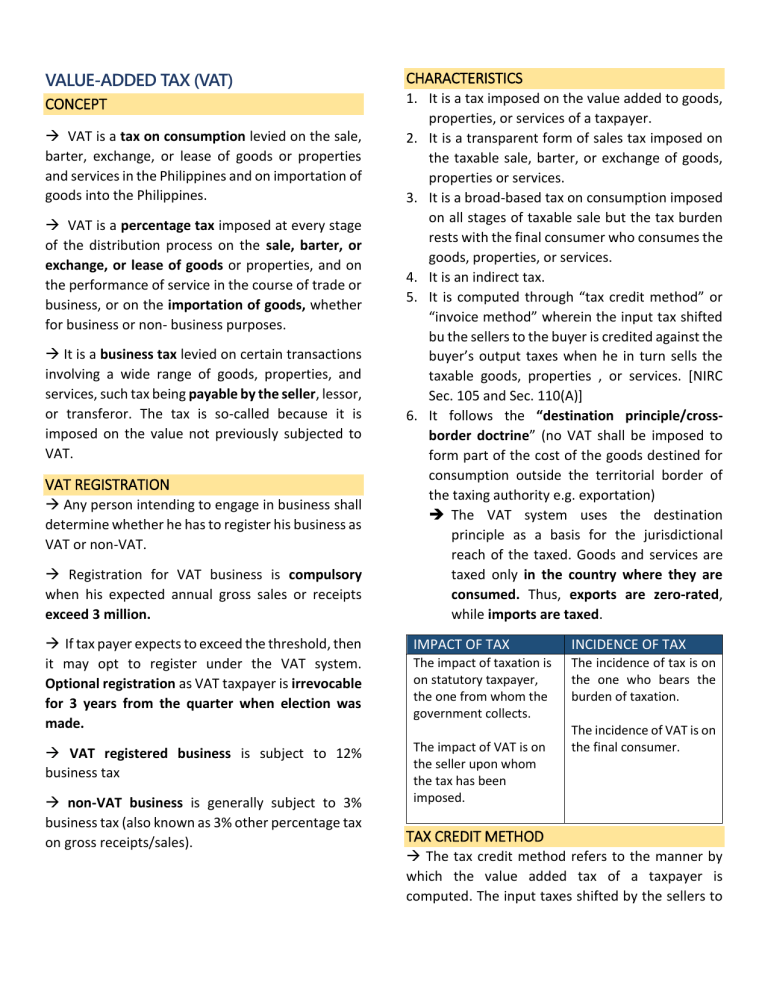

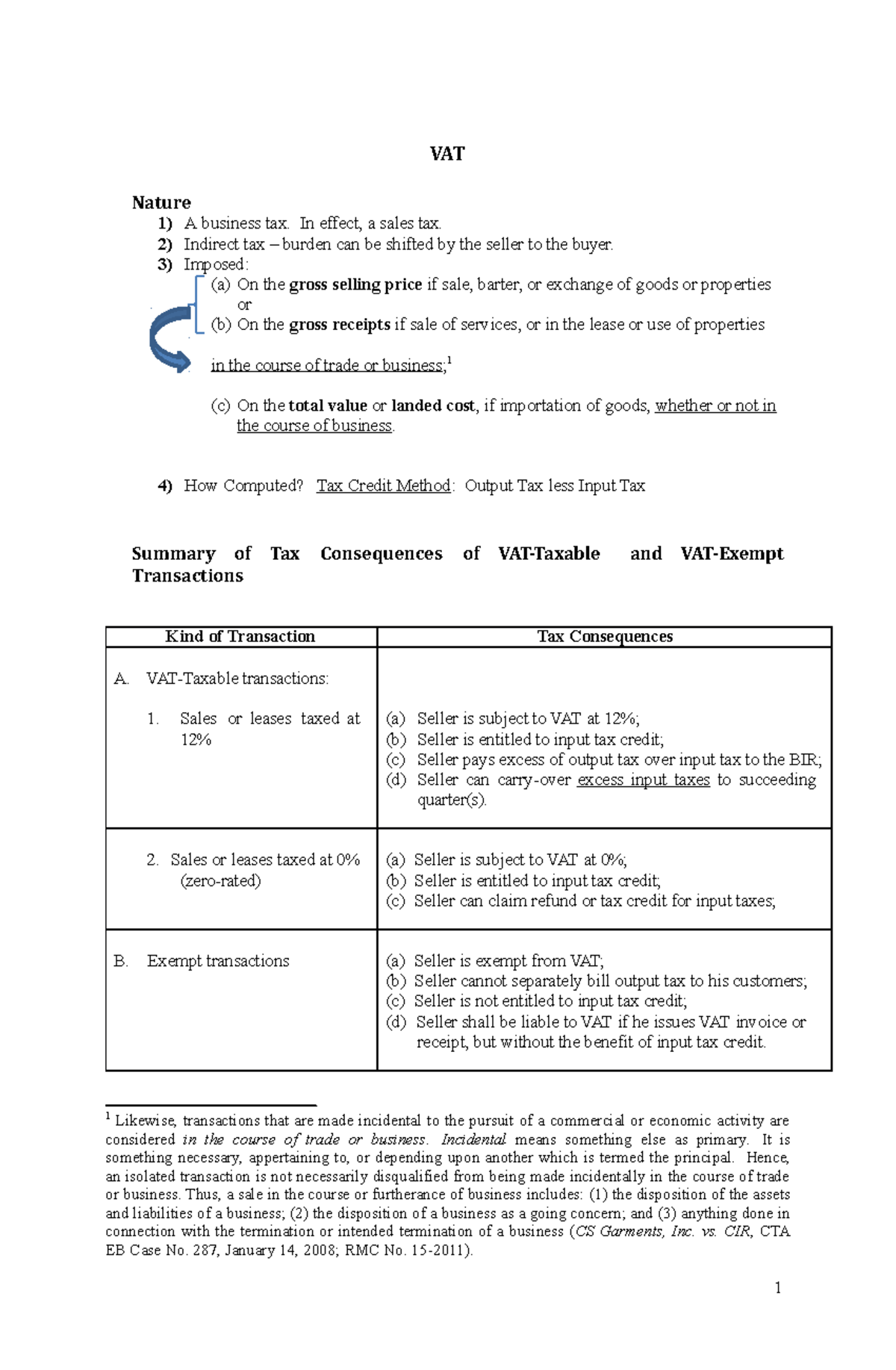

Material 8 VAT Vat tax individual VAT Nature 1 A business tax In

VAT value added tax Chapter 6 Cost Price

VAT VAT DEFINITION OF VAT Valued added tax is tax levied on the

VAT NOTES Value Added Tax Chapter 7 INTRODUCTION VAT is charged on

Vat in a nutshell vat notes VALUE ADDED TAX PREFACE This paper is a

Purchase of Capital Goods

Introduction to VAT Notes on VAT 15 INTRODUCTION TO VALUE ADDED TaX

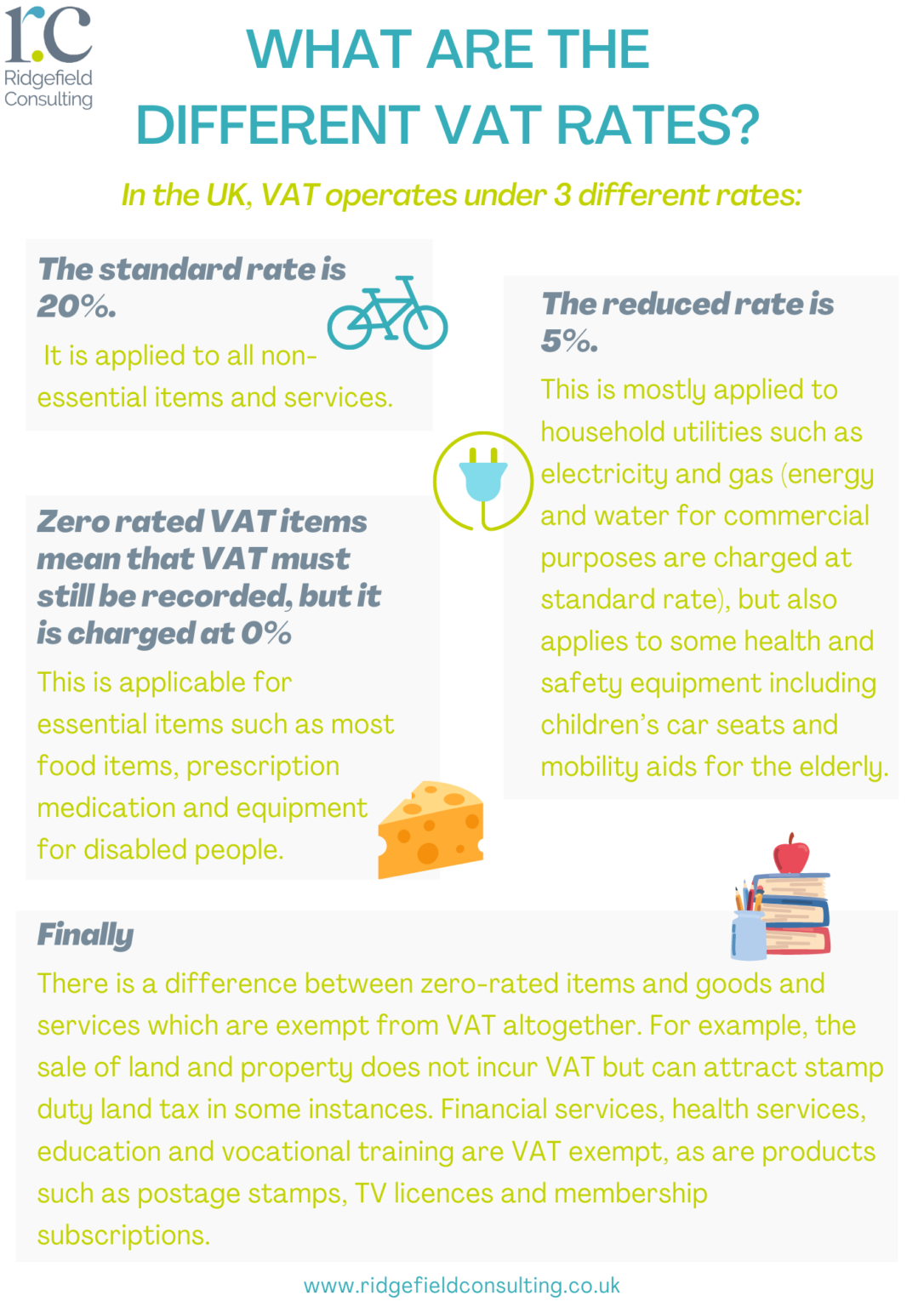

How does VAT work for businesses Ridgefield Consulting

What Is The Difference Between Exempt And Zero Rated for VAT

Understanding Zero Rated VAT Transactions On Property Sales Marder

VAT Notes VAT summary What is VAT VAT is Value Added Tax is the

VAT Notes VALUE ADDED TAX CAP 476 Value Added Tax is charged on

A VAT Concept stock image Image of blocks accounts 180393485

A Comprehensive Guide to Understanding VAT What It Is and How It Works

What Does This Is Not a VAT Invoice Really Mean Jon Davies Accountants

How Does VAT Work and What Does it Mean for Your Company

VAT 1 Over view of VAT Definition VAT is a form of sales tax

VAT 0 VS Non VAT amp Audit Firm ACC CONSULTING CO LTD

VAT nill What is VAT VAT stands for Value Added Tax It is a

VAT Week 1 910866407 Nature of VAT VAT is a tax on consumption

VAT Note 1 These notes are helpful to understand Value Added Tax a

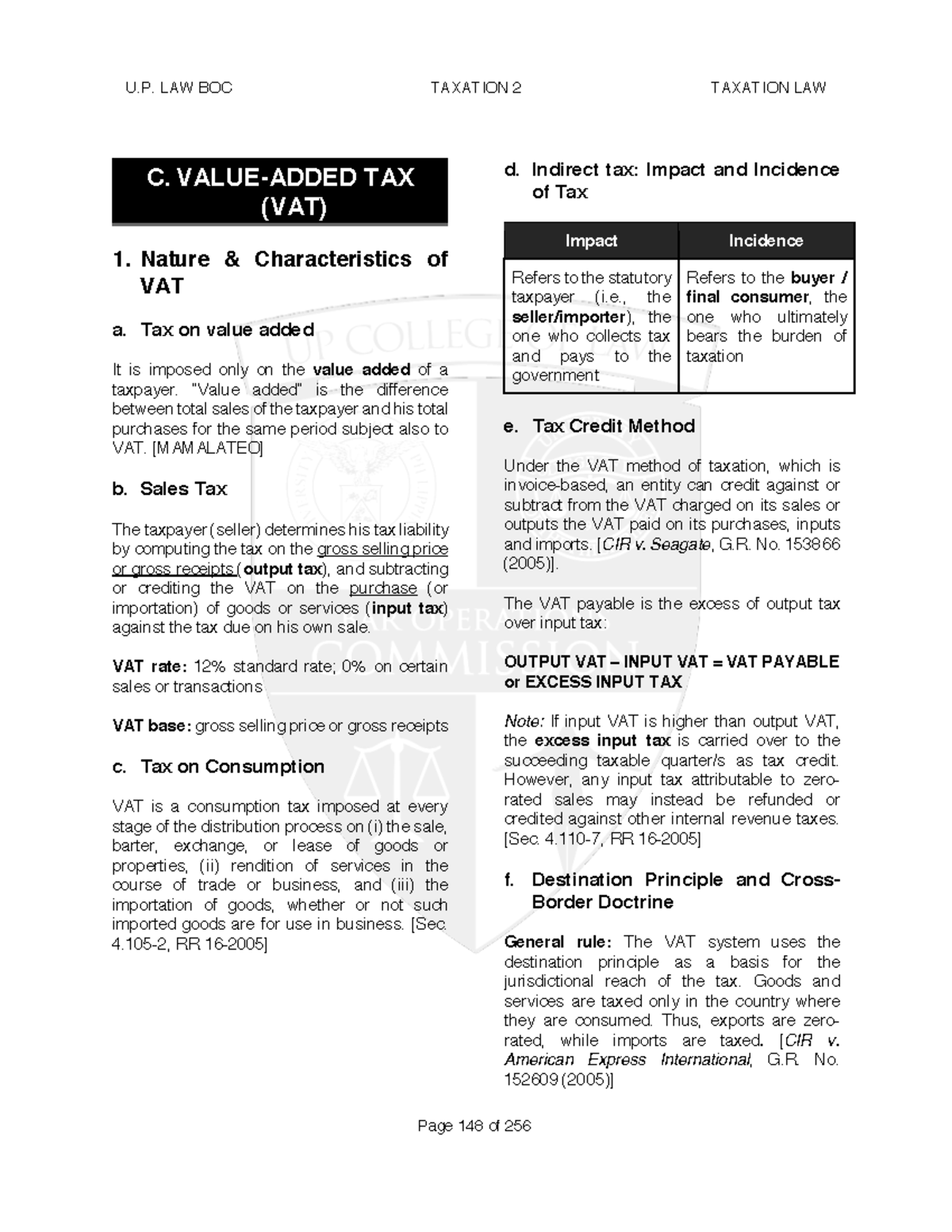

5 VAT Taxation Law notes C VALUE ADDED TAX VAT 1 Nature

Th ghi nh Not subjected to declaration calculation and pay VAT

Webinar VAT basics for non VAT experts YouTube

What Is Notional Vat - The pictures related to be able to What Is Notional Vat in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

:.jpg)